The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2023.

Regarding loans to businesses, survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

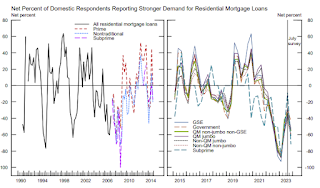

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government residential mortgages, for which standards remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined.

The left graph is 1990 to 2014. The right graph is 2015 to Q3 2023.