by Calculated Risk on 4/11/2005 04:50:00 AM

Monday, April 11, 2005

More on Oil

My most recent post on Angry Bear, Oil: The Impact on the US Economy, is now up.

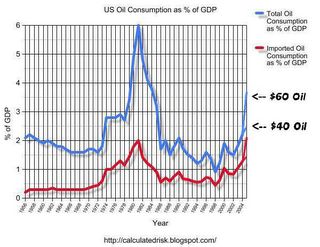

On the following graph, I plotted total oil consumption and imported oil consumption as a % of GDP. The plot for imported oil is slightly different than from my previous post (if you have a microscope!).

Click on graph for larger image.

The reason for the difference is I used different data sources. For this post, I used the DOE's data and for the previous post, I used the Census Bureau's trade data. They were very close, but I was able to plot a longer time series with the DOE's data.

I did not discuss peak oil in this analysis. That is a separate topic. I tried to stick to the question of the immediate impact on the US economy of the current price of oil.

Best Regards to All! And thanks for all the comments.

Friday, April 08, 2005

Oil Imports as % of GDP

by Calculated Risk on 4/08/2005 07:24:00 PM

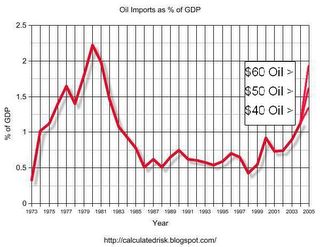

Dr. Altig's graph this morning compared US energy production and consumption (in BTUs) divided by real GDP. Altig defines the difference between consumption and production as our energy dependence. The following graph shows another measure of energy dependence.

Click on graph for larger image.

This graph shows the nominal dollar value of oil imports as a percent of nominal GDP. The data is from the Census Bureau's U.S. Imports of Crude Oil and only goes back to 1973.

For 2004, oil imports were 1.13% of GDP, the highest level since 1982. I plotted three alternatives for 2005: $40 oil, $50 oil and $60 oil. It is important to note that the average contract price paid for oil is usually $5 to $10 below the spot prices. With Oil priced at $53.32 per barrel today, the average import contract price is probably in the mid to high $40s.

For GDP in 2005, I assumed a nominal increase of 6%.

From this chart, $60 oil would be 1.9% of GDP, just below the peak years of 1980 (2.22%) and 1981 (1.98%). For $50 oil, imports would be 1.59% of GDP.

To reach the record 2.22%, with 6% nominal GDP growth, the average price of imported oil would have to be $69 per barrel. Of course we had a recession in 1980, and $60+ imported oil would probably slow GDP growth in 2005 too. With slower growth, oil imports would reach the record as a percentage of GDP somewhere in the mid to low $60s.

Thursday, April 07, 2005

DOE: Short-Term Energy Outlook

by Calculated Risk on 4/07/2005 04:39:00 PM

The Department of Energy released their Short-Term Energy Outlook today. The DOE is now projecting monthly average gas prices to peak at about $2.35 per gallon in May. That probably means around $2.60 per gallon for regular unleaded in California.

This graph from the DOE shows average US gas prices for the last 2 years.

The average U.S. price right now for regular grade gasoline is $2.22. California is $2.46. So the DOE is expecting approximately another $0.13 increase over the next 30 days.

For crude oil: WTI prices are projected to remain above $50 per barrel for the rest of 2005 and 2006.  The second graph (DOE slide 3) shops the DOE predictions. Bear in mind that every month, for almost a year, the DOE has projected oil prices to flatten or decrease, and every month prices have exceeded their base case expectations.

The second graph (DOE slide 3) shops the DOE predictions. Bear in mind that every month, for almost a year, the DOE has projected oil prices to flatten or decrease, and every month prices have exceeded their base case expectations.

The high end of the DOE's projected range for the next two years (95% confidence) is $65 per barrel (WTI) and the low end is $45 per barrel.

Click on graph for larger image.

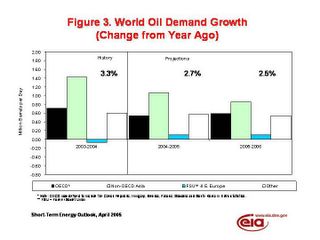

The third graph(DOE slide 4) shows the DOE's expected increase in World demand for crude oil in 2005 and 2006.

The DOE is expecting world oil demand to grow 2.7% in 2005 and 2.5% in 2006, compared to 3.3% in 2004. With worldwide demand at over 80 million bbd, a 2.7% increase would add 2.2 million bbd. So when OPEC announces they are adding 0.5 million bbd that is just a portion of the expected demand increase.

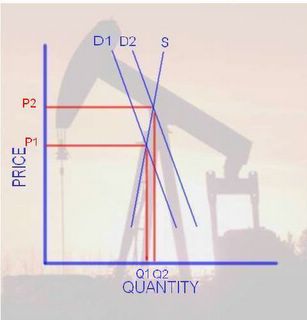

From a previous post on the oil situation: Both the supply and demand curves for oil are very steep. We all know this intuitively. If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; for the most part people stay with their routines and keep their same vehicle. With two steep curves (supply and demand) we get the following:

With a small increase in Demand (from D1 to D2), we see a small increase in Quantity (Q1 to Q2), but a large change in Price (from P1 to P2). Also a large price increase would occur if we had a small decrease in supply such as disruption to production, transport or refining (like hurricane Ivan in the GOM last year).

Of course the opposite is also true. A relatively small decrease in demand (or increase in supply) would cause a significant drop in price. If the DOE’s estimate of demand is correct, we will probably continue to see high energy prices.

No wonder the IMF warned today on the risk of a "permanent oil shock". From the FT article:

Raghuram Rajan, IMF chief economist, said: “We should expect to live with high oil prices.”Sorry for all the gloom and doom lately. At least the price of oil was off a little today.

“Oil prices will continue to present a serious risk to the global economy,” he added.

“The shock we see is a permanent shock that is going to continue... and countries need to adjust to that,” said David Robinson, deputy IMF chief economist.

UPDATE:

This graph shows the average price of regular unleaded in California and the US for the last 2 years. The graph is from GasBuddy. Give it a try for prices in your area (by state or city). Thanks to Jim Teter!

Note that the DOE prices were for April 4th ($2.22 for US, $2.46 for California). This graph shows that prices have climbed over the last 3 days, especially in California.

UPDATE 2:

Kash at Angry Bear has an interesting chart tracking economists' predictions, "Oil Prices and Recession".

Dave at Macroblog also has an interesting post "Energy Prices: Not The 1970s Redux (?)" on oil today.

With all this commentary, does that mean prices have peaked?

Housing Bubble: Foreclosures up 57%, Mostly Non-Bubble States

by Calculated Risk on 4/07/2005 12:30:00 AM

In a new report, U.S. foreclosures are up 57% from March 2004.

"The hardest hit states: Ohio, Texas, Michigan and Georgia, with more than 2,300 new foreclosures each."What is interesting is these are the non-bubble states according to an analysis by Richard J. DeKaser, Chief Economist at National City Corporation. Borrowers in these non-bubble states are getting in trouble first, probably because of job losses (their local economies are not as strong as the bubble states without the booming RE business) and they were not able to extract as much equity during the refinancing boom. The article cited higher interest rates and job losses:

Non-mortgage debt may help explain the troubling trend, [Marquette University economist David E. Clark] said. Most consumers opt for fixed-rate mortgages and thus are immune to rising interest rates, Clark noted. But their credit cards and home equity lines of credit carry variable interest rates - rates that have climbed in recent weeks.I am not surprised that the non-bubble states are seeing the impact of the housing slowdown first. But I think the real problem will start when the bubble states see a slowdown and a drop in transaction volumes.

"These (easy credit avenues) may have allowed people to get in rather dire straits financially, get overextended, and this is the final chapter of that process," Clark said.

Jim Houston, vice president with Foreclosure.com, said March's figures involve "the highest spike we've ever seen" in new foreclosures.

UPDATE: Here is the foreclosure.com press release with numbers by state.

Wednesday, April 06, 2005

Talk of the Nation: Schiller on Real Estate

by Calculated Risk on 4/06/2005 07:27:00 PM

Robert Schiller, Yale economics professor and author of "Irrational Exuberance" was on NPR's Talk of the Nation today. Click on listen.

A few Schiller quotes:

"In a sense the irrational exuberance never left the housing market. The housing market started to boom in the late '90s and it continues to go up. It wasn't interrupted by the earnings drop that we saw in stocks in 2001. It has just kept going."How much overvalued is the Real Estate market?

"I think its one of the amazing facts about statistics and econometrics that no one had collected a long time series of home prices in the U.S.. How can you get perspective about whether there are bubbles or not, if no one collects the data?

What I did is I went back and I found various fragmentary home price indexes that kept quality constant and linked them together and added, filled a gap. So I have a series back to 1890. When I plotted that I was quite surprised to see what happened.

The U.S. has basically has never been in a bubble like the one we are in now, with the possible exception of the period right after WWII when the soldiers came home and were bidding up home prices. It is a very rare phenomenon. So people who claim to have done statistical analysis - they can't have done it, they haven't had the data!"

"Some of these people will realize that their mortgage is worth - that the debt is greater than the value of the house and they will walk away. They will say that 'I'm making payments, huge payments on this house and its not even worth what I'm owing". If, as I expect, in many places prices will fall, defaults on mortgages will go up. There will be some disruption in people's lives."

"That varies very much by city. We looked at ratios of median home price to per capita personal income. We find that in many places in the U.S. that is only about 2, the median home is only like 2 years income or 3 years income. But in other cities it is 10 years income. So - I think that is getting a little - more than a little high. What supports it? Why would you live in a city were homes cost 10 years income, when you can live in a city were they cost 3 years income or 2 years income? You might say some cities are better than others and they have better job opportunities than others. But I think they are a bit overrated."In answer to a question:

"Miami had one of the most famous home price bubbles in 1925. In that year people began to think that land was running out in Florida and that you'd better buy now or it will be too late. Promoters started traveling all over the country and people started flowing in - there was a huge immigration into Florida at that time - but then the bubble burst in 1926. And it didn't rekindle in Florida until recently.

I think what is happening in Florida then and now are similar. Its a glamour story, a story of excitement, a story that land is running out that suddenly becomes prominent in people's minds."

Much more in interview. Enjoy!

World Bank: Economic Recovery Globally Has 'Peaked'

by Calculated Risk on 4/06/2005 11:04:00 AM

The World Bank warned Wednesday that the global economic recovery has "peaked" and said the severity of the coming slowdown will depend on the extent to which foreign investors lose their nerve about buying U.S.-dollar-denominated assets.And more:

"The global economy is at a turning point," said Francois Bourguignon, the bank's chief economist, in a foreword to the report. "Growth has peaked, and pressures to address global imbalances are growing, exposing important risks facing both developed and developing countries as the needed adjustments occur."

The bank said its best-case scenario calls for a mild slowdown in global economic growth over the next few years. The annual growth rate of gross domestic product, 3.8% in 2004, is likely to drop to 3.1% this year and hover about that level through 2007. Among developing countries, the rate is likely to slip from 6.6% last year to 5.7% in 2005, and 5.2% in 2006.

Still, the bank said, a new global recession is a possibility. "A reduction in the pace at which central banks are accumulating dollars, a weakening in investors' appetite for risk, or a greater-than-anticipated pickup in inflationary pressures could cause interest rates to rise farther than projected, providing a deeper-than-expected slowdown or even a global recession," it said.

The R word is starting to raise its ugly head. I'll be back to the Mug's game soon.

Monday, April 04, 2005

The Worsening General Fund Deficit

by Calculated Risk on 4/04/2005 06:07:00 PM

Here is the current Year over Year deficit number (April 1, 2004 to April 1, 2005). As of April 1, 2005 our National Debt is:

$7,783,719,222,961.24 (that is almost $7.8 Trillion)

As of April 1, 2004, our National Debt was:

$7,122,841,728,666.17

So the General Fund has run a deficit of $660.9 Billion over the last 12 months. SOURCE: US Treasury

Click on graph for larger image.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

It just keeps getting worse.

NOTE: I use the increase in National Debt as a substitute for the General Fund deficit. For technical reasons this is not exact, but it is close. Besides I think this is a solid measure of our indebtedness; it is how much we owe!

NAR: Pending Home Sales Index

by Calculated Risk on 4/04/2005 03:32:00 PM

The National Association of Realtors (NAR) has introduced a "Pending Home Sales Index".

Here is their first news release "Pending Home Sales Index Rises".

"The Pending Home Sales Index,* based on data collected for February, stands at 123.2, which was 2.2 percent above January and 10.4 percent above February 2004. The index is based on pending sales of existing homes, including single-family and condo. A home sale is pending when the contract has been signed but the transaction has not closed. Pending sales typically close within one or two months of signing.

David Lereah, NAR’s chief economist, said sales are looking strong for March and April. “Although home sales eased in February, housing activity appears to be firming with a modest uptrend in the months ahead,” he said. Data for March existing-home sales will be released April 25.

An index of 100 is equal to the average level of contract activity during 2001, the first year to be analyzed. Coincidentally, 2001 was the first of four consecutive record years for existing-home sales. 2001 sales are fairly close to the higher level of home sales expected in the coming decade relative to the norms experienced in the mid-1990s. As such, an index of 100 coincides with a historically high level of home sales activity."

Click on graph for larger image.

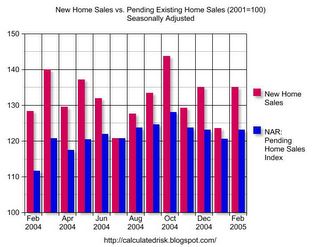

This graph compares New Home Sales vs. the new Pending Home Sales Index (2001 = 100 for both series - all data seasonally adjusted). Sources: NAR and Census Bureau.

Previously I have ignored Existing Home Sales since it lagged New Home Sales by a couple of months. Maybe this new index will be more useful.

More on Housing Speculation

by Calculated Risk on 4/04/2005 02:49:00 AM

My most recent post is up on Angry Bear.

Housing: Speculation is the Key

Although my post on Angry Bear is about speculation and the housing bubble, I am mostly concerned with the impact of a housing slowdown on the general economy. Here is my thinking process:

1) Is there a bubble? Yes.

2) If there is a bubble, how widespread?

3) How and when will it end?

4) What will be the impact on the general economy (and the trade deficit, and interest rates)? Click on Graph for larger image.

Click on Graph for larger image.

This graph is part of the answer to "how widespread?" The graph shows home appreciation, in both nominal and real terms, over the last 5 years by region (and the US total). In some of the Central areas, there has been very little appreciation, but I would still be interested in leveraged financing and Mortgage Equity Withdrawal numbers in those areas.

Best Regards to All!

Housing: Speculation is the Key

by Calculated Risk on 4/04/2005 02:21:00 AM

I have taken to calling the housing market a "bubble". But how do I define a bubble?

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation - the topic of this post. Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.

Speculation is the key.

A recent report by the National Association of Realtors (NAR) reported that 23% of all homes nationwide were bought by investors. Another 13% of homes were purchased as second homes. In Miami, it was reported that 85% of "all condominium sales in the downtown Miami market are accounted for by investors and speculators". This is clear evidence of speculation.

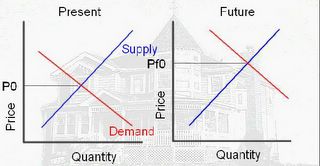

The following supply demand diagrams illustrate this type of speculation.

Click on diagram for larger image.

Click on diagram for larger image.

The above diagram shows the motive for the speculator. If he buys today, at price P0, he believes he can sell in the future at price Pf0 (price future zero), because of higher future demand. The speculation would return: Profit = Pf0-P0-storage costs (the storage costs are mortgage, property tax, maintenance, and other expenses minus any rents).

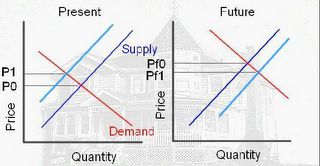

In this model, speculation is viewed as storage; it removes the asset from the supply. The following diagram shows the impact on price due to the speculation:

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

However, if the price does not rise, the speculator must either hold onto the asset or sell for a loss. If the speculator chooses to sell, this will add to the supply and put additional downward pressure on the price.

This type of speculation appears to be rampant only in certain regions, mostly the coastal areas. However, something akin to speculation is more widespread – homeowners using substantial leverage with escalating financing such as ARMs or interest only loans.

Leverage as Speculation.

In this LA Times article "They're In — but Not Home Free", the writer describes a woman that is "able to afford, barely, her first home". She has taken out "an adjustable-rate mortgage that won't require her to pay any principal for three years". She is already strapped, working overtime to pay her bills, and doesn’t know what she will do in three years. She is a gambling that either her income will increase or that the value of her home will rise enough to sell at a profit.

Californians are adopting a "buy now, pay later" strategy on a massive scale. The boom in interest-only loans — nearly half the state's home buyers used them last year, up from virtually none in 2001— is the engine behind California's surging home prices.See article for graphic on “Risky Debt”. Here is a similar article in the Sunday Washington Post, "Homeowners in Harm's Way" and a summary of financing options from the WSJ Online: "Buy Now, Pay Later"

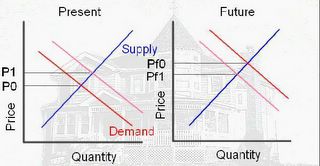

This type of leveraged activity pulls demand from future periods. Starting with the first diagram above, these leveraged financing programs shift the demand curve to the right (light red) and increase the price from P0 to P1. In the future, the demand will be shifted to the left and the future price will be Pf1. If Pf1 is less than P1 (the LA Times buyer's price), then her house might be foreclosed, increasing the supply too!

One way to prolong the bubble is to offer ever more leveraged financing. And here it is - a 35 year loan, interest only for the first 5 years, with no money down and 103% Loan To Value (to cover closing costs). Amazing.

One way to prolong the bubble is to offer ever more leveraged financing. And here it is - a 35 year loan, interest only for the first 5 years, with no money down and 103% Loan To Value (to cover closing costs). Amazing.How many people are on the ragged edge? From the LA Times article:

The number of buyers falling into this category in any given month is unclear. But a California home builder recently got a sense when he sought to answer this question: How many of the potential buyers of his houses could still afford them if interest rates went up even a little?Only one in six buyers qualified for a slightly higher financing package. I believe that means we are close to the end of the housing cycle. Both types of activities are increasing prices: speculation is reducing supply and leverage is increasing demand.

To find out, the builder conducted a little experiment.

His firm's preferred lender had pre-qualified 90 potential buyers for a group of new houses. Since the houses wouldn't be ready for another six months, the builder tightened the loan criteria. He didn't want buyers to sign up for a house and then get frightened into canceling by rising rates.

He raised the threshold from a fully variable loan, the easiest to get since it immediately moves upward when rates increase, to a mortgage that was fixed for the first three years. That would shield buyers from rate jumps for at least a little while, but it's also more expensive.

Under the higher threshold, only about 15 of the buyers still qualified.

The Bust

Housing "bubbles" typically do not "pop", rather prices deflate slowly in real terms, over several years. Historically real estate prices display strong persistence and are sticky downward. Sellers tend to want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices.

This means real estate markets do not clear immediately, and what we usually observe is a drop in transaction volumes. That is my expectation for this year: stable prices (maybe declining slightly on the coasts) and declining volumes. Stable or lower prices will halt speculation and increase the supply. And if rates rise further, or lenders become more discerning, demand will also decrease. Either spells bust for the current bubble.

Originally posted on Angry Bear.