The recent falloff in the SAAR from summer highs could mean more consumers are reaching price fatigue. It also could be that some of the stronger selling segments – especially fullsize trucks – of the past two-plus years are closer than other segments to meeting the pent-up demand built up since the inventory drain caused by the semiconductor shortage began in early 2021. Of course, there also has been a rise in distractions over that period, locally and internationally.

emphasis added

Click on graph for larger image.

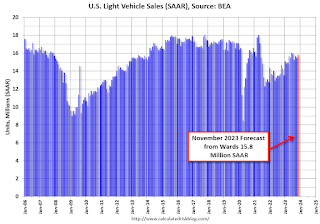

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for November (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.8 million SAAR, would be up 2% from last month, and up 11% from a year ago.

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues.