by Calculated Risk on 12/20/2023 02:05:00 PM

Wednesday, December 20, 2023

Review: Ten Economic Questions for 2023

At the end of each year, I post Ten Economic Questions for the following year (2023). I followed up with a brief post on each question. Here is review (we don't have all data yet, but enough). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments.

I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong. As an example, when the pandemic hit, I switched from being mostly positive on the economy to calling a recession in early March 2020.

Another example from last year: In December 2022, housing inventory was very low, but increasing quickly, and house prices were declining month-to-month, and I expected prices to decline slightly in 2023. However, when the inventory surge turned out to be a "head fake", I changed my mind!

Here were my questions from December 2022:

10) Question #10 for 2023: Will inventory increase further in 2023?

"The bottom line is inventory will probably increase year-over-year in 2023."

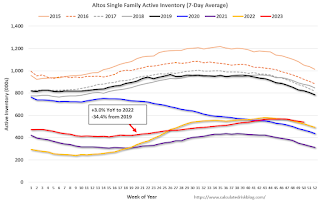

Here is a graph from Altos Research showing active single-family inventory through December 15, 2023.

The red line is for 2023. The black line is for 2019. Note that inventory is up from the record low for the same week in 2021, but still well below normal levels.

Inventory was up 3.0% compared to the same week in 2022 but still down 34.1% compared to the same week in 2019.

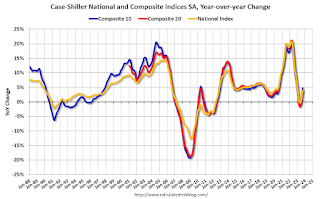

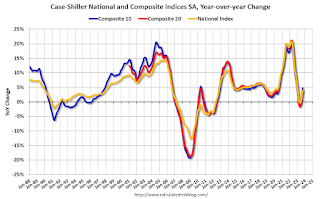

9) Question #9 for 2023: What will happen with house prices in 2023? I was correct about prices not falling sharply, but house prices actually increased in 2023. That is why I changed my mind!

I was correct about prices not falling sharply, but house prices actually increased in 2023. That is why I changed my mind!

As of September, the National Case-Shiller index SA was up 3.9% year-over-year. (Case-Shiller for October will be released next week).

It appears prices will still be up mid-single digits in December.

8) Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

I was expecting further weakness for new home sales early in the year, and new home sales actually bottomed in July 2022.

I was expecting further weakness for new home sales early in the year, and new home sales actually bottomed in July 2022.

This graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in October 2023 were up 17.7% from October 2022. Year-to-date sales are up 4.6% compared to the same period in 2022.

The low level of existing home inventory, combined with mortgage rate buydowns, helped new home sales increase in 2023.

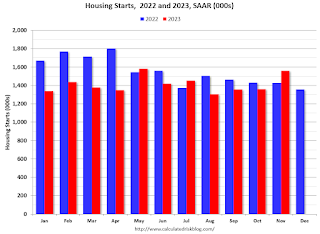

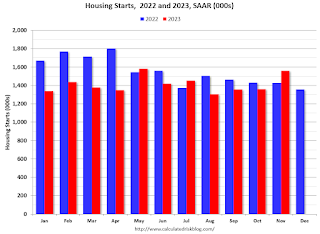

The next graph shows housing starts for 2022 and 2023 by month (Seasonally Adjusted Annual Rate).

The next graph shows housing starts for 2022 and 2023 by month (Seasonally Adjusted Annual Rate).

Total starts year-to-date are down 9.9% compared to last year.

This was a somewhat smaller decline for total starts than I expected.

7) Question #7 for 2023: How much will wages increase in 2023?

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

9) Question #9 for 2023: What will happen with house prices in 2023?

"[M]ost homeowners have substantial equity, and a low fixed-rate mortgage, and they can afford the monthly payments. So, it is extremely unlikely that we see a surge in distressed sales like happened after the housing bubble. And that means prices probably won’t decline sharply like in 2008 when prices fell about 12% according to the Case-Shiller National Index.

So, based on my inventory and mortgage rate forecasts, my guess is that year-over-year house prices will decrease in 2023, probably in the low-to-mid single digit range. "

I was correct about prices not falling sharply, but house prices actually increased in 2023. That is why I changed my mind!

I was correct about prices not falling sharply, but house prices actually increased in 2023. That is why I changed my mind!As of September, the National Case-Shiller index SA was up 3.9% year-over-year. (Case-Shiller for October will be released next week).

It appears prices will still be up mid-single digits in December.

8) Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

"[M]y guess is that new home sales will bottom for this cycle in 2023, down another 15% to 20% from 2022 levels.

My guess is multi-family starts will decline in 2023 as rents soften and as the record number of housing units under construction are completed. Total starts will likely be down around 15% to 20% year-over-year in 2023, depending on how quickly multifamily starts slow down."

I was expecting further weakness for new home sales early in the year, and new home sales actually bottomed in July 2022.

I was expecting further weakness for new home sales early in the year, and new home sales actually bottomed in July 2022.This graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in October 2023 were up 17.7% from October 2022. Year-to-date sales are up 4.6% compared to the same period in 2022.

The low level of existing home inventory, combined with mortgage rate buydowns, helped new home sales increase in 2023.

The next graph shows housing starts for 2022 and 2023 by month (Seasonally Adjusted Annual Rate).

The next graph shows housing starts for 2022 and 2023 by month (Seasonally Adjusted Annual Rate).Total starts year-to-date are down 9.9% compared to last year.

This was a somewhat smaller decline for total starts than I expected.

7) Question #7 for 2023: How much will wages increase in 2023?

"My sense is nominal wages will increase in the 3.0% to 3.5% YoY range in 2023 according to the CES."

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). There was a huge increase at the beginning of the pandemic as lower paid employees were let go, and then the pandemic related spike reversed a year later.

Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.0% YoY in November.

Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.0% YoY in November.

Since wages increased sharply last December, it is likely YoY wage growth will slow further next month. Still somewhat above my guess.

6) Question #6 for 2023: What will the Fed Funds rate be in December 2023?

"My guess is there will be around 2 rate hikes in 2023, and if there are more, the FOMC will be under pressure later in 2023 to cut rates putting the Fed Funds rate under 5% at the end of 2023."There were 4 rate hikes in 2023 with the Fed Funds rate target range at 5-1/4 to 5-1/2 percent in December 2023. The Fed is now expected to cut rates in 2024.

5) Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

"My guess is core PCE inflation (year-over-year) will decrease in 2023 (from the current 4.7%), and I think core PCE inflation will be below 3% by the end of 2023."According to the October Personal Income and Outlays report, the October PCE price index increased 3.0 percent year-over-year and the October PCE price index, excluding food and energy, increased 3.5 percent year-over-year. And PCE measures of inflation are expected to slow further in November and December.

4) Question #4 for 2023: What will the participation rate be in December 2023?

"There are probably a few more people that will return to the workforce in 2023, pushing up the participation rate. However, demographics will be pushing the rate down. So, my guess is the participation rate will be mostly unchanged year-over-year, around 62.3%."My guess was somewhat low since more people entered the labor force than I expected (also impacting job growth). The Labor Force Participation Rate was at 62.8% in November.

3) Question #3 for 2023: What will the unemployment rate be in December 2023?

"[M]y guess is the unemployment rate will increase to around 4% in December 2023 from the current 3.5%. (Lower than the FOMC forecast of 4.4% to 4.7%)."The unemployment rates was at 3.7% in November (this guess was looking good in October when the unemployment rate hit 3.9%).

2) Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

"My sense is the FOMC is overly pessimistic, and my guess is there will be something like 400 to 800 thousand jobs added in 2023."

This graph shows the jobs added per month since January 2021.

This graph shows the jobs added per month since January 2021.Through November the economy has added 2.55 million jobs, well above my guess. At least I was much closer than the Fed!

1) Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

"My sense is growth will stay sluggish in 2023, but the economy will avoid recession. ... My guess is that real GDP growth will probably be positive in the 1.0% range in 2023.I was correct about no recession, but growth will likely be closer to 2.7% or so in 2023.

I was more optimistic than most analysts (no recession, positive job growth, inflation falling), but not optimistic enough!

My biggest misses were on house prices, new home sales, GDP and employment (all too pessimistic).