The first graph is the one Fed Chair Powell has been mentioning.

Click on graph for larger image.

Click on graph for larger image.This graph shows the YoY price change for Services and Services less rent of shelter through May 2023.

Services were up 6.3% YoY as of May 2023, down from 6.8% YoY in April.

Services less rent of shelter was up 4.2% YoY in May, down from 5.2% YoY in April.

Services less rent of shelter was up 4.2% YoY in May, down from 5.2% YoY in April.

Will services ex-shelter inflation be persistent, or will it follow a similar pattern as goods? This is a topic I discussed in Pandemic Economics, Housing and Monetary Policy: Part 2.

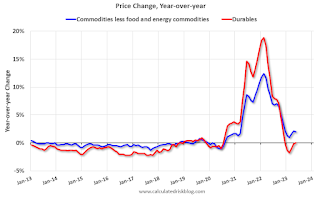

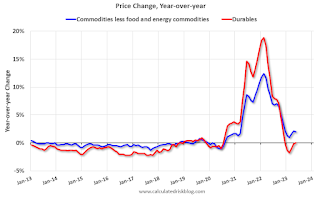

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Durables were at 0.0% YoY as of May 2023, up from -0.2% YoY in April.

Commodities less food and energy commodities were up 2.0% YoY in May, down from 2.1% YoY in April.

Commodities less food and energy commodities were up 2.0% YoY in May, down from 2.1% YoY in April.

Goods inflation was transitory.

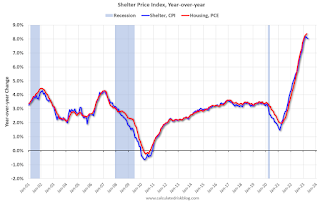

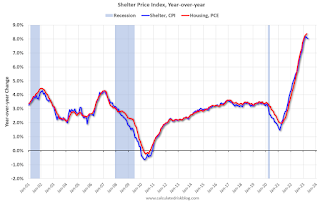

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April 2023)

Shelter was up 8.0% year-over-year in May, down from 8.1% in April. Housing (PCE) was up 8.4% YoY in April, from 8.3% in March.

The BLS noted this morning: "The index for shelter was the largest contributor to the monthly all items increase, followed by an increase in the index for used cars and trucks." Asking rent increases have slowed sharply, and these measures of shelter will decline soon.

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April 2023)Shelter was up 8.0% year-over-year in May, down from 8.1% in April. Housing (PCE) was up 8.4% YoY in April, from 8.3% in March.

The BLS noted this morning: "The index for shelter was the largest contributor to the monthly all items increase, followed by an increase in the index for used cars and trucks." Asking rent increases have slowed sharply, and these measures of shelter will decline soon.