From the AIA: Architecture Billings Index (ABI) Slowdown Continues into February

More architecture firms reported a decline in billings in February, indicating an extension of a recent downturn in design activity according to a new report released today from The American Institute of Architects (AIA).

The combination of an unsettled economy and high interest rates is causing investors and property owners to take a closer look at their plans for construction projects,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While this is producing delays for some projects under design, architecture firms are reporting that prospects for future project work remain generally positive.”

...

• Regional averages: West (50.4); Midwest (48.8); Northeast (48.4); South (47.3)

• Sector index breakdown: mixed practice (57.0); institutional (46.9); commercial/industrial (45.8); multi-family residential (46.2)

emphasis added

Click on graph for larger image.

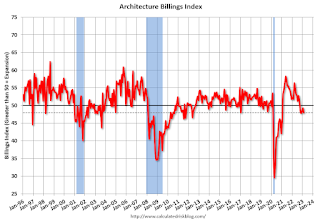

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.0 in February, down from 49.3 in January. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had been positive for 20 consecutive months but indicated a decline the last five months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment in early 2023, but a slowdown in CRE investment later in 2023.

Note that multi-family billing turned down in August 2022 and has been negative for seven consecutive months. This suggests we will see a downturn in multi-family starts this year.