From Matthew Graham at Mortgage News Daily: Mortgage Rates Sharply Lower

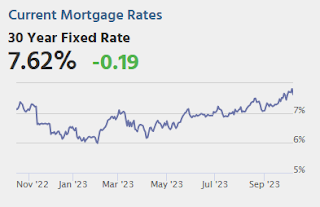

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sharply LowerThe average mortgage lender is quoting a top tier 30yr fixed mortgage rate that is nearly a quarter of a percent lower than the same scenario last Friday. Granted, big moves like this are more common after hitting multi-decade highs, bit today's example has other motivations.Wednesday:

Specifically, the outbreak of the Israel-Gaza conflict prompted some excess demand for safer haven assets like US Treasuries and mortgage-backed securities. Perhaps more importantly the conflict creates geopolitical uncertainty that is seen as one more reason for the Fed to "wait and see" when it comes time to decide whether to hike rates one more time in 2023 or not. [30 year fixed 7.62%]

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for September from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.2% increase in core PPI.

• At 2:00 PM, FOMC Minutes, Minutes Meeting of September 19-20, 2023