by Calculated Risk on 1/10/2024 07:00:00 AM

Wednesday, January 10, 2024

MBA: Mortgage Applications Increased in Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 5, 2024. The results include an adjustment to account for the New Year’s holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 9.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 45 percent compared with the previous week. The holiday adjusted Refinance Index increased 19 percent from the previous week and was 30 percent higher than the same week one year ago. The unadjusted Refinance Index increased 53 percent from the previous week and was 17 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 40 percent compared with the previous week and was 16 percent lower than the same week one year ago.

“Despite an uptick in mortgage rates to start 2024, applications increased after adjusting for the holiday,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The increase in purchase and refinance applications for both conventional and government loans is promising to start the year but was likely due to some catch-up in activity after the holiday season and year-end rate declines. Mortgage rates and applications have been volatile in recent weeks and overall activity remains low.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.81 percent from 6.76 percent, with points remaining unchanged at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 16% year-over-year unadjusted.

Red is a four-week average (blue is weekly).

Purchase application activity is up from the lows in late October and early November, but still below the lowest levels during the housing bust.

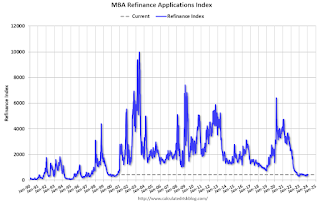

The second graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index declined sharply in 2022, and even with some recent increases, activity is barely off the bottom.