by Calculated Risk on 3/15/2005 09:46:00 AM

Tuesday, March 15, 2005

UCLA Anderson Forecast: False Sense of Wealth

2nd UPDATE: Another good article with more quotes and facts from the Anderson Forecast:

From 2001 to 2004, the value of California's 7 million homes has increased by about $175,000 per home, resulting in a total rise of more than $1.2 trillion according to UCLA Anderson Forecast. Appreciation of apartments has added an additional $440 billion.And on the Central Valley:

"To put this in context, the personal income for the state was $4.7 trillion over the same period of time," the forecast states. "Hence, Californians have been essentially given a 30 percent-plus boost to their annual incomes due to the housing bubble we are currently experiencing."

The forecast is especially ominous for the central San Joaquin Valley, where the building boom has fueled some of the strongest job growth in the state. Of the 3,900 net new nonfarm jobs created in Fresno County last year, for instance, 2,100 were created in construction, an amount 3 1/2 times greater than that added in manufacturing, according to state jobs data.

UPDATE: A couple more quotes:

“This year we are expecting trouble with housing in the second half that will make GDP growth a little weaker than normal, but it (is) unlikely that a recession could get started that quickly without more telltale signs today,” [UCLA Anderson Forecast Director Edward] Leamer’s report said.ORIGINAL POST:

“The key here is that at best the state economy can be expected to maintain slow growth over the next few years as the weak housing sector saps off strength created in other parts of the state’s recovering external economy,” the report stated. “On the other hand, a sudden rise in interest rates or some other spark that could cause the housing sector bubble to implode at a faster rate could instead cause another recession, both in California and the U.S.”

This morning, at a UCLA conference, forecasters will caution on the impact of a Real Estate slowdown on California and the Nation. From an LA Times article:

Half of the private-sector jobs created in California in the last two years are connected in some way to real estate. Meanwhile, property values in the last four years have swelled $1.7 trillion, the equivalent of about 35% of the total personal income in the state since 2001.

This sharp increase in home equity has spurred consumer spending that, in turn, has fueled more economic growth.

"We have an economy that's rolling along on the basis of a false sense of wealth," said Christopher Thornberg, a senior economist with the Anderson Forecast team.

In a previous post, I discussed the impact of a housing slowdown on employment. The following graph shows the growth in employment in just one housing related area: mortgage employment.

We see that we have added 200K jobs in the mortgage industry alone in under 4 years. The mean salary (according to the BLS in 2001) was $45,380 for the mortgage industry.

Click on graph for larger image.

Graph thanks to ild and Elroy.

Another example: Just 2 years ago, there were 338,579 licensed RE Agents (brokers and salespeople) in California. Now, according to the Department of Real Estate, there are 423,315 licensees.

More from the article:

Thornberg said that in California, where home prices have increased faster than in the rest of the nation, the situation is precarious. Even a simple slowdown in the accumulation of equity in the state, he said, could harshly depress spending habits, job creation and economic expansion.

Real estate has become central to California's economy. Real estate-related jobs account for about 10% of private sector jobs in the state, according to the Anderson Forecast, and are growing rapidly.

Of the 243,000 private payroll jobs added in California since 2003, 122,000 are linked to the industry — jobs with construction companies, mortgage processing centers and the like.

And Thornberg's final comment: "The best-case scenario is mediocre."

Monday, March 14, 2005

Mortgage Debt and the Trade Deficit

by Calculated Risk on 3/14/2005 09:02:00 PM

Money flowing into the housing market works its way back into the economy by increasing consumption or savings (and investment). In recent years, aggregate savings have declined, therefore it appears money has flowed to consumption, both domestic (measured by the increase in GDP) and imports (measured by the increase in the trade deficit).

This is very simplistic but provides a general description of what I believe is happening. I will use the annual increase in mortgage debt as a measure of the money flowing into the economy from housing activities.

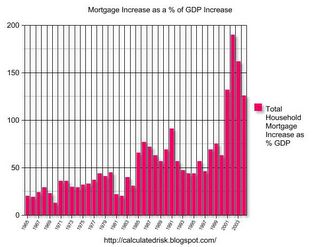

Previously I posted a graph of the annual Increase in Mortgage Debt vs. the Increase in GDP. The graph illustrated that during each of the preceding four years, U.S. households had assumed more mortgage debt than the increase in nominal GDP. I was asked if there were any other periods of similar increases in mortgage debt. The answer is NO, at least not in the last 40 years, as shown by the following graph:

The last four years have been atypical. There has been a surge in mortgage borrowing that far exceeded nominal GDP growth. It is unclear how much of GDP growth was driven by the increase in mortgage debt. However, since I believe most of the mortgage debt has flowed to consumption (not savings or investment); the portion that didn’t contribute to GDP growth must have flowed to imports.

Click on graph for larger image.

From the following chart it appears that the increase in mortgage debt is a factor in the increased trade deficit. The chart shows the annual trade deficit compared to the annual increase in mortgage debt. Data sources: trade deficit, GDP, New Home Sales, Mortgage Debt. There is a strong correlation between increases in mortgage debt and increases in the trade deficit. Although the correlation is high, it is very possible that there is no direct linkage, instead the same economic causes that led to higher trade deficits also led to more household borrowing. However, in recent years, with the dramatic increases in mortgage borrowing (far exceeding the increases in GDP) it is reasonable to expect that some of that money is flowing to imports.

There is a strong correlation between increases in mortgage debt and increases in the trade deficit. Although the correlation is high, it is very possible that there is no direct linkage, instead the same economic causes that led to higher trade deficits also led to more household borrowing. However, in recent years, with the dramatic increases in mortgage borrowing (far exceeding the increases in GDP) it is reasonable to expect that some of that money is flowing to imports.

The implications are important: if the housing market slows down, it will negatively impact both the domestic economy and the economies of our export driven trading partners: China, Japan, S. Korea and others.

The concern is obvious: If we slide into a global recession, we have limited tools available to stimulate the economy. Interest rates are already very low (although the Fed has recently put some arrows back into the quiver), and we are already running general fund budget deficits of close to 6% of GDP. And the concerns are not just economic. Historically, poor economic conditions are the precursors to civil unrest and wars.

One thing is certain, mortgages and housing play a much larger role in today's economy than in the past. In another recent post, I had suggested that the volume of New Home Sales seemed like a reasonable leading indicator of the consumer economy. The following graph shows New Home Sales since 1963.

The gray lines are approximate U.S. economic recessions as determined by NBER. With the exceptions of the 2001 (non-consumer recession) and '69-'70 recessions, New Home Sales were falling for 8 to 12 months prior to the onset of the recession. Since housing is a significantly larger portion of the economy today, a slowdown in housing would have a corresponding larger impact on the overall economy.

That is why I’m so focused on the housing market. I would like to see an orderly rebalancing of the World's economy, but I am not sanguine.

Friday, March 11, 2005

China Reduces Dollars in Its Reserves, Lehman Says

by Calculated Risk on 3/11/2005 01:39:00 AM

According to a Bloomberg article based on a Lehman report, China has "cut the share of its currency reserves held in dollars and raised its holdings of euros".

Lehman also predicts China will allow the yuan to fluctuate by the end of June.

First, in late February, Korea was rumored to be diversifying "the currencies in which it invests".

Then, two days ago, Japanese Prime Minister Junichiro Koizumi said his country ``in general'' needs to consider diversifying its foreign currency reserves.

Now China.

Thursday, March 10, 2005

Mortgage Debt Increases 13% in 2004

by Calculated Risk on 3/10/2005 11:47:00 PM

Today the Federal Reserve released the "Flow of Funds Accounts" for 2004. The report shows that total household mortgage debt increased 13.5% in 2004. The following chart shows the annual rate of mortgage debt increase:

Click on graphs for larger image.

The rate of increase of mortgage debt has increased every year since 1999.

Household mortgage debt increased from $6.64 Trillion in 2003 to $7.54 Trillion in 2004.

The next graph shows the Fed's estimate of the market value of all household real estate and household mortgage debt as a % of GDP.

Although mortgage debt has shown a substantial increase as a % of GDP (almost 20% over the last decade), the estimated value of household Real Estate has also increased substantially.

The appreciating value of household RE has kept the debt to value ratio under 50% based on the Fed's estimates.

The final graph compares the annual increase in mortgage debt to the annual increase in GDP. This shows the impact of mortgage debt on GDP.

The economy was in recession for part of 2001, so it is not surprising that mortgage debt exceeded GDP growth for that year.

However, it is surprising that mortgage debt has substantially exceeded GDP growth for four consecutive years.

This lends credence to the idea that the American consumers are maintaining their lifestyles using their homes as ATMs. Please see these previous posts that expound on this supposition:

Mortgage Debt and the "Recovery"

A Recovery Built on a Marshland of Debt?

Volcker: Circumstances "dangerous and intractable"

The Other Trust Funds

by Calculated Risk on 3/10/2005 03:02:00 PM

With all of the attention on Social Security (OASI), perhaps we should also look at some of the other trust funds. As an example, the CSRS (Civil Service Retirement System) is similar to OASI program. CSRS is a defined benefit plan that uses contributions from today's employees to pay today's retirees. And like OASI, CSRS is running annual surpluses; $28 Billion in fiscal 2003. SOURCE: Monthly Treasury Statement.

But unlike OASI, CSRS is on-budget and is included in the President's budget report. In fact, with the exception of OASI and the Postal Service, all of the other trust funds (150+ in all) are included on-budget. This means that the surpluses from these programs are used to directly offset any deficit spending by the Federal Government. Of course, even Fed Chairman Greenspan talks about the "unified" budget that includes the OASI surplus as part of the budget - so the distinction between on-budget and off-budget is being lost.

This graph shows the growth of both OASI and the other trust funds. SOURCE: Treasury Dept.

Trust Fund reserves in Billions.

Click on Graph for larger image.

Many of these programs will suffer similar demographic issues as OASI. So when someone like victor at the Dead Parrot questions the existence of the OASI Trust Fund, he is also speaking to our military, Federal employees, Civil Service workers and many others who are paying into similar retirement insurance plans. Thanks to pgl at Angry Bear and William Polley for reminding me of this issue.

Tuesday, March 08, 2005

Fed's Poole: Social Security Needs Small Changes

by Calculated Risk on 3/08/2005 03:31:00 PM

In a Q&A session after a speech today in West Palm Beach, Federal Reserve Bank of St. Louis President William Poole said, according to a Reuters article, that it would not take a large change in some combination of either tax increases, benefit cuts or an increase in the retirement age to put the Social Security retirement plan in "pretty good balance."

In the speech, "A Perspective on the Graying Population and Current Account Balances" Poole argued that demographic factors are being overlooked with regards to the Current Account Balance.

Housing: Excessive Leverage?

by Calculated Risk on 3/08/2005 01:46:00 AM

The article "Risky real estate moves" on CNN Money discusses the growing prevalence of no money down home purchases by first time buyers. The article presents a table showing the percentage down payment for first time homebuyers. The following table combines CNN's table (data from the National Association of Realtors in early 2005) with earlier data from NAR in early 2003.

Click on graph for larger image.

Source: NAR

Fully 42% of first time buyers put no money down and 69% put less than 10% down. Two years ago 28% put no money down and 61% put less than 10% down. Clearly first time buyers are opting for more leveraged transactions.

The CNN article also discusses three leveraged borrowing programs. The first, "piggyback" loans, allows the homebuyer to take out a line of credit to cover the down payment resulting in 100% financing.

The second, interest only loans, allows the buyer to purchase more home by limiting their payment to the interest due. And the third program has several payment options, including a "minimum payment" that allows the buyer to pay less than the interest owed, resulting in an increasing loan balance.

All of these programs are increasing in popularity and increasing the amount of leverage for the buyer. The third program, combined with no money down, creates significant systemic risk. Who bears the risk? Not the first time buyer. Since the loan is collateralized with the house, the buyer can just walk away and only suffer the minor indignity of a foreclosure on their credit record. The real risk is borne by the lender.

Monday, March 07, 2005

Housing: Two Worrisome Signs

by Calculated Risk on 3/07/2005 03:25:00 AM

Two articles on Real Estate caught my attention tonight ...

The first is a "How to Flip" article on ABC News! (thanks to Patrick)

Sensible Shopper: Real Estate 'Flipping'Oh my! Of course I've been telling people that it is rational to speculate in Real Estate as long as very little of their own money is at risk. I've even explained "moral hazard" to a few people.

What You Need to Know to Get in on the Trend in the Hot Real-Estate Market

The second is a monthly newsletter concerning Bay Area Real Estate (Northern California). Here is the executive summary:

"The SCC real estate market has lost much of its steam in terms of volume. Decreasing volume is 'normal' behavior for the Santa Clara County real estate market for the end of the year. It is the degree of the decrease that remains a concern. Volume went from 154% of the 10-year average to 132% in June. Then went from 132% to 114% from mid-November to mid-December; and finally from 114% to 98% starting January 12, 2005. SCC only experienced 44% of the offers seen during the peak summer. This is a lower percentage than any of the 10-years that we have data for."Blame it on the rain?

Sunday, March 06, 2005

China and the Price of Gas

by Calculated Risk on 3/06/2005 08:51:00 PM

Last Friday, the USA Today reported that "Gas prices might increase 24 cents". Then at the annual meeting of the National People's Congress, Chinese Foreign Minister Li Zhaoxing told reporters that China 'should not be held responsible for the world's rising oil prices'.

Is China responsible for the increase in oil prices, and consequently, gas prices?

Li was quoted as saying: "Although China's energy import has increased a little bit over the past two years, its import only accounts for approximately six per cent of the world's total traded oil."

From the article:

It's true that China's energy demand has increased to certain extent as the country's economy has been growing rapidly in recent years, but the demand is mainly to be met domestically, he said.

Besides, he said, there is a big potential of saving energy and improving the use of energy efficiency in China's domestic energy supply.

Therefore, the Western media criticism saying that China is a major impact on the world's oil price is "groundless", he said

First, here is a chart of China's oil production and consumption since 1980 (Source: Dept of Energy)

Click on graph for larger image.

Source: Dept of Energy

Starting in 1994 China became a net importer of oil. The graph ends in 2003 with China importing 2.1 million barrels per day (bbl/d). In 2004 China's oil imports increased another 35% to approximately 3 million bbl/d. Still, as Minister Li pointed out, that is a small percentage of the World's traded oil. Also, the United States increased oil imports in 2004 by about 0.7 million bbl/d to 12.25 m bbl/d. Although China's oil imports are growing faster than the US, both in percentage and bbl/d terms, China's oil import quantities are still only about 25% of the United States.

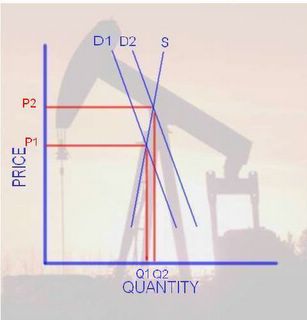

So why has the price of oil increased so dramatically? Here is at least part of the reason: Both the supply and demand curves for oil are very steep. We all know this intuitively. If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; for the most part people stay with their routines and keep their same vehicle. With two steep curves (supply and demand) we get the following:

OIL Supply and Demand

UPDATE: fixed typo on drawing. With a small increase in Demand (from D1 to D2), we see a small increase in Quantity (Q1 to Q2), but a large change in Price (from P1 to P2). Also a large price increase would occur if we had a small decrease in supply such as disruption to production, transport or refining (like hurricane Ivan in the GOM last year).

Of course the opposite is also true. A relatively small decrease in demand (or increase in supply) would cause a significant drop in price. So China's relatively small increase in demand (and the US too!) could have caused a large increase in oil prices.

Is China to blame for higher gas prices? Of course not. They have the same right to oil as any other consumer. But the increased demand in the US and China has most likely caused (without blame) the increase in prices.

The above assumes perfectly competitive markets. And oil differs from most commodities: "it is an exhaustible resource, production is controlled by national governments, and for the major oil exporters oil is the overwhelmingly dominant source of national income." (See: Krugman "The Energy Crisis Revisited") However if the world's spare capacity is exhausted, then the simple approach is probably reasonable.

There could be other factors effecting the price of oil - a terrorism premium and hedge funds speculation are often mentioned as culprits - however, I think the simple explanation is probably the most accurate: fast growth in China coupled with strong growth in the U.S. has utilized most of the world's spare capacity. Since supply is almost inelastic (in the short term), price fluctuates significantly with small changes in demand.

But what happens in the intermediate term? In the longer term the situation becomes more complicated. Since oil is an exhaustible resource, we may be getting close to "peak production" - where the maximum annual oil production is reached and then we will start a long decline in production. There is no way of knowing how close the world is to peak production since many of the key reserves are held by national governments (like Saudi Arabia) and they are not forthcoming with hard data. This lack of transparency has caused concern and might be leading to some of the rumored hedge fund speculation. After oil production starts to decline, the world will need to find a substitute for the loss of oil supply. In that regards, I believe high prices will be the wellspring of innovation.

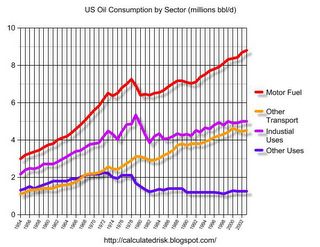

More certain is that if the prices hold, we will see both more production (assuming we are not at Peak Oil), substitution and a moderation in demand. The following chart shows US oil consumption for the last 50 years.

Source: Dept of Energy

The two oil shocks (1973 and 1979) were followed by periods of slackening demand. The industrial sector has never returned to the 1979 consumption levels (due to a combination of efficiencies and substitutes) and "other uses", like electricity generation using oil, has also declined significantly. This leaves motor fuel and "other transportation" as the growth sectors for oil consumption. For demand to decrease, people will probably have to park their Hummers and buy a Prius!

Final comments: There are other reasons than just price to decrease our dependence on oil.

First, burning oil products is a major contributor to global warming. This is a serious problem and, as Professor Tim Barnett of the Scripps Institution of Oceanography said in February: "The debate over whether there is a global warming signal is over now at least for rational people."

And the second is an ethical question: Since oil is an exhaustible resource, do we, the 21st Century cohorts, have a right to burn all of it? Or do we have a responsibility to future generations to use it more discerningly?

Saturday, March 05, 2005

Greenspan's March to Infamy

by Calculated Risk on 3/05/2005 02:22:00 AM

On two March 2nds, exactly four years apart, Fed Chairman Alan Greenspan testified before the House Committee on the Budget, not in his role as Chairman of the Federal Reserve, but speaking for "himself".

In his 2001 testimony, Mr Greenspan, with his usual caution and caveats, talked of surpluses for the foreseeable future. Greenspan was effusive (well, effusive for Greenspan) offering projections of "an on-budget surplus of almost $500 billion ... in fiscal year 2010". The National Debt would soon be retired and the Boomer's retirements secure. Greenspan offered a projection of "an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs."

Just four years later, again on March 2nd, Greenspan offered a starkly different view to the same committee. This year Greenspan talked of large "unified" deficits and commented that "our budget position is unlikely to improve substantially in the coming years unless major deficit-reducing actions are taken." He targeted Social Security and Medicare for cuts, saying "we may have already committed more physical resources to the baby-boom generation in its retirement years than our economy has the capacity to deliver."

I will leave the interpretation of Greenspan's motivations to others (like Paul Krugman's Op-Ed piece "Deficits and Deceit" in the NYTimes). But for this review, I would like to point out three significant misleading comments in Greenspan's speeches.

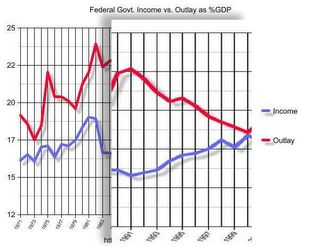

First, in both speeches Greenspan praised the fiscal discipline of Congress in the '90s and suggested that Congress' discipline, along with strong productivity gains, brought the deficits of the '80s under control. Greenspan is only half right. Look at this graph (with the 1990s enlarged) from this previous post.

NOTE: Click on graphs for larger image.

Source: U.S Treasury

Not only did Government Outlay as a % of GDP decline in the '90s, but Greenspan seems to have forgotten that Government Income increased as a % of GDP; the tax side of the equation! In fact there were 5 major General Fund tax increases between 1982 and 1993 that contributed to bringing the budget into balance. They were:

Tax Equity and Fiscal Responsibility Act of 1982 - ReaganFor an analysis of Major Tax Bills since 1940 see OTA Working Paper 81, U.S. Treasury Office of Tax Analysis by Jerry Tempalski.

Deficit Reduction Act of 1984 - Reagan

Omnibus Budget Reconciliation Act of 1987 - Reagan

Omnibus Budget Reconciliation Act of 1990 - G HW Bush

Omnibus Budget Reconciliation Act of 1993 - Clinton

Second, Mr. Greenspan erroneously suggests that only budget cuts, not tax increases, will bring the budget back into balance. He said "... tax increases ... arguably pose significant risks to economic growth and the revenue base." Further, Greenspan said "... if at all possible ... close the fiscal gap primarily, if not wholly, from the outlay side." That argument ignores the cause of the budget deficit that the following graph illustrates (same as above without '90s enlarged):

The annual deficit is the difference between the red and blue lines. Although spending increased after 2000, most of the deficit came from the substantial tax cuts of the last four years. These are historically low tax rates (as a % of GDP) and to suggest that raising the rates would jeopardize the recovery has no foundation in economic theory. It also contradicts recent history (that Mr. Greenspan seems to have forgotten).

Source: U.S. Treasury

And third, in his 2005 speech, Mr. Greenspan referred to the "unified budget" saying that "the unified budget is running deficits equal to about 3-1/2 percent of gross domestic product". In his 2001 speech, Mr. Greenspan more correctly spoke of on-budget and off-budget surpluses. Now that we are running large deficits, he only talks about the "unified budget". This is very misleading.

The problem with the "unified budget" is that it adds the Social Security surplus (and other off-budget surpluses) to the General Fund and masks the actually budget problem. One would think that the annual budget deficit would equal the annual increase in the National Debt. This is true if you use the General Fund deficit, but not the "unified deficit". The real fiscal issue is the General Fund deficit; the General Fund is running annual deficits of almost 6% of GDP!

Of course, if the Social Insurance payroll tax is just another General Fund tax then Mr. Greenspan is correct. But let me remind Mr. Greenspan (who chaired the 1983 Social Security "Greenspan Commission"):

1) IF the entire Social Insurance payroll tax is used for social insurance (retirement insurance, survivors insurance, health insurance) then the tax is NOT regressive.

2) IF the Social Insurance surplus is used as a General Fund tax (as using the "unified budget" suggests), then that portion of the payroll tax is highly regressive.

A regressive tax is redistributive of wealth from lower income workers to the wealthy. Not a desired consequence of tax policy.

These are three major misleading comments. Mr. Greenspan may have been speaking for himself, but his words carry the power and authority of the World's leading banker. I believe he should be more careful and far more accurate.