by Calculated Risk on 1/10/2024 03:48:00 PM

Wednesday, January 10, 2024

Question #1 for 2024: How much will the economy grow in 2024? Will there be a recession in 2024?

Earlier I posted some questions on my blog for this year: Ten Economic Questions for 2024. Some of those questions concerned real estate (inventory, house prices, housing starts, new home sales), and I posted thoughts on those in the newsletter (others like GDP and employment are on this blog).

I've added some thoughts and made some predictions for each question.

1) Economic growth: Economic growth was probably close to 2.6% in 2023. The FOMC is expecting growth of 1.2% to 1.7% Q4-over-Q4 in 2024. How much will the economy grow in 2024? Will there be a recession in 2024?

A year ago, I argued that "the economy will avoid recession" in 2023, even though some key indicators suggested a possible recession, the FOMC was forecasting an employment recession, and many Wall Street analysts were forecasting an economic recession.

It is satisfying to make an out of consensus forecast, and get it mostly correct. But we are not out of the woods yet. Recessions can be the result of exogenous events, like the pandemic or the oil shocks due to geopolitical issues in the 1970s, the bursting of speculative bubbles like in 2001 (stock) or 2007 (housing), or - most frequently - the Fed tightening monetary policy to slow inflation.

Exogenous events are always a threat, and there are several geopolitical issues that could lead to recession - in Ukraine, the Middle East, and even with China. However, none of those risks appear likely to cause a U.S. recession this year.

But there is a risk that the Fed will be overly tight in 2024. The "Art of the Soft Landing" requires that the Fed reduce rates quick enough to keep economic growth positive, and slow enough not to reignite inflation. That seems very possible.

My view is a soft landing is achieved if growth stays positive, inflation returns to target, and the yield curve flattens or reverts to normal (long yields higher than short yields.

Here is a graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED since 1976.

Here is a graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED since 1976. Note that recessions usually happen after the yield curve reverts. However, this time, inflation was driven by pandemic economics (supply shocks, etc), and it seems likely the yield curve will revert without a recession.

Click here for interactive graph at FRED.

Click here for interactive graph at FRED.

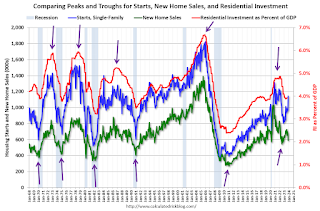

One of my favorite models for business cycle forecasting uses new home sales (also housing starts and residential investment). The purpose of the next graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent likely bottom.

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent likely bottom.New home sales and single-family starts turned down in 2022 in response to higher mortgage rates. However, all three measures appear to have bottomed without a recession.

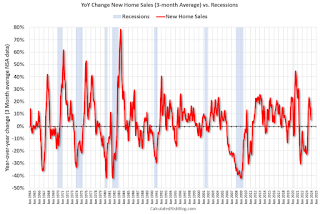

The third graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are up 5% year-over-year.

The third graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are up 5% year-over-year.Usually when the YoY change in New Home Sales falls about 20%, a recession will follow. An exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Another exception was in late 2021 - we saw a significant YoY decline in new home sales related to the pandemic and the surge in new home sales in the second half of 2020. I ignored that pandemic distortion. Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust.

IMPORTANT: These business cycle models (yield curve, housing) are very useful, but I'm not a slave to any model!

Here is a table of the annual change in real GDP since 2005. Prior to the pandemic, economic activity was mostly in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%..

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). For 2023, I used a 2.6% growth rate Q4 over Q4. (this gives 2.4% real annual growth).

My sense is growth will be sluggish in 2024, and the economy will avoid recession. Monetary policy is restrictive, but the Fed is expected to cut rates this year. Vehicle sales will probably pick up in 2024, and so will new home sales.

Here is a table of the annual change in real GDP since 2005. Prior to the pandemic, economic activity was mostly in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%..

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). For 2023, I used a 2.6% growth rate Q4 over Q4. (this gives 2.4% real annual growth).

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.5% | 3.0% |

| 2006 | 2.8% | 2.6% |

| 2007 | 2.0% | 2.1% |

| 2008 | 0.1% | -2.5% |

| 2009 | -2.6% | 0.1% |

| 2010 | 2.7% | 2.8% |

| 2011 | 1.6% | 1.5% |

| 2012 | 2.3% | 1.6% |

| 2013 | 2.1% | 3.0% |

| 2014 | 2.5% | 2.7% |

| 2015 | 2.9% | 2.1% |

| 2016 | 1.8% | 2.2% |

| 2017 | 2.5% | 3.0% |

| 2018 | 3.0% | 2.1% |

| 2019 | 2.5% | 3.2% |

| 2020 | -2.2% | -1.1% |

| 2021 | 5.8% | 5.4% |

| 2022 | 1.9% | 0.7% |

| 20231 | 2.4% | 2.6% |

| 1 2023 estimate based on 2.6% Q4 SAAR annualized real growth rate. | ||

My sense is growth will be sluggish in 2024, and the economy will avoid recession. Monetary policy is restrictive, but the Fed is expected to cut rates this year. Vehicle sales will probably pick up in 2024, and so will new home sales.

So, my guess is that real GDP growth will be positive in the 1% to 2% range in 2024.

• Question #1 for 2024: How much will the economy grow in 2024? Will there be a recession in 2024?

• Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

• Question #3 for 2024: What will the unemployment rate be in December 2024?

• Question #4 for 2024: What will the participation rate be in December 2024?

• Question #5 for 2024: What will the YoY core inflation rate be in December 2024?

• Question #6 for 2024: What will the Fed Funds rate be in December 2024?

• Question #7 for 2024: How much will wages increase in 2024?

• Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

• Question #9 for 2024: What will happen with house prices in 2024?

• Question #10 for 2024: Will inventory increase further in 2024?