The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.29% of servicers’ portfolio volume in the prior month to 0.26% as of November 30, 2023. According to MBA’s estimate, 130,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.

In November 2023, the share of Fannie Mae and Freddie Mac loans in forbearance declined 2 basis points to 0.16%. Ginnie Mae loans in forbearance decreased 5 basis points to 0.47%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 2 basis points to 0.30%.

“Nearly 96 percent of all home mortgages are performing, which underscores how strong servicing portfolio performance is right now with the same resilience seen in the U.S. labor market,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Meanwhile, the performance of loan workouts is solid, but declined last month. Roughly 70 percent of loan workouts initiated since 2020 are current.”

Added Walsh, “MBA forecasts an economic downturn in 2024, and there are signs of early distress in other credit types such as car loans and credit cards. Those borrowers who struggled in making their mortgage payments in the past may find themselves in similar situations in a softening economy and rising unemployment.”

emphasis added

Click on graph for larger image.

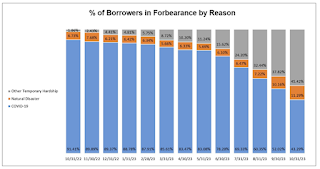

Click on graph for larger image.This graph shows the reasons for forbearance: COVID-19, Naturnal Disaster, other Temporary Hardship.

From the MBA:

• By reason, 53.6% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 34.3% of borrowers are in forbearance because of COVID-19. Another 12.1% are in forbearance because of a natural disaster.At the end of November, there were about 130,000 homeowners in forbearance plans.