by Calculated Risk on 2/21/2023 04:00:00 PM

Tuesday, February 21, 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.64% in January"

Note: This is as of January 31st.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.64% in January

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 0.70% of servicers’ portfolio volume in the prior month to 0.64% as of January 31, 2023. According to MBA’s estimate, 320,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.30%. Ginnie Mae loans in forbearance decreased 8 basis points to 1.37%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 17 basis points to 0.83%.

“The forbearance rate decreased across all investor types in January, as borrowers continued to recover from pandemic-related hardships,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “With the national emergency set to end on May 11 of this year, many borrowers will no longer have the option to initiate COVID-19-related forbearance. Mortgage forbearance in other forms – whether due to natural disasters or life events – will continue, albeit with different requirements and parameters.

emphasis added

Click on graph for larger image.

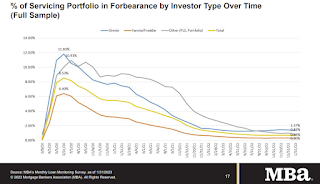

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been generally decreasing.

At the end of January, there were about 320,000 homeowners in forbearance plans.