by Calculated Risk on 7/08/2022 09:27:00 AM

Friday, July 08, 2022

Comments on June Employment Report

The headline jobs number in the June employment report was above expectations, however employment for the previous two months was revised down by 74,000. The participation rate and the employment-population ratio both decreased slightly, and the unemployment rate was unchanged at 3.6%.

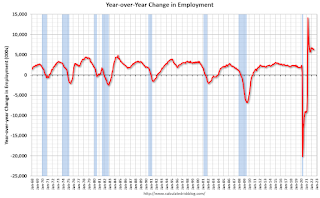

In June, the year-over-year employment change was 6.3 million jobs.

Permanent Job Losers

Click on graph for larger image.

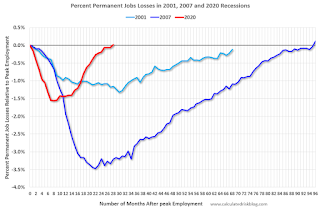

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

In June, the number of permanent job losers declined to 1.273 million from 1.386 million in the previous month.

Prime (25 to 54 Years Old) Participation

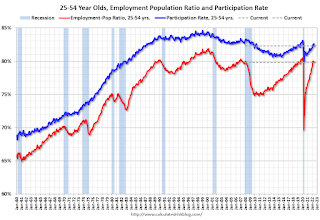

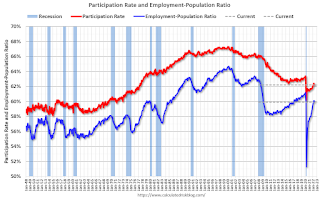

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate decreased in June to 82.3% from 82.6% in May, and the 25 to 54 employment population ratio decreased to 79.8% from 80.0% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons declined by 707,000 to 3.6 million in June and is below its February 2020 level of 4.4 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in June to 3.621 million from 4.328 million in May. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 6.7% from 7.1% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is lower than the 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.336 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.356 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was above expectations; however, the previous two months were revised down by 74,000 combined.

June Employment Report: 372 thousand Jobs, 3.6% Unemployment Rate

by Calculated Risk on 7/08/2022 08:40:00 AM

From the BLS:

Total nonfarm payroll employment rose by 372,000 in June, and the unemployment rate remained at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, leisure and hospitality, and health care.

...

The change in total nonfarm payroll employment for April was revised down by 68,000, from +436,000 to +368,000, and the change for May was revised down by 6,000, from +390,000 to +384,000. With these revisions, employment in April and May combined is 74,000 lower than previously reported.

emphasis added

Click on graph for larger image.

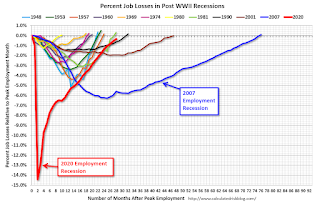

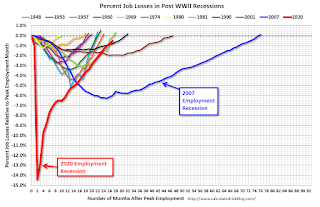

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was 6.3 million jobs. This was up significantly year-over-year.

Total payrolls increased by 372 thousand in June. Private payrolls increased by 381 thousand, and public payrolls decreased 9 thousand.

Payrolls for April and May were revised down 74 thousand, combined.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 62.2% in June, from 62.3% in May. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 62.2% in June, from 62.3% in May. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 59.9% from 60.1% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

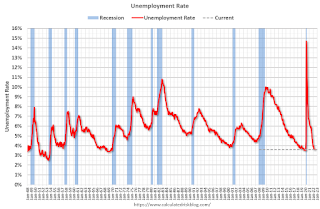

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in June at 3.6% from 3.6% in May.

This was above consensus expectations; however, April and May payrolls were revised down by 74,000 combined.

Thursday, July 07, 2022

Friday: Employment Report

by Calculated Risk on 7/07/2022 09:11:00 PM

My June Employment Preview

Goldman June Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for June. The consensus is for 270,000 jobs added, and for the unemployment rate to be unchanged at 3.6%

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.3 | --- | ≥2321 | |

| New Cases per Day3 | 106,549 | 110,875 | ≤5,0002 | |

| Hospitalized3🚩 | 28,891 | 26,959 | ≤3,0002 | |

| Deaths per Day3 | 273 | 345 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Goldman June Payrolls Preview

by Calculated Risk on 7/07/2022 03:48:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 250k in June ... employment surveys and Big Data employment indicators generally weakened in the month, and the Challenger report showed an increase in job cuts—particularly in real estate, autos, and media. ... We estimate an unchanged unemployment rate at 3.6%—in line with consensus—reflecting a solid rise in household employment offset by a 0.1pp rise in labor force participation to 62.4%.CR Note: The consensus is for 270 thousand jobs added, and for the unemployment rate to be unchanged at 3.6%.

emphasis added

June Employment Preview

by Calculated Risk on 7/07/2022 12:18:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for 270,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 800 thousand fewer jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 27 months after the onset, has recovered quicker than the previous two recessions.

• ADP Report: The ADP employment report has been "paused" and is being retooled.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in June to 47.3%, down from 50.9% last month. This would suggest 35,000 jobs lost in manufacturing.

The ISM® services employment index decreased in June to 47.4%, down from 50.2% last month. This would suggest service employment was unchanged in June.

Combined, the ISM surveys suggest 35,000 jobs lost in June.

• Unemployment Claims: The weekly claims report showed an increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 218,000 in May to 233,000 in June. This would usually suggest a few more layoffs in June than in May. In general, weekly claims were above expectations in June.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the May report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the May report.This data is only available back to 1994, so there is only data for three recessions. In May, the number of permanent job losers was unchanged at 1.386 million from 1.386 million in the previous month.

1st Look at Local Housing Markets in June, Sales Down Sharply

by Calculated Risk on 7/07/2022 10:05:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in June, Sales Down Sharply

A brief excerpt:

From Denver Metro Association of Realtors® (DMAR): DMAR Real Estate Market Trends ReportThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/As month-end active inventory skyrockets, the Denver Metro hit a new record for the average price of attached properties at $504,193. At the end of June 2021, Denver Metro ended with 3,122 properties on the market. It has now almost doubled that amount over the year, with a total of 6,057 properties currently sitting on the market. … “The increase in supply will eventually impact pricing, days in the MLS and the relationship between buyers and sellers, which have negatively impacted buyers’ purchasing power,” commented Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver Realtor®. “The stock market, inflation and cryptocurrency have all taken a hit in the last few months. Housing will eventually be a victim to the economy as a whole, but just how much is yet to be seen. It is realistic to see days in the MLS, currently sitting at a historic low of four, increase in the coming months.”

emphasis added... And a table of June sales. Sales in these areas were down 23.4% YoY, Not Seasonally Adjusted (NSA). Contracts for sales in June were mostly signed in April and May, when mortgage rates were lower than in June.

...

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle) and Santa Clara (San Jose)

Trade Deficit decreased to $85.5 Billion in May

by Calculated Risk on 7/07/2022 08:46:00 AM

From the Department of Commerce reported:

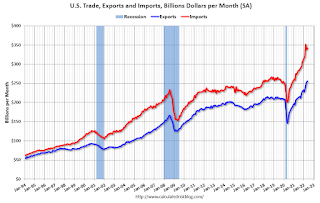

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $85.5 billion in May, down $1.1 billion from $86.7 billion in April, revised.

May exports were $255.9 billion, $3.0 billion more than April exports. May imports were $341.4 billion, $1.9 billion more than April imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in May.

Exports are up 22% year-over-year; imports are up 23% year-over-year.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

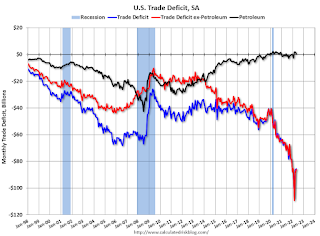

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $31.5 billion in May, from $26.1 billion a year ago.

Weekly Initial Unemployment Claims Increase to 235,000

by Calculated Risk on 7/07/2022 08:34:00 AM

The DOL reported:

In the week ending July 2, the advance figure for seasonally adjusted initial claims was 235,000, an increase of 4,000 from the previous week's unrevised level of 231,000. The 4-week moving average was 232,500, an increase of 750 from the previous week's unrevised average of 231,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 232,500.

The previous week was unrevised.

Weekly claims were higher than the consensus forecast.

Wednesday, July 06, 2022

Thursday: Unemployment Claims, Trade Deficit

by Calculated Risk on 7/06/2022 09:02:00 PM

Thursday:

• At 8:15 AM ET, The ADP Employment Report for June will NOT be released.

"ADP Research Institute (ADPRI) and the Stanford Digital Economy Lab (the "Lab") announced they will retool the ADP National Employment Report (NER) methodology to provide a more robust, high-frequency view of the labor market and trajectory of economic growth. In preparation for the changeover to the new report and methodology, ADPRI will pause issuing the current report and has targeted August 31, 2022 ..."• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand down from 231 thousand last week.

• Also at 8:30 AM, Trade Balance report for May from the Census Bureau. The consensus is the trade deficit to be $84.9 billion. The U.S. trade deficit was at $87.1 billion the previous month.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.3 | --- | ≥2321 | |

| New Cases per Day3 | 106,178 | 108,391 | ≤5,0002 | |

| Hospitalized3🚩 | 28,101 | 26,543 | ≤3,0002 | |

| Deaths per Day3 | 267 | 345 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

ISM® Services Index Decreased to 55.3% in June, Employment Contracted

by Calculated Risk on 7/06/2022 07:01:00 PM

(Posted with permission). The ISM® Services index was at 55.3%, down from 55.9% last month. The employment index decreased to 47.4%, from 50.2%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 55.3% June 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in June for the 25th month in a row — with the Services PMI® registering 55.3 percent, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.This was slightly better than expected.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In June, the Services PMI® registered 55.3 percent, 0.6 percentage point lower than May’s reading of 55.9 percent. This is the lowest reading since May 2020 (45.2 percent). The Business Activity Index registered 56.1 percent, an increase of 1.6 percentage points compared to the reading of 54.5 percent in May. The New Orders Index figure of 55.6 percent is 2 percentage points lower than the May reading of 57.6 percent.

...

The Employment Index (47.4 percent) contracted...

emphasis added