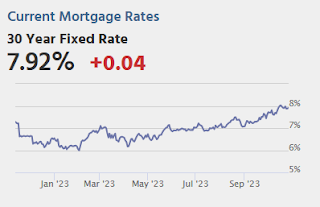

From Matthew Graham at Mortgage News Daily: Mortgages Rates Just Barely Higher. Bigger Moves Are Likely Ahead

From Matthew Graham at Mortgage News Daily: Mortgages Rates Just Barely Higher. Bigger Moves Are Likely AheadMortgage rates barely budged today. The average lender was just a hair higher compared to Friday's top tier conventional 30yr fixed rate offerings.Tuesday:

...

The biggest risk (or opportunity) involves a cohesive message across multiple economic reports and events. In other words, if the economic data on Tue-Fri sends the same message as the Fed announcement on Wednesday, and if a handful of other relevant events argue the same case, rates could move significantly higher or lower by Friday afternoon. [30 year fixed 7.92%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 0.1% year-over-year.

• Also at 9:00 AM, FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 44.8, up from 44.1 in September.

• At 10:00 AM, The Q3 Housing Vacancies and Homeownership report from the Census Bureau.