by Calculated Risk on 1/01/2023 09:56:00 AM

Sunday, January 01, 2023

Reis: Office Vacancy Rate Increased in Q4 as "demand plummeted", Mall Vacancy Rate Unchanged

From Moody’s Analytics Senior Economist Lu Chen and economist Xiaodi Li: Apartment struck a balance, Office demand plummeted, and Retail remains flat

Corporate profits squeezed under macroeconomic uncertainties and flexible work arrangements weakened office demand and continued to transform the sector’s fundamental. Moreover, new office demand isn’t always reflected through direct leases. As office downsizing became more commonplace, sublet space inevitably followed to absorb new demand. Net absorption plummeted from over 3 million square feet (sqft) in Q3 to -7.13 million sqft in Q4.

Affected by the overall office sector sentiment, new delivery dwindled to slightly above 2 million sqft nationwide, the lowest quarterly delivery in our more than 20 years of tracking history. Vacancy climbed for the fourth straight quarter to 18.7%, 20 bps higher than the previous quarter or 60 bps higher than the same time last year. Compared to Q3, asking rent in Q4 increased by 0.3% (from $35.05 to $35.14), and effective rent edged up 0.1% (from $28.00 to $28.04).

emphasis added

Reis reported the office vacancy rate was at 18.7% in Q4 2022, up from 18.5% in Q3, and up from 18.1% in Q4 2021.

This was the highest vacancy rate for offices since 1992 (following the S&L crisis).

NOTE: This says nothing about how many people are in the offices (related to the increase in work-from-home), just whether or not the office space is leased.

Click on graph for larger image.

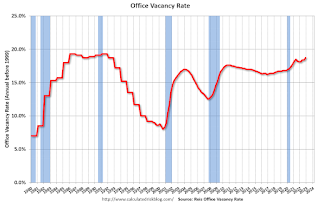

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

The office vacancy rate was elevated prior to the pandemic and moved up during the pandemic.

Reis also reported that office effective rents increased 0.1% in Q4; rents are about at the same level as before the pandemic.

And from Reis on Retail:

Bolstered by consumer spending, neighborhood and community shopping center net absorption was up 44% in Q4 as compared to last quarter. New construction delivery fell under 600,000 sqft and caused the inventory to grow just above 3 million sqft for the year, less than half of 2019’s record. Given the relative balance between supply and demand, national vacancy for neighborhood and community shopping centers stayed flat at 10.3% for the fifth straight quarter. Asking/effective rents were up slightly by 0.2%/0.2% in Q4 and remained in the $21/$18-per-sqft range, a level unchanged since 2018. Regional mall properties, on the other hand, continue to be the most at-risk retail subtype according to our commercial mortgage delinquency data, driving overall delinquency behavior among retail assets. Regional and super regional malls’ vacancy ticked up 10 bps to 11.2%, identical to the same time last year.

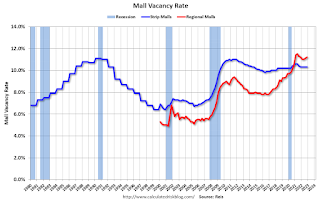

Reis reported that the vacancy rate for regional malls was 11.2% in Q4 2022, up from 11.1% in Q2 2021, and unchanged from 11.2% in Q4 2021. The regional mall vacancy rate peaked at 11.5% in Q2 2021.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.3% in Q4, unchanged from 10.3% in Q3, and unchanged from 10.3% in Q4 2021. For strip malls, the vacancy rate peaked during the pandemic at 10.6% in both Q1 and Q2 2021.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis. In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the last several years, even prior to the pandemic, the regional mall vacancy rates increased significantly from an already elevated level.

Effective rents have been mostly unchanged for regional malls over the last 4+ years, and flat for strip malls for 3+ years.

All vacancy data courtesy of Moody’s Analytics Reis