A brief excerpt:

Some interesting data on negative equity and limited equity.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

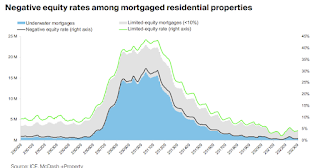

• As of September, 383K (0.7% of) mortgage holders were underwater on their homes – less than half the share prior to the pandemic and in the early 2000s before the Global Financial Crisis

• Likewise, the number of borrowers in limited-equity positions remains historically low, with 1.9M (4.2% of) mortgage holders having less than 10% equity in their homes

• Austin – where home prices remain more than 14% off 2022 peaks – is in the worst position of all markets, with 2.1% of mortgage holders underwater, followed by Las Vegas (1.7%) and Phoenix (1.6%)

• San Jose – despite its home-price struggles last year – and Los Angeles have the lowest negative equity rates at 0.1%

• Overall, the weighted-average combined loan-to-value ratio for all mortgaged homes in the U.S. is 45%, among the strongest we’ve seen, dating back more than 20 years, outside of Feb.-Aug. 2022 at the peak of home prices

emphasis added