Rising inventory, combined with pent-up demand, is keeping growth going mostly by holding the long list of economic- and price-related headwinds at bay, but there is potential for demand to sharply drop at the end of the month – and in June - if an agreement on the U.S. debt ceiling remains elusive and further spooks consumers.Note: When writing "biggest volume gain", Wards is referring to the year-over-year gain since sales were especially weak in May 2022.

emphasis added

Click on graph for larger image.

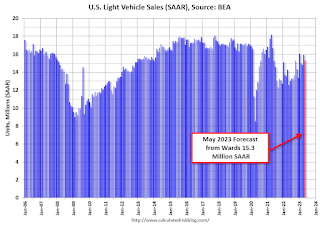

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for May (Red).

The Wards forecast of 15.3 million SAAR, would be down 3.9% from last month, and up 21.6% from a year ago.

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues and have picked up recently.