by Calculated Risk on 8/23/2021 10:11:00 AM

Monday, August 23, 2021

NAR: Existing-Home Sales Increased to 5.99 million in July

From the NAR: Existing-Home Sales Climb 2.0% in July

Existing-home sales rose in July, marking two consecutive months of increases, according to the National Association of Realtors®. Three of the four major U.S. regions recorded modest month-over-month gains, and the fourth remained level. Figures varied from a year-over-year perspective as two regions saw gains, one witnessed a decline and one was unchanged.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 2.0% from June to a seasonally adjusted annual rate of 5.99 million in July. Sales inched up year-over-year, increasing 1.5% from a year ago (5.90 million in July 2020).

...

Total housing inventory at the end of July totaled 1.32 million units, up 7.3% from June's supply and down 12.0% from one year ago (1.50 million). Unsold inventory sits at a 2.6-month supply at the present sales pace, up slightly from the 2.5-month figure recorded in June but down from 3.1 months in July 2020.

emphasis added

Click on graph for larger image.

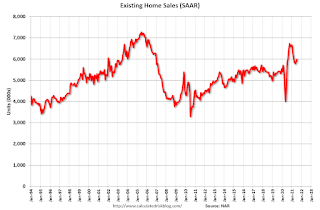

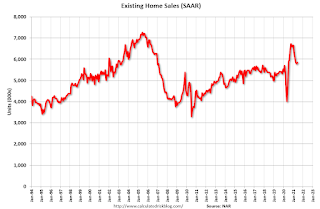

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (5.99 million SAAR) were up 2.0% from last month, and were 1.5% above the July 2020 sales rate.

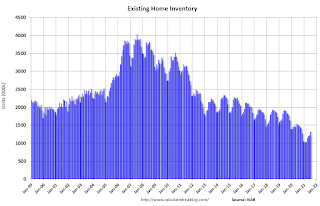

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.32 million in July from 1.23 million in June.

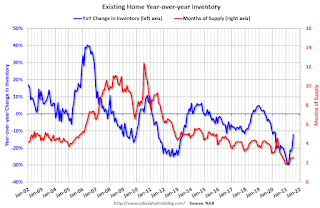

According to the NAR, inventory increased to 1.32 million in July from 1.23 million in June.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 12.0% year-over-year in July compared to July 2020.

Inventory was down 12.0% year-over-year in July compared to July 2020. Months of supply increased to 2.6 months in July from 2.5 months in June.

This was slightly above the consensus forecast. I'll have more later.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 8/23/2021 08:27:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of August 22nd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 23.3% from the same day in 2019 (76.7% of 2019). (Dashed line)

There was a slow increase from the bottom starting in May 2020 - and then TSA data picked up in 2021 - but the dashed line was moving sideways, and has moved down recently.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through August 21, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was generally picking up, but has moved down recently - especially in Florida and Texas. The 7-day average for the US is down 10% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $107 million last week, down about 43% from the median for the week.

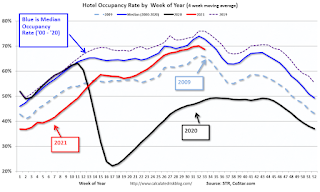

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is above the horrible 2009 levels. With solid leisure travel, the Summer months had decent occupancy - but it is uncertain what will happen in the Fall with business travel - especially with the sharp increase in COVID pandemic cases and hospitalizations.

This data is through August 14th. The occupancy rate is down 8.4% compared to the same week in 2019. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

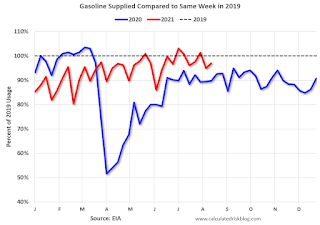

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of August 13th, gasoline supplied was down 3.0% compared to the same week in 2019.

There have been four weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through August 14th for the United States and several selected cities.

This data is through August 14th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 105% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, August 20th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, August 22, 2021

Monday: Existing Home Sales

by Calculated Risk on 8/22/2021 07:29:00 PM

Weekend:

• Schedule for Week of August 22, 2021

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.81 million SAAR, down slightly from 5.86 million last month.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 4 and DOW futures are up 30 (fair value).

Oil prices were down over the last week with WTI futures at $62.38 per barrel and Brent at $65.49 per barrel. A year ago, WTI was at $42, and Brent was at $44 - so WTI oil prices are UP about 50% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.14 per gallon. A year ago prices were at $2.18 per gallon, so gasoline prices are up $0.96 per gallon year-over-year.

August 22nd COVID-19: Averaging Over 1 Million Doses Administered Last 4 Days

by Calculated Risk on 8/22/2021 04:33:00 PM

Note: Cases and Deaths are not updated on Sundays.

Total doses administered: 362,657,771, as of a week ago 356,433,665. Average doses last week: 0.89 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.5% | 51.3% | 50.6% | ≥70.0%1 |

| Fully Vaccinated (millions) | 170.8 | 170.4 | 168.1 | ≥2321 |

| New Cases per Day3🚩 | 137,188 | 134,859 | 122,769 | ≤5,0002 |

| Hospitalized3🚩 | 79,310 | 80,298 | 69,269 | ≤3,0002 |

| Deaths per Day3🚩 | 738 | 688 | 600 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.4%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.0%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 48.4%, Ohio at 47.8%, Kentucky at 47.6%, Kansas at 47.2%, Arizona at 47.0%, Utah at 46.7%, Alaska at 46.6%, and Nevada at 46.6%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of hospitalizations reported.

Columbus Real Estate in July: Sales Up 3% YoY, Inventory UP 4% YoY

by Calculated Risk on 8/22/2021 03:23:00 PM

The is only the second local market that I track that saw a year-over-year increase in active inventory in July.

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

Here is a summary post for many markets: Existing Home Inventory in July: Local Markets

For for the Columbus, Ohio area:

Closed sales in July 2021 were 3,630, up 2.7% from 3,536 in July 2020.

Active Listings in July 2021 were 3,079, up 4.2% from 2,955 in July 2020.

Months of Supply was 1.0 Months in July 2021, compared to 1.1 Months in July 2020.

Inventory in July was up 27.0% from last month, and up 87.9% from the all time low in March 2021.

30 Year Mortgage Rates "Stuck in the Middle" at 2.93%

by Calculated Risk on 8/22/2021 08:58:00 AM

From Matthew Graham at Mortgage News Daily: Rates Stuck in The Middle

Rates are on hold until the next chapter is written in the complex saga of covid versus the market. This isn't to say rates perfectly flat--simply that the prevailing momentum has been sideways for the past few weeks.

Since mortgage rates only change once or twice a day, we can use 10yr Treasury yields to see finer detail. This entire week took place in the fairly narrow range of 1.29 to 1.21, and it ended with yields precisely in the middle at 1.25%.

...

What does all this mean in plain English? Rates are low--much lower than most anyone expected at this point in the year. The key reason is "delta" and Fed's patient approach to changing rate-friendly policies. The lingering concerns about the nature of the post-covid economy also make the list. [30 year fixed 2.93%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac).

Saturday, August 21, 2021

Indiana Real Estate in July: Sales Down 7% YoY, Inventory Down 25% YoY

by Calculated Risk on 8/21/2021 04:50:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

Here is a summary post for many markets: Existing Home Inventory in July: Local Markets

For for the entire state Indiana:

Closed sales in July 2021 were 9,585, down 6.5% from 10,256 in July 2020.

Active Listings in July 2021 were 8,874, down 24.6% from 11,762 in July 2020.

Months of Supply was 1.1 Months in July 2021, compared to 1.6 Months in July 2020.

Inventory in July was up 14.6% from last month, and up 50.5% from the all time low in March 2021.

August 21st COVID-19: Hospitalizations over 80,000, Cases and Deaths Increasing

by Calculated Risk on 8/21/2021 04:46:00 PM

The 7-day average deaths is the highest since March 25th.

Total doses administered: 361,684,564, as of a week ago 355,768,825. Average doses last week: 0.85 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent fully Vaccinated | 51.3% | 51.2% | 50.6% | ≥70.0%1 |

| Fully Vaccinated (millions) | 170.4 | 170.0 | 168.1 | ≥2321 |

| New Cases per Day3🚩 | 137,188 | 134,859 | 122,769 | ≤5,0002 |

| Hospitalized3🚩 | 80,101 | 78,944 | 66,996 | ≤3,0002 |

| Deaths per Day3🚩 | 738 | 688 | 600 | ≤502 |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 17 states and D.C. have between 50% and 59.9% fully vaccinated: Washington at 59.3%, New Hampshire, New York State, New Mexico, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa and Illinois at 50.3%.

Next up (total population, fully vaccinated according to CDC) are Michigan at 49.9%, South Dakota at 48.4%, Ohio at 47.7%, Kentucky at 47.5%, Kansas at 47.0%, Arizona at 46.9%, Utah at 46.7%, Alaska at 46.6%, and Nevada at 46.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Schedule for Week of August 22, 2021

by Calculated Risk on 8/21/2021 08:11:00 AM

The key reports this week are the second estimate of Q2 GDP, July New and Existing Home sales, and Personal Income and Outlays for July.

For manufacturing, the August Richmond and Kansas City Fed surveys will be released.

Fed Chair Jerome Powell will speak on "The Economic Outlook" at the Jackson Hole Symposium on Friday.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.81 million SAAR, down slightly from 5.86 million last month.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.81 million SAAR, down slightly from 5.86 million last month.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 5.86 million SAAR.

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 690 thousand SAAR, up from 676 thousand in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.2% decrease in durable goods orders.

8:30 AM: Gross Domestic Product, 2nd quarter 2021 (second estimate). The consensus is that real GDP increased 6.7% annualized in Q2, up from the advance estimate of 6.5% in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a increase slightly to 350 thousand from 348 thousand last week.

11:00 AM: the Kansas City Fed manufacturing survey for August.

Thursday through Saturday: Jackson Hole Economic Policy Symposium, Macroeconomic Policy in an Uneven Economy

8:30 AM ET: Personal Income and Outlays, July 2021. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%.

10:00 AM: Speech, Fed Chair Jerome Powell, The Economic Outlook, At the Jackson Hole Economic Policy Symposium

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 70.9.

Friday, August 20, 2021

California July Housing: Sales down 2% YoY, "Home sales and prices curb in July"

by Calculated Risk on 8/20/2021 03:46:00 PM

The CAR reported: California housing market continues to normalize as home sales and prices curb in July, C.A.R. reports

California’s housing market moderated for the third straight month in July with both home sales and prices tempering from the heated market conditions seen over the past year, while still staying above pre-pandemic levels, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Note that inventory was up 15.4% from June to July, similar to the increase the previous month. Although the CAR doesn't report inventory, it appears inventory is down about 12% year-over-year.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 428,980 in July, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2021 if sales maintained the July pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

July home sales dipped 1.6 percent on a monthly basis from 436,020 in June and were down 2 percent from a year ago, when 437,890 homes were sold on an annualized basis. July’s sales level was the second highest level in a July in the past six years. Despite the downward trend, California home sales maintained a solid year-to-date increase of 27.3 percent.

“The California housing market continues to normalize from the white-hot conditions we experienced at the height of the pandemic with both sales and prices moderating as we slowly transition from the peak home-buying season into the fall,” said C.A.R. President Dave Walsh. “The market remains solid, however, as sales were still the second highest level for a July in the last six years, and the statewide median price continues to perform above last year’s level by double-digits. Housing supply, while improved, remains tight and market competition is still heated with homes flying off the market in record time.”

...

The state housing supply condition continued to improve with active listings reaching the highest level since last October. The number of for-sale properties increased 15.4 percent in July from the prior month as more homes were being listed on the market. Despite an increase in total active listings in July, new listings added in the month dipped slightly for the first time after gaining year-over-year for four straight months.

emphasis added