by Calculated Risk on 11/30/2024 08:11:00 AM

Saturday, November 30, 2024

Schedule for Week of December 1, 2024

The key report this week is the November employment report on Friday.

Other key indicators include the October Trade Deficit, the November ISM manufacturing index and November vehicle sales.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 47.5%, up from 46.5%.

10:00 AM: Construction Spending for October. The consensus is for 0.2% increase in spending.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 16.0 million SAAR in November, unchanged from the BEA estimate of 16.04 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967.

The dashed line is the current sales rate.

----- Tuesday, December 3rd -----

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

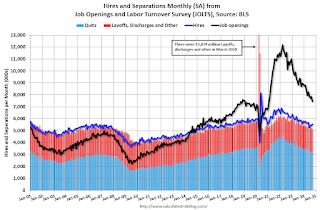

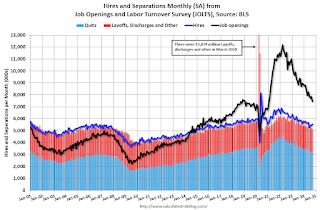

This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in September to 7.44 million from 7.86 million in August.

The number of job openings (black) were down 20% year-over-year. Quits were down 15% year-over-year.

----- Wednesday, December 4th -----

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 166,000 jobs added, down from 233,000 in October.

10:00 AM: the ISM Services Index for November. The consensus is for 55.5, down from 56.0.

1:45 PM: Discussion, Fed Chair Jerome Powell, Moderated Discussion, At the New York Times DealBook Summit, New York, N.Y.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

----- Thursday, December 5th -----

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 213 thousand last week.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau.

This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $78.8 billion. The U.S. trade deficit was at $84.4 billion in September.

----- Friday, December 6th -----

8:30 AM: Employment Report for November. The consensus is for 183,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

8:30 AM: Employment Report for November. The consensus is for 183,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

There were 12,000 jobs added in October, and the unemployment rate was at 4.1%.

This graph shows the jobs added per month since January 2021.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in September to 7.44 million from 7.86 million in August.

The number of job openings (black) were down 20% year-over-year. Quits were down 15% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 166,000 jobs added, down from 233,000 in October.

10:00 AM: the ISM Services Index for November. The consensus is for 55.5, down from 56.0.

1:45 PM: Discussion, Fed Chair Jerome Powell, Moderated Discussion, At the New York Times DealBook Summit, New York, N.Y.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 213 thousand last week.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $78.8 billion. The U.S. trade deficit was at $84.4 billion in September.

8:30 AM: Employment Report for November. The consensus is for 183,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

8:30 AM: Employment Report for November. The consensus is for 183,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.There were 12,000 jobs added in October, and the unemployment rate was at 4.1%.

This graph shows the jobs added per month since January 2021.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).