Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 7, 2023. This week’s results include an adjustment for the observance of Independence Day.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 19 percent compared with the previous week. The Refinance Index decreased 1 percent from the previous week and was 39 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 19 percent compared with the previous week and was 26 percent lower than the same week one year ago.

“Incoming economic data continue to send mixed signals about the economy, with the overall impact leaving Treasury yields higher last week as markets expect that the Federal Reserve will need to hold rates higher for longer to slow inflation. All mortgage rates in our survey followed suit, with the 30-year fixed rate increasing to 7.07 percent, the highest level since November 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The jumbo rate also increased to 7.04 percent, a record high for the jumbo series, which dates back to 2011.”

Added Kan, “Purchase applications increased, but remained at a very low level and are 26 percent lower than the same week last year. The rise in purchase activity was driven by increases in both FHA and VA purchase applications. The refinance index dropped to its lowest level since early June, as demand for rate/term and cash-out refinances remains extremely low with mortgage rates over 7 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.07 percent from 6.85 percent, with points increasing to 0.74 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

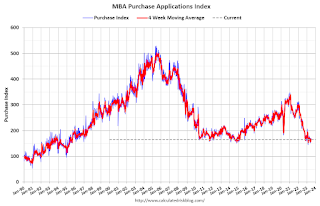

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 26% year-over-year unadjusted.

Red is a four-week average (blue is weekly). This is close to the lowest level since the mid-'90s!

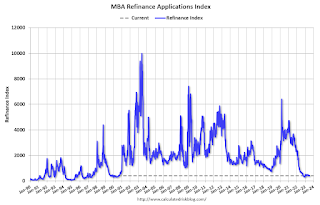

The second graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index declined sharply in 2022 - and has mostly flat lined at a low level since then.