by Calculated Risk on 10/30/2023 01:34:00 PM

Monday, October 30, 2023

Goldman: 2024 Inflation Outlook

A few excerpts from a note by Goldman Sachs economists Spencer Hill and Manuel Abecasis: 2024 Inflation Outlook: Approaching the Target

"We are lowering our December 2024 core CPI forecast by two tenths to 2.7% year-on-year, and we continue to expect a significant decline in core PCE inflation from 3.7% currently to 2.4% in December 2024. We expect the backdrop of falling but above-target inflation to validate the Fed’s decision to hold the fed funds rate at its current level until 2024Q4."Currently the FOMC is projecting core PCE inflation to decline to 2.5% to 2.8% year-over-year (YoY) in Q4 2024. The Goldman Sachs projection is 2.4% by December 2024. Two of the key reasons that YoY inflation will likely continue to decline is wage growth has slowed (and appears likely to continue to slow), and shelter inflation will decline sharply in 2024.

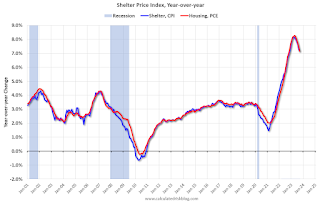

And here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report through September 2023.

CPI Shelter was up 7.1% year-over-year in September, down from 7.2% in August, and down from the cycle peak of 8.2% in March 2023.

CPI Shelter was up 7.1% year-over-year in September, down from 7.2% in August, and down from the cycle peak of 8.2% in March 2023.Housing (PCE) was up 7.2% YoY in September, down from 7.4% in August, and down from the cycle peak of 8.3% in April 2023.

Since asking rents are slightly negative year-over-year, these measures will continue to slow over coming months.

Since asking rents are slightly negative year-over-year, these measures will continue to slow over coming months.

Note that core CPI ex-shelter was up 1.9% YoY in September, down from 2.3% in August. And over the last 4 months, core CPI ex-shelter has increased at a 0.8% annual rate.