From Moody’s Analytics economists: Apartment and Retail in Holding Pattern, Office Evolution and Stress Continued, And Industrial Fundamentals Leveled Off

Q1 2024 data revealed trends similar to those observed in 2023, with retail vacancy rate remaining stable at 10.3%. Asking rents rose slightly by 0.2% to $21.69 per sqft, while effective rents also enjoyed 0.2% increase to $18.98 per sqft. During the holiday season, consumer activity was robust but as expected, decelerated in January as retailers reduced their expenditures at the start of the year. However, February marked a resurgence in consumer spending, with retail sales climbing by 0.6%. It is anticipated that overall retail sales in 2024 will mirror those of 2023, albeit with a larger share attributed to non-store and online transactions. The quarter also saw the addition of 198,000 square feet in new retail construction. Despite this growth, the retail sector continues to confront familiar financing obstacles due to persistent high interest rates, suggesting little change in this trend for the remainder of the year. Although bankruptcy announcements have been prevalent, the vacancy rate has remained steady. This stability is partly due to new, smaller store openings by entities that normally wouldn’t fill this space, such as Macy's and Toys R Us.

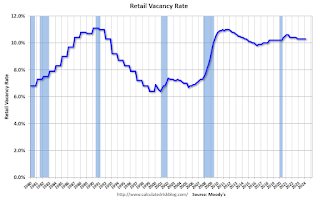

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently the vacancy rate has held steady at a high level as online shopping continues to impact brick and mortar stores.