by Calculated Risk on 10/16/2023 04:07:00 PM

Monday, October 16, 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.31% in September"

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.31% in September

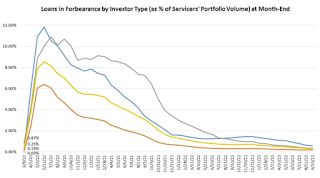

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.33% of servicers’ portfolio volume in the prior month to 0.31% as of September 30, 2023. According to MBA’s estimate, 155,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8 million borrowers since March 2020.

In September 2023, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.18%. Ginnie Mae loans in forbearance decreased 8 basis points to 0.57%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 4 basis points to 0.35%.

“The number of loans in forbearance dropped in September, but the overall performance of servicing portfolios and loan workouts declined slightly,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “MBA’s baseline forecast has a recession in the first half of 2024. Several factors – including unemployment increases, rising property taxes and insurance, the resumption of student debt payments, and possible natural disasters – may affect loan performance in future months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing and declined to 0.31% in September from 0.33% in August.

At the end of August, there were about 155,000 homeowners in forbearance plans.