by Calculated Risk on 5/06/2022 09:11:00 AM

Friday, May 06, 2022

Comments on April Employment Report

This was another solid report.

The headline jobs number in the April employment report was slightly above expectations, however employment for the previous two months was revised down by 39,000. The participation rate and the employment-population ratio both decreased slightly, and the unemployment rate was unchanged at 3.6%.

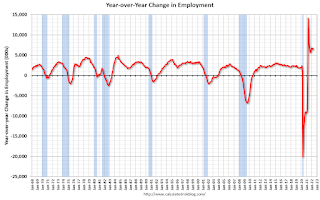

In April, the year-over-year employment change was 6.6 million jobs.

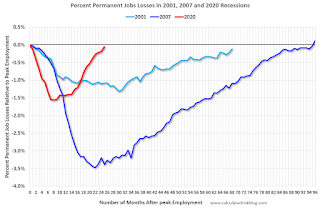

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

In April, the number of permanent job losers decreased to 1.386 million from 1.392 million in the previous month.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate decreased in April to 82.4% from 82.5% in March, and the 25 to 54 employment population ratio decreased to 79.9% from 80.0% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons was little changed at 4.0 million in April and is down by 357,000 from its February 2020 level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in April to 4.033 million from 4.170 million in March. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.0% from 6.9% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure at the 7.0% in February 2020 (pre-pandemic).

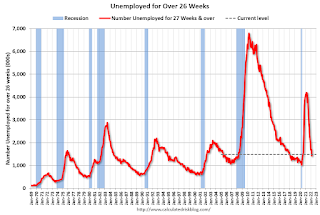

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.483 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.428 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was slightly above expectations; however, the previous two months were revised down by 39,000 combined.

April Employment Report: 428 thousand Jobs, 3.6% Unemployment Rate

by Calculated Risk on 5/06/2022 08:41:00 AM

From the BLS:

Total nonfarm payroll employment increased by 428,000 in April, and the unemployment rate was unchanged at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, in manufacturing, and in transportation and warehousing.

The change in total nonfarm payroll employment for February was revised down by 36,000, from +750,000 to +714,000, and the change for March was revised down by 3,000, from +431,000 to +428,000. With these revisions, employment in February and March combined is 39,000 lower than previously reported.

emphasis added

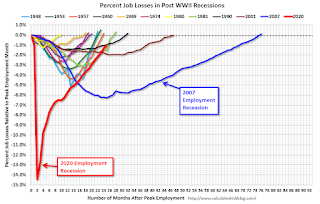

Click on graph for larger image.

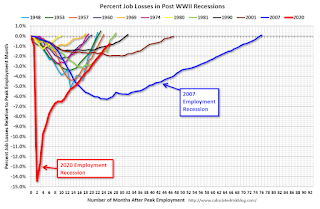

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was 6.6 million jobs. This was up significantly year-over-year.

Total payrolls increased by 428 thousand in April. Private payrolls increased by 406 thousand, and public payrolls increased 22 thousand.

Payrolls for February and March were revised down 39 thousand, combined.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 62.2% in April, from 62.4% in March. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 62.2% in April, from 62.4% in March. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 60.1% from 60.0% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in April at 3.6% from 3.6% in March.

This was slightly above consensus expectations; however, February and March payrolls were revised down by 39,000 combined.

Thursday, May 05, 2022

Friday: Employment Report

by Calculated Risk on 5/05/2022 08:45:00 PM

My April Employment Preview

Goldman April Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for April. The consensus is for 400,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.9 | --- | ≥2321 | |

| New Cases per Day3🚩 | 61,712 | 50,531 | ≤5,0002 | |

| Hospitalized3🚩 | 12,437 | 10,931 | ≤3,0002 | |

| Deaths per Day3🚩 | 325 | 311 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

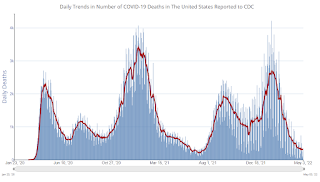

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Goldman April Payrolls Preview

by Calculated Risk on 5/05/2022 04:39:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 300k in April (mom sa), below consensus of +385k and our original forecast of +350k. While labor demand remains at elevated levels and dining activity has returned to normal, seasonally-adjusted job growth tends to slow during the spring hiring season when the labor market is tight. ...We estimate a one-tenth drop in the unemployment rate to 3.5%, reflecting a solid or strong rise in household employment partially offset by another 0.1pp rise in labor force participation to 62.5%CR Note: The consensus is for 400 thousand jobs added, and for the unemployment rate to be unchanged at 3.6%.

emphasis added

Hotels: Occupancy Rate Down 3.4% Compared to Same Week in 2019

by Calculated Risk on 5/05/2022 03:27:00 PM

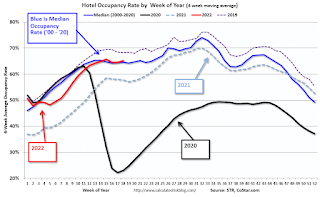

U.S. hotel occupancy improved from the previous week, while average daily rate (ADR) decreased slightly, according to STR‘s latest data through April 30.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 24-30, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 66.6% (-3.4%)

• Average daily rate (ADR): $146.67 (+10.2%)

• Revenue per available room (RevPAR): $97.72 (+6.4%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Lawler: Mortgage/Treasury Spreads, Part I

by Calculated Risk on 5/05/2022 12:12:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Mortgage/Treasury Spreads, Part I

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

The most widely quoted statistic from the PMMS is the 30-year mortgage rate from the survey. Yet the survey also shows the typical/average fees/points associated with this interest rate, and these fees/points have changed dramatically over time. Below is a historical chart showing the fees/points charged along with the PMMS rate.

Click on graph for larger image.

As the chart shows, from the late 70’s to the late 90’s the average fees/points associated with the PMMS mortgage rate were substantially higher than has been the case over the last two decades. As such, the spread between the “effective” mortgage rate and the PMMS mortgage rate was considerably wider from the late 70’s to the late 90’s than has been than in the more recent decades.

...

More on this topic later. However, the fact that nominal mortgage to 10-year Treasury spreads have widened considerably this year is not surprising given other developments in fixed-income markets, and there is no reason to expect that they will revert back to some “mean” level.

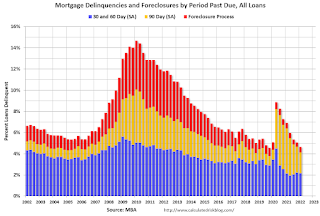

MBA: "Mortgage Delinquencies Decrease in the First Quarter of 2022"

by Calculated Risk on 5/05/2022 10:13:00 AM

From the MBA: Mortgage Delinquencies Decrease in the First Quarter of 2022

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.11 percent of all loans outstanding at the end of the first quarter of 2022, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate decreased 54 basis points from the fourth quarter of 2021 and was down 227 basis points from one year ago.

“The mortgage delinquency rate dropped for the seventh consecutive quarter, reaching its lowest level since the fourth quarter of 2019,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The decrease in delinquency rates was apparent across all loan types, and especially for FHA loans. The delinquency rate for FHA loans declined 118 basis points from fourth-quarter 2021 and was down 509 basis points from one year ago.”

According to Walsh, most of the improvement in loan performance can be attributed to the movement of loans that were 90-days or more delinquent. The majority of these aged delinquencies were either cured or entered post-forbearance loan workouts.

The expiration of pandemic-related foreclosure moratoriums led to a modest increase in foreclosure starts from the record lows maintained over the past two years. At 0.19 percent, the foreclosure starts rate remains below the quarterly average of 0.41 percent dating back to 1979.

Added Walsh, “Given the nation’s limited housing inventory and the variety of home retention and foreclosure alternatives on the table across various loan types, the probability of a significant foreclosure surge is minimal. Borrowers have more choices today to either stay in their homes or sell without resorting to a foreclosure.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q1.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 6 basis points to 1.59 percent, the 60-day delinquency rate remained unchanged at 0.56 percent, and the 90-day delinquency bucket decreased 48 basis points to 1.96 percent.This sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 0.53 percent, up 11 basis points from the fourth quarter of 2021 and down 1 basis point from one year ago. The percentage of loans on which foreclosure actions were started in the first quarter rose by 15 basis points to 0.19 percent. The foreclosure starts rate remains below the quarterly average of 0.41 percent dating back to 1979.

The percent of loans in the foreclosure process increased in Q1 with the end of the foreclosure moratoriums.

April Employment Preview

by Calculated Risk on 5/05/2022 09:35:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus is for 400,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 1.6 million fewer jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 25 months after the onset, has recovered quicker than the previous two recessions.

• ADP Report: The ADP employment report showed a gain of 247,000 private sector jobs, well below the consensus estimates of 395,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests a weaker than expected BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in April to 50.9%, down from 56.3% last month. This would suggest 15,000 jobs lost in manufacturing employment in April. ADP showed 25,000 manufacturing jobs added.

The ISM® Services employment index decreased in April to 49.5%, down from 54.0% last month. This would suggest a 60 thousand increase in service employment in April. Combined, the ISM indexes suggest employment well below the consensus estimate.

• Unemployment Claims: The weekly claims report showed an increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 177,000 in March to 185,000 in April. This would usually suggest a few mort layoffs in April than in March, although this might not be very useful right now. In general, weekly claims were at expectations in April.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the January report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the January report.This data is only available back to 1994, so there is only data for three recessions. In March, the number of permanent job losers decreased to 1.392 million from 1.583 million in the previous month.

• Conclusion: The consensus is for job growth to slow to 400,000 jobs added in April. Overall, the ADP report was below expectations, the ISM employment surveys were weak, and unemployment claims was mostly neutral during the reference week. This suggests a weaker than expected employment report for April.

Weekly Initial Unemployment Claims Increase to 200,000

by Calculated Risk on 5/05/2022 08:33:00 AM

The DOL reported:

In the week ending April 30, the advance figure for seasonally adjusted initial claims was 200,000, an increase of 19,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 180,000 to 181,000. The 4-week moving average was 188,000, an increase of 8,000 from the previous week's revised average. The previous week's average was revised up by 250 from 179,750 to 180,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 188,000.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, May 04, 2022

Thursday: Unemployment Claims

by Calculated Risk on 5/04/2022 10:49:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 180 thousand unchanged from 180 thousand last week.