• Active inventory declined, with for-sale homes lagging behind year ago levels by 5%. A year into weekly new listing declines, active inventory levels have started to mirror the slow down in listing activity. More than 80% of home-shoppers looking to buy and sell a home feel locked in by their current mortgage rate. As a result, buyers are seeing fewer available homes on the market. We expect to see this trend continue as mortgage rates are expected to remain elevated for the time being.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 27% from one year ago. The number of newly listed homes has been lower than the same time the previous year for the past 53 weeks. This week’s data shows a wider gap than last week, and is bigger than what has been typical year-to-date. The job market’s ongoing resilience has enabled buyers to remain active in today’s market, despite the high cost of homeownership. However, high mortgage rates have convinced many would-be sellers to hold off on listing their home for sale. Buyer demand and lack of existing home inventory has resulted in renewed new home sales energy.

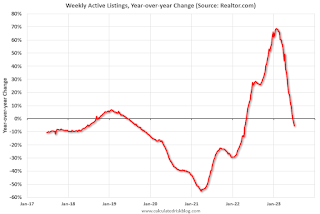

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 5.0% year-over-year - this was the third consecutive YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Inventory is still up from the record lows in the 2nd half of 2021 and early 2022, and it is unlikely we will see new record lows this year.