by Calculated Risk on 3/29/2024 08:30:00 AM

Friday, March 29, 2024

Personal Income increased 0.3% in February; Spending increased 0.8%

From the BEA: Personal Income and Outlays for February:

Personal income increased $66.5 billion (0.3 percent at a monthly rate) in February, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $50.3 billion (0.2 percent) and personal consumption expenditures (PCE) increased $145.5 billion (0.8 percent).The February PCE price index increased 2.5 percent year-over-year (YoY), up from 2.4 percent YoY in January, and down from the peak of 7.1 percent in June 2022.

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.3 percent. Real DPI decreased 0.1 percent in February and real PCE increased 0.4 percent; goods increased 0.1 percent and services increased 0.6 percent .

emphasis added

The PCE price index, excluding food and energy, increased 2.8 percent YoY, down from 2.9 percent in January, and down from the peak of 5.6 percent in February 2022.

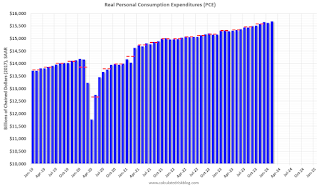

The following graph shows real Personal Consumption Expenditures (PCE) through January 2024 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.

The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations and PCE was at expectations.

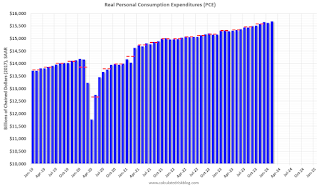

The following graph shows real Personal Consumption Expenditures (PCE) through January 2024 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations and PCE was at expectations.

Inflation was at expectations.

Using the two-month method to estimate Q1 real PCE growth, real PCE was increasing at a 2.7% annual rate in Q1 2024. (Using the mid-month method, real PCE was increasing at 2.7%). This suggests solid PCE growth in Q1.