by Calculated Risk on 3/13/2023 08:43:00 PM

Monday, March 13, 2023

Tuesday: CPI

If you're just getting caught up or otherwise haven't heard, the biggest news in financial markets since last Friday has been the precipitous failure of Silicon Valley Bank. While not necessarily a household name, SVB was the 16th largest bank in terms of assets and the 2nd biggest bank failure in history behind Washington Mutual 15 years ago.Tuesday:

Combine that with the fact that the 3rd largest bank failure in history (Signature Bank) occurred 2 days later and it's no surprise that there's some panic in financial markets about systemic risk (aka, a domino effect resulting in additional turmoil).

...

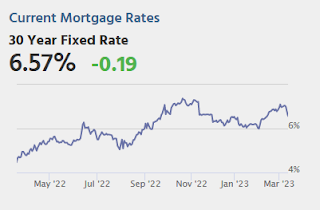

If the market is calmer, then why are rates still so much lower? This has to do with the market shifting its expectations for Fed rate hikes in the rest of 2023. Specifically, the market now sees the Fed hitting a ceiling rate that's more than 1.5% lower than it was at the beginning of last week! [30 year fixed 6.57%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for February.

• At 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.4% increase in core CPI. The consensus is for CPI to be up 6.0% Year-over-year (YoY), and core CPI to be up 5.5% YoY.