by Calculated Risk on 2/18/2023 08:11:00 AM

Saturday, February 18, 2023

Schedule for Week of February 19, 2023

The key reports this week are January New and Existing Home sales, the second estimate of Q4 GDP and Personal Income and Outlays for January.

All US markets will be closed in observance of the Presidents' Day holiday.

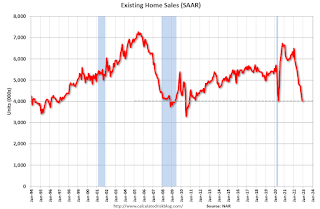

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, up from 4.02 million.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, up from 4.02 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.18 million SAAR for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of January 31-February 1, 2023

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 194 thousand last week.

8:30 AM: Gross Domestic Product, 4th quarter 2022 (Second estimate). The consensus is that real GDP increased 2.9% annualized in Q4, unchanged from the advance estimate of 2.9%.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

11:00 AM: the Kansas City Fed manufacturing survey for February.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.9% increase in personal income, and for a 1.3% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 4.9% YoY, and core PCE prices up 4.3% YoY.

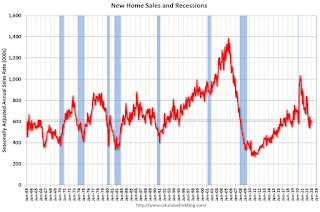

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

The consensus is that new home sales increased to 620 thousand SAAR, down from 616 thousand in December.

10:00 AM: University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 66.4.

10:00 AM: University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 66.4.