by Calculated Risk on 3/18/2023 08:11:00 AM

Saturday, March 18, 2023

Schedule for Week of March 19, 2023

The key reports this week are February New and Existing Home Sales.

The FOMC meets this week, and there is some uncertainty on rate hikes due to the recent banking issues.

No major economic releases scheduled.

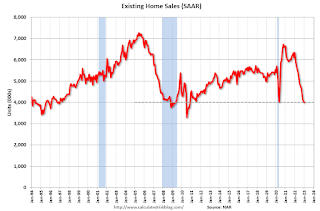

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 4.15 million SAAR, up from 4.00 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 4.15 million SAAR, up from 4.00 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.51 million SAAR for February (well above consensus).

----- Wednesday, March 22nd -----

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bps at this meeting, although there is some uncertainty due to the bank issues.

2:00 PM: FOMC Projections. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with updated economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

----- Thursday, March 23rd -----

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 190 thousand initial claims, down from 192 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau.

This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 650 thousand SAAR, down from 670 thousand in January.

11:00 AM: the Kansas City Fed manufacturing survey for March.

----- Friday, March 24th -----

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.2% increase in durable goods orders.

10:00 AM: State Employment and Unemployment (Monthly), February 2023

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bps at this meeting, although there is some uncertainty due to the bank issues.

2:00 PM: FOMC Projections. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with updated economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 190 thousand initial claims, down from 192 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 650 thousand SAAR, down from 670 thousand in January.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.2% increase in durable goods orders.

10:00 AM: State Employment and Unemployment (Monthly), February 2023