Mortgage applications decreased 1.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 15, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 3 percent compared with the previous week. The Refinance Index decreased 2 percent from the previous week and was 18 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 18 percent lower than the same week one year ago.

"With the positive news about the drop in inflation, and the FOMC projections proclaiming a pivot towards rate cuts, the 30-year fixed mortgage rate reached its lowest level since June 2023, declining to 6.83 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. "At least as of last week, borrowers' response to this rate move was rather tepid. VA refinance applications jumped 18 percent for the week, but otherwise, both refinance and purchase applications showed small declines."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.83 percent from 7.07 percent, with points increasing to 0.60 from 0.59 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

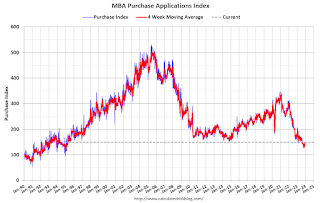

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

Red is a four-week average (blue is weekly).

Purchase application activity is up from the lows in late October and early November, but still below the lowest levels during the housing bust.

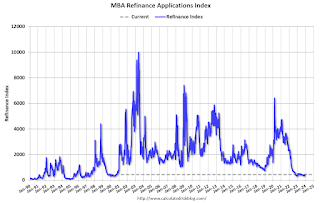

The second graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index declined sharply in 2022, and even with some recent minor increases, activity is barely off the bottom.