by Calculated Risk on 5/28/2024 09:00:00 AM

Tuesday, May 28, 2024

Case-Shiller: National House Price Index Up 6.5% year-over-year in March

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Hits New All-Time High in March 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.5% annual gain for March, the same increase as the previous month. The 10- City Composite saw an increase of 8.2%, up from a 8.1% increase in the previous month. The 20-City Composite posted a slight year-over-year increase to 7.4%, up from a 7.3% increase in the previous month. San Diego continued to report the highest year-over-year gain among the 20 cities this month with an 11.1% increase in March, followed by New York and Cleveland, with increases of 9.2% and 8.8%, respectively. Portland, which still holds the lowest rank after reporting three consecutive months of the smallest year-over-year growth, posted the same 2.2% annual increase in March as the previous month.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite all continued their upward trend from last month, showing pre-seasonality adjustment increases of 1.3%, 1.6% and 1.6%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0. 3%, while the 20-City and the 10-City Composite both reported month-over-month increases of 0.3% and 0.5%, respectively.

“This month’s report boasts another all-time high,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “We’ve witnessed records repeatedly break in both stock and housing markets over the past year. Our National Index has reached new highs in six of the last 12 months. During that time, we’ve seen record stock market performance, with the S&P 500 hitting fresh all-time highs for 35 trading days in the past year.

“San Diego stands out with an impressive 11.1% annual gain, followed closely by New York, Cleveland, and Los Angeles, indicating a strong demand for urban markets."

emphasis added

Click on graph for larger image.

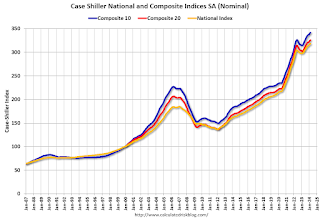

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in March (SA). The Composite 20 index was up 0.3% (SA) in March.

The National index was up 0.3% (SA) in March.

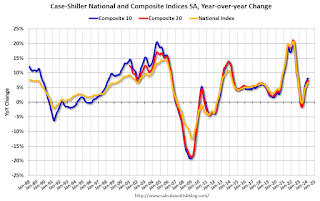

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 8.2% year-over-year. The Composite 20 SA was up 7.4% year-over-year.

The National index SA was up 6.5% year-over-year.

Annual price changes were close to expectations. I'll have more later.