by Calculated Risk on 5/18/2023 10:13:00 AM

Thursday, May 18, 2023

NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April

From the NAR: Existing-Home Sales Faded 3.4% in April

Existing-home sales decreased in April, according to the National Association of REALTORS®. All four major U.S. regions registered month-over-month and year-over-year sales declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – slid 3.4% from March to a seasonally adjusted annual rate of 4.28 million in April. Year-over-year, sales slumped 23.2% (down from 5.57 million in April 2022).

...

Total housing inventory registered at the end of April was 1.04 million units, up 7.2% from March and 1.0% from one year ago (1.03 million). Unsold inventory sits at a 2.9-month supply at the current sales pace, up from 2.6 months in March and 2.2 months in April 2022.

emphasis added

Click on graph for larger image.

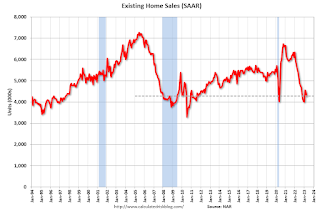

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in April (4.28 million SAAR) were down 3.4% from the previous month and were 23.2% below the April 2022 sales rate.

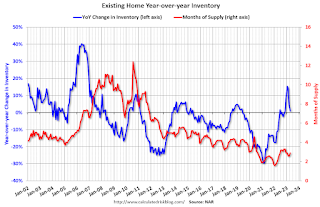

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.04 million in April from 0.97 million in March.

According to the NAR, inventory increased to 1.04 million in April from 0.97 million in March.

According to the NAR, inventory increased to 1.04 million in April from 0.97 million in March.

According to the NAR, inventory increased to 1.04 million in April from 0.97 million in March.Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

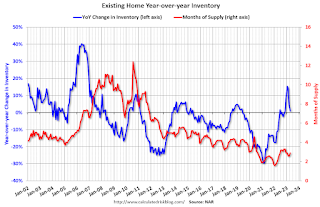

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 1.0% year-over-year (blue) in April compared to April 2022.

Inventory was up 1.0% year-over-year (blue) in April compared to April 2022.

Months of supply (red) increased to 2.9 months in April from 2.6 months in March.

This was slightly below the consensus forecast. I'll have more later.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 1.0% year-over-year (blue) in April compared to April 2022.

Inventory was up 1.0% year-over-year (blue) in April compared to April 2022. Months of supply (red) increased to 2.9 months in April from 2.6 months in March.

This was slightly below the consensus forecast. I'll have more later.