by Calculated Risk on 11/24/2015 07:45:00 PM

Tuesday, November 24, 2015

Wednesday: New Home Sales, Unemployment Claims, Personal Income and Outlays, Durable Goods, and more

From the WSJ: Real Home Prices Could Take 17 Years to Return to Peak

Most measures of home prices—including the S&P/Case-Shiller Home Price Index, the CoreLogic Home Price Index and the National Association of Realtors existing home sales report—don’t take inflation into account and show prices nearing or surpassing the peak hit in 2006 or early 2007.As the article notes, the nominal Corelogic index is 7% below the peak, but 20% below the peak when adjusted for inflation. As I noted this morning, the nominal Case-Shiller index 6% below the bubble, but 19.7% below the peak when adjusted for inflation.

But a new analysis by real-estate information firm CoreLogic finds that when adjusted for inflation, home prices are years away from hitting the lofty heights of the housing boom. Indeed, economists there say that prices are unlikely to surpass 2006 levels until 2023 or beyond, some 17 years past the peak.

This is important. As I wrote in early 2005, "a bubble requires both overvaluation based on fundamentals and speculation", and currently we are seeing little speculation and valuations aren't anything like during the bubble. So no bubble.

The WSJ article quotes Corelogic chief economist Sam Khater:

“The market is overvalued but it’s not a bubble,” Mr. Khater said. “Unlike the last boom, which was heavily demand-driven, this boom [in] home prices is driven by the chronic lack of supply.”Wednesday:

• 7:00 AM ET: the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 271 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders.

• Also at 8:30 AM, Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:00 AM, the FHFA House Price Index for September 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

• At 10:00 AM, New Home Sales for October from the Census Bureau. The consensus is for a increase in sales to 499 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 468 thousand in September.

• Also at 10:00 AM, the University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 93.1, unchanged from the preliminary reading.

Chemical Activity Barometer "Chemical Activity Barometer Stabilizes"

by Calculated Risk on 11/24/2015 03:27:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

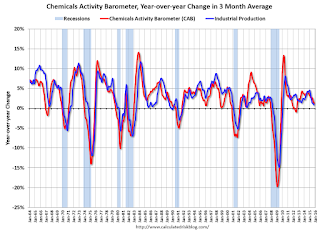

From the American Chemistry Council: Chemical Activity Barometer Stabilizes as Year End Approaches

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), stabilized in November, rising 0.1 percent following three consecutive months of decline. October data was revised up 0.3 percent and September by 0.2 percent. All data is measured on a three-month moving average (3MMA).The pattern reverses a downward trend that had begun to gain momentum. Accounting for adjustments, the CAB remains up 1.3 percent over this time last year, a deceleration of annual growth. In November 2014, the CAB logged a 3.4 percent annual gain over October 2013. ...

...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

This suggests that industrial production might have stabilized.

Real Prices and Price-to-Rent Ratio in September

by Calculated Risk on 11/24/2015 12:04:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 4.9% year-over-year in September

The year-over-year increase in prices is mostly moving sideways now at between 4% and 5%. In October 2013, the National index was up 10.9% year-over-year (YoY). In September 2015, the index was up 4.9% YoY.

Here is the YoY change since January 2014 for the National Index:

| Month | YoY Change |

|---|---|

| Jan-14 | 10.5% |

| Feb-14 | 10.1% |

| Mar-14 | 8.9% |

| Apr-14 | 7.9% |

| May-14 | 7.1% |

| Jun-14 | 6.3% |

| Jul-14 | 5.7% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.6% |

| Nov-14 | 4.6% |

| Dec-14 | 4.6% |

| Jan-15 | 4.3% |

| Feb-15 | 4.3% |

| Mar-15 | 4.3% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

| Jun-15 | 4.4% |

| Jul-15 | 4.5% |

| Aug-15 | 4.6% |

| Sep-15 | 4.9% |

This slowdown in price increases this year was expected by several key analysts, and I think it is good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 6.0% below the bubble peak. However, in real terms, the National index is still about 19.7% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through September) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through September) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to August 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to September 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.5% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to October 2003.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

Case-Shiller: National House Price Index increased 4.9% year-over-year in September

by Calculated Risk on 11/24/2015 09:28:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Widespread Gains in Home Prices for August According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a slightly higher year-over-year gain with a 4.9% annual increase in September 2015 versus a 4.6% increase in August 2015. The 10-City Composite increased 5.0% in the year to September compared to 4.7% previously. The 20-City Composite’s year-over-year gain was 5.5% versus 5.1% in the year to September. After adjusting for the CPI core rate of inflation, the S&P/Case Shiller National Home Price Index rose 3% from September 2014 to September 2015.

...

Before seasonal adjustment, the National Index posted a gain of 0.2% month-over-month in September. The 10-City Composite and 20-City Composite both reported gains of 0.2% month-over-month in September. After seasonal adjustment, the National Index posted a gain of 0.8%, while the 10-City and 20-City Composites both increased 0.6% month-over-month. Fifteen of 20 cities reported increases in September before seasonal adjustment; after seasonal adjustment, 19 cities increased for the month.

...

“Home prices and housing continue to show strength with home prices rising at more than double the rate of inflation,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.3% from the peak, and up 0.6% in September (SA).

The Composite 20 index is off 13.0% from the peak, and up 0.6% (SA) in September.

The National index is off 6.0% from the peak, and up 0.8% (SA) in September. The National index is up 27.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.1% compared to September 2014.

The Composite 20 SA is up 5.5% year-over-year..

The National index SA is up 4.9% year-over-year.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in September seasonally adjusted. (Prices increased in 15 of the 20 cities NSA) Prices in Las Vegas are off 39.2% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 54% above January 2000 (54% nominal gain in almost 16 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 14% above the change in overall prices due to inflation.

Three cities - Denver (up 70% since Jan 2000) and Dallas (up 52% since Jan 2000) and Boston (up 80% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Charlotte, San Francisco, Portland and Seattle). Detroit prices are barely above the January 2000 level.

I'll have more on house prices later.

Q3 GDP Revised Up to 2.1% Annual Rate

by Calculated Risk on 11/24/2015 08:35:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2015 (Second Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 2.1 percent in the third quarter of 2015, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.9 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 3.2% to 3.0%. Residential investment was revised up from 6.1% to 7.3%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 1.5 percent. With the second estimate for the third quarter, the decrease in private inventory investment was smaller than previously estimated ...

emphasis added

Monday, November 23, 2015

Tuesday: GDP, Case-Shiller House Prices

by Calculated Risk on 11/23/2015 08:11:00 PM

A couple of people were too kind today:

From Paul Krugman: Shorts Subject

Last night I was invited to a screening of The Big Short, which I thought was terrific; who knew that CDOs and credit default swaps could be made into an edge-of-your-seat narrative (with great acting)?I'm looking forward to seeing the movie.

And from Joseph Weisenthal at Bloomberg: Bloomberg TV’s What’d You Miss? thinks of linear TV as “a source of content for online video”

This guy in California named Bill McBride who runs a blog called Calculated Risk. He was one of the best and greatest chroniclers of the housing market. He was talking about how the housing market was really in trouble as early as 2005. His blog was a must-read. On the way down, he also nailed the situation perfectly. And then, unlike a lot of the people who were calling for doom and gloom in 2009 and 2010, he started talking about the rebound of the economy.Thank you. My co-blogger during the bubble, Doris "Tanta" Dungey, always blushed when people said nice things about her - and it happened frequently to her. As an aside, Tanta's birthday was Nov 15th and she would have been 54. When people mention that time period, I always think of "T". Tanta Vive!

Tuesday:

• 8:30 AM ET: Gross Domestic Product, 3rd quarter 2015 (Second estimate). The consensus is that real GDP increased 2.1% annualized in Q3, revised up from the advance estimate of 1.5%.

• At 9:00 AM, S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices. The consensus is for a 5.3% year-over-year increase in the Comp 20 index for September. The Zillow forecast is for the National Index to increase 4.7% year-over-year in September.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for November

Kolko: "Why Millennials Still Live With Their Parents"

by Calculated Risk on 11/23/2015 04:52:00 PM

Some excellent research from Jed Kolko: Why Millennials Still Live With Their Parents

This morning the Census reported that more young adults are living with their parents in 2015 than during the recession. Despite widespread expectations (including my own) that young people would move out as the job market recovered, they are not. The share of 18-34 year-olds living with parents was 31.5% in 2015, up from 31.4% in 2014. (These Census data are from March of each year. See note at end of post on data and methods.) ...Kolko digs through the data and concludes:

After dropping a bit from the late 1990s to the early 2000s, the share of 18-34 year-olds living in their parents’ home rose steadily from 2005 to 2012 and has remained near this post-recession high even as the economy has recovered and unemployment for young adults has dropped sharply.

So that’s the punchline: the increase in young adults living with parents over the past twenty years can be explained entirely by demographic changes. The increase since 2005 is not an aberration; once demographics are taken into account, the aberration is the bubble years of the mid-2000s, when an unusually low share of young adults was living with parents.Very interesting.

Adjusting for demographics doesn’t make the recent increase in young adults living with parents — or the implications for today’s housing market — any less “real.” The increased share of young adults living with parents means that household formation is being driven not by millennials but by baby boomers, and helps explain the low share of first-time home-buyers.

But adjusting for demographics does change what we should expect from the future. Because the demographics-adjusted share of young adults living with parents today is similar to pre-bubble levels, long-term demographic shifts may simply have pushed up the share of young adults living with parents to a new normal. Unless demographic trends reverse, the share of young adults living with parents is unlikely to fall much. Today’s millennials will leave their parents’ homes as they age — they’re not going to live there forever. But it won’t be the sudden unleashing of pent-up demand we might have expected if the increase of living with parents were only about the housing bust and recession and not about longer-term demographic shifts.

A Few Random Comments on October Existing Home Sales

by Calculated Risk on 11/23/2015 01:02:00 PM

Earlier: Existing Home Sales in October: 5.36 million SAAR

I expected some increase in inventory this year, but that hasn't happened. Inventory is still very low and falling year-over-year (down 4.5% year-over-year in September). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

It would seem if we do see lower sales - and higher prices - that should eventually lead to more inventory. So far the opposite has been true.

Also, if sales do slow, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. So some slowing for existing home sales (if it happens) will not be a big deal for the economy.

Also, the NAR reported distressed sales declined further year-over-year and are now at the lowest level since the NAR started tracking distressed sales in 2008:

Distressed sales – foreclosures and short sales – declined to 6 percent in October, which is the lowest since NAR began tracking in October 2008; they were 9 percent a year ago. Five percent of October sales were foreclosures and 1 percent were short sales.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in October (red column) were the highest for October since 2006 (NSA).

Existing Home Sales in October: 5.36 million SAAR

by Calculated Risk on 11/23/2015 10:11:00 AM

From the NAR: Existing-Home Sales Dial Back in October

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 3.4 percent to a seasonally adjusted annual rate of 5.36 million in October from 5.55 million in September. Despite last month's decline, sales are still 3.9 percent above a year ago (5.16 million). ...

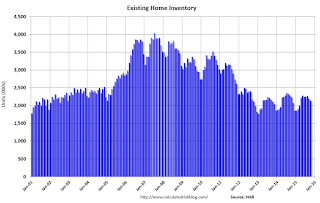

Total housing inventory at the end of October decreased 2.3 percent to 2.14 million existing homes available for sale, and is now 4.5 percent lower than a year ago (2.24 million). Unsold inventory is at a 4.8-month supply at the current sales pace, up from 4.7 months in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (5.36 million SAAR) were 3.4% lower than last month, and were 3.9% above the October 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.14 million in October from 2.19 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.14 million in October from 2.19 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 4.5% year-over-year in October compared to October 2014.

Inventory decreased 4.5% year-over-year in October compared to October 2014. Months of supply was at 4.8 months in October.

This was below expectations of sales of 5.41 million. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Chicago Fed: "Index shows economic growth improved in October"

by Calculated Risk on 11/23/2015 08:46:00 AM

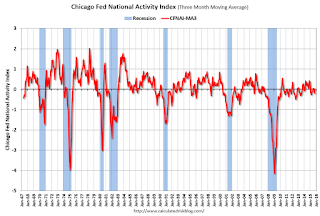

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth improved in October

Led by improvements in employment- and production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to –0.04 in October from –0.29 in September. Two of the four broad categories of indicators that make up the index increased from September, but only one category made a positive contribution to the index in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.20 in October from –0.03 in September. October’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was a little below the historical trend in October (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.