Mortgage applications increased 6.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 5, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 6.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 7 percent compared with the previous week. The Refinance Index increased 10 percent from the previous week and was 44 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 5.3 percent compared with the previous week and was 32 percent lower than the same week one year ago.

“Mortgage applications responded positively to a drop in rates last week, as the Fed signaled a potential pause at the current level for the federal funds rate in anticipation of inflation slowing and tightening financial conditions that will slow economic and job growth. Mortgage rates for all surveyed loan types decreased over the week with the 30-year fixed rate at 6.48 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications increased 5 percent last week but were still more than 30 percent below last year’s level. Lower rates from week to week have helped buyers in the market, but limited for-sale inventory remains a challenge for many homebuyers. Refinance activity jumped 10 percent to its highest levels since September 2022, although there is only a small pool of borrowers who can benefit from refinancing with rates at these levels.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.48 percent from 6.50 percent, with points decreasing to 0.61 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

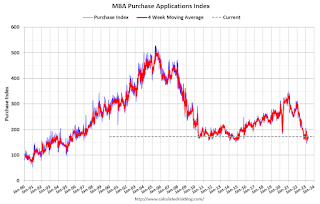

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 32% year-over-year unadjusted.

Red is a four-week average (blue is weekly).

The second graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index declined sharply in 2022 - and has mostly flat lined at a low level since then.