by Calculated Risk on 4/14/2005 12:32:00 PM

Thursday, April 14, 2005

New Inflation Tool at the Cleveland Fed

The Cleveland Fed has introduced "Inflation Central", a Worldwide database of inflation measures.

See World Inflation From The Cleveland Fed at Macroblog for much more.

I was surprised to discover that Bangladesh has had more inflation than Albania. But what do I do with that information?

Wednesday, April 13, 2005

More on Health Care

by Calculated Risk on 4/13/2005 06:39:00 PM

The highest priority fiscal problem in the US is the budget deficit; we will add close to $650 Billion in debt this fiscal year alone! The second highest priority is the US health care system.

In "Ailing Health Care", Paul Krugman tries to change the debate from Social Security to health care. As Krugman wrote, the issue is "health care reform," not "Medicare reform." The problem is far larger than Medicare alone, and yet the Medicare shortfall dwarfs the projected Social Security shortfall.

Earlier this year, the GAO pointed out that health care is the largest and perhaps most difficult part of the long-term fiscal challenges. The GAO calculated the Social Security shortfall at $3.7 Trillion (over 75 years) and the Medicare shortfall at almost $28 Trillion over the same period; more than 7 times larger than the Social Security shortfall. And Medicare is only a portion of the health care crisis!

As a follow up to Krugman, Kash compared some outcomes and expenses in the US to several other developed Nations.

Today, Kash followed up with more comments on the "Performance of the US Health Care System."

Angry Bear followed up with the first in a three part series: "Health Care in The U.S. And The World, Part I: How much do we spend?"

If it was up to me, I would change the debate to the deficit. But real budget solutions are probably unachievable in this ideologically driven period. Doesn't that apply to health care too? So what is the solution? Do nothing for four years?

Tuesday, April 12, 2005

The Mug's Game Challenge: Predict the Start of the Next Recession

by Calculated Risk on 4/12/2005 05:47:00 PM

A recession is probably not imminent, but there are reasons to be concerned. General Glut ventured this today:

The "hard versus soft" landing debate is stale. The real question now is only "how hard?"The next question is: When?

The Mug's Game Challenge

Here is a simple contest to predict the start of the next recession. The rules:

1) Enter a month and a year in the comments at any time right up to the recession being announced (one entry per person). Please feel free to state your reasons. I will feature those comments for the winners.

NOTE: You do not need to enter now. I am still waiting before I make my prediction. But early entries will be rewarded. I will update the contest every month as a reminder.

2) Scoring:

A) The Starting Month: The official starting month will be determined by the NBER. This usually occurs several months after the recession starts.

B) A pick will be considered correct if it is within +/- 2 months of the NBER determination (a 5 month window centered on the month picked). It is VERY difficult to pick the exact month, and being within a couple of months is quite an achievement.

C) All correct picks will be ranked by the number of months prior to the recession that the pick was entered. As an example, say the recession starts in Oct 2005: If someone correctly picks any month August 2005 through December 2005 (+/- 2 months) during April 2005, they will be rated a "6". This rewards picking the recession early.

All correct picks will be featured when the recession is announced and ranked by earliest picks.

Earlier I offered some thoughts on leading indicators for recessions. Several people have suggested other leading indicators to me. No one wants a recession, but we might as well have some fun!

Good luck to all!

UPDATE: Prize? The winners get their names mentioned, their comments featured, the admiration of their peers, and a free subscription to Calculated Risk!

UPDATE 2&3&4: Elaine is already a winner! Here are the picks so far (updates in bold):

Aug 2005 Kirk Spencer, wharf rat

Sep 2005 Vernon Bush

Oct 2005 BE, David Bennett

Nov 2005 David Yaseen, Fernando Margueirat, steve kyle, Nguyen Khuu

Jan 2006 Yusef Asabiyah, dryfly, Frank, redfish

Feb 2006 Mish, E.Robinson

Mar 2006 Colin H, ChasHeath, Alan Greenspend, Movie Guy, F.Hagan

Apr 2006 battlepanda

May 2006 Ken Houghton, navin

Jun 2006 DOR

Aug 2006 Jason Wright

Mar 2008 dilbert dogbert

Jul 2008 jl

Nov 2008 Elaine Supkis

March, 2011 Paul

NEVER Larry Kudlow's doppelganger

Posters can take the same month.

Record US Trade Deficit: $61 Billion for February

by Calculated Risk on 4/12/2005 08:49:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for February:

"... total February exports of $100.5 billion and imports of $161.5 billion resulted in a goods and services deficit of $61.0 billion, $2.5 billion more than the $58.5 billion in January, revised.

February exports were $0.1 billion more than January exports of $100.4 billion. February imports were $2.6 billion more than January imports of $158.9 billion."

Click on graph for larger image.

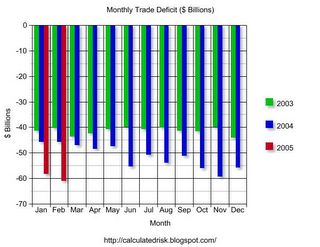

This graph shows the monthly trade balances for 2003, 2004 and 2005 and depicts the worsening year over year trade imbalance. The February trade deficit was an all time record, as exports stalled and imports continued to climb.

The recent increase in oil prices did not impact the February trade deficit. In fact, Oil imports were down slightly in February. The following graph shows the impact of imported oil on the trade deficit.

This graph shows oil imports per month for 2003, 2004 and the first two months of 2005. Oil imports are less than 20% of the trade deficit and just over 1% of GDP (as discussed in this post on Angry Bear). Even without oil, the trade deficit would be 5% of GDP - a serious problem.

The recent run up in oil prices will impact the trade deficit for March.

UPDATE: The average contract price for crude oil in Feb was $36.85 per barrel. According to the DOE, the average price will be almost $10 higher for March. That will add $4.5 Billion to the trade deficit, before seasonal adjustments - or another $3.5+ Billion to imports in March.

I expect the trade deficit for March to even be worse!

Monday, April 11, 2005

More on Oil

by Calculated Risk on 4/11/2005 04:50:00 AM

My most recent post on Angry Bear, Oil: The Impact on the US Economy, is now up.

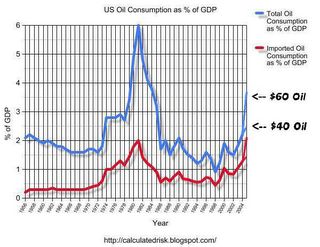

On the following graph, I plotted total oil consumption and imported oil consumption as a % of GDP. The plot for imported oil is slightly different than from my previous post (if you have a microscope!).

Click on graph for larger image.

The reason for the difference is I used different data sources. For this post, I used the DOE's data and for the previous post, I used the Census Bureau's trade data. They were very close, but I was able to plot a longer time series with the DOE's data.

I did not discuss peak oil in this analysis. That is a separate topic. I tried to stick to the question of the immediate impact on the US economy of the current price of oil.

Best Regards to All! And thanks for all the comments.

Friday, April 08, 2005

Oil Imports as % of GDP

by Calculated Risk on 4/08/2005 07:24:00 PM

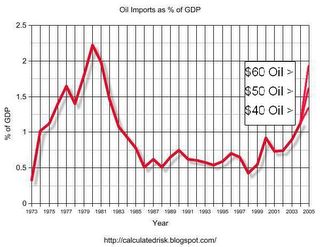

Dr. Altig's graph this morning compared US energy production and consumption (in BTUs) divided by real GDP. Altig defines the difference between consumption and production as our energy dependence. The following graph shows another measure of energy dependence.

Click on graph for larger image.

This graph shows the nominal dollar value of oil imports as a percent of nominal GDP. The data is from the Census Bureau's U.S. Imports of Crude Oil and only goes back to 1973.

For 2004, oil imports were 1.13% of GDP, the highest level since 1982. I plotted three alternatives for 2005: $40 oil, $50 oil and $60 oil. It is important to note that the average contract price paid for oil is usually $5 to $10 below the spot prices. With Oil priced at $53.32 per barrel today, the average import contract price is probably in the mid to high $40s.

For GDP in 2005, I assumed a nominal increase of 6%.

From this chart, $60 oil would be 1.9% of GDP, just below the peak years of 1980 (2.22%) and 1981 (1.98%). For $50 oil, imports would be 1.59% of GDP.

To reach the record 2.22%, with 6% nominal GDP growth, the average price of imported oil would have to be $69 per barrel. Of course we had a recession in 1980, and $60+ imported oil would probably slow GDP growth in 2005 too. With slower growth, oil imports would reach the record as a percentage of GDP somewhere in the mid to low $60s.

Thursday, April 07, 2005

DOE: Short-Term Energy Outlook

by Calculated Risk on 4/07/2005 04:39:00 PM

The Department of Energy released their Short-Term Energy Outlook today. The DOE is now projecting monthly average gas prices to peak at about $2.35 per gallon in May. That probably means around $2.60 per gallon for regular unleaded in California.

This graph from the DOE shows average US gas prices for the last 2 years.

The average U.S. price right now for regular grade gasoline is $2.22. California is $2.46. So the DOE is expecting approximately another $0.13 increase over the next 30 days.

For crude oil: WTI prices are projected to remain above $50 per barrel for the rest of 2005 and 2006.  The second graph (DOE slide 3) shops the DOE predictions. Bear in mind that every month, for almost a year, the DOE has projected oil prices to flatten or decrease, and every month prices have exceeded their base case expectations.

The second graph (DOE slide 3) shops the DOE predictions. Bear in mind that every month, for almost a year, the DOE has projected oil prices to flatten or decrease, and every month prices have exceeded their base case expectations.

The high end of the DOE's projected range for the next two years (95% confidence) is $65 per barrel (WTI) and the low end is $45 per barrel.

Click on graph for larger image.

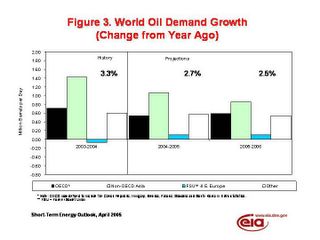

The third graph(DOE slide 4) shows the DOE's expected increase in World demand for crude oil in 2005 and 2006.

The DOE is expecting world oil demand to grow 2.7% in 2005 and 2.5% in 2006, compared to 3.3% in 2004. With worldwide demand at over 80 million bbd, a 2.7% increase would add 2.2 million bbd. So when OPEC announces they are adding 0.5 million bbd that is just a portion of the expected demand increase.

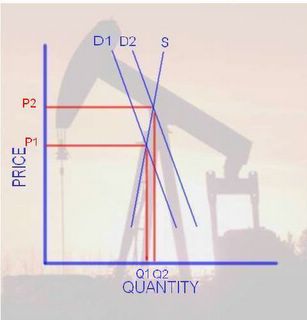

From a previous post on the oil situation: Both the supply and demand curves for oil are very steep. We all know this intuitively. If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; for the most part people stay with their routines and keep their same vehicle. With two steep curves (supply and demand) we get the following:

With a small increase in Demand (from D1 to D2), we see a small increase in Quantity (Q1 to Q2), but a large change in Price (from P1 to P2). Also a large price increase would occur if we had a small decrease in supply such as disruption to production, transport or refining (like hurricane Ivan in the GOM last year).

Of course the opposite is also true. A relatively small decrease in demand (or increase in supply) would cause a significant drop in price. If the DOE’s estimate of demand is correct, we will probably continue to see high energy prices.

No wonder the IMF warned today on the risk of a "permanent oil shock". From the FT article:

Raghuram Rajan, IMF chief economist, said: “We should expect to live with high oil prices.”Sorry for all the gloom and doom lately. At least the price of oil was off a little today.

“Oil prices will continue to present a serious risk to the global economy,” he added.

“The shock we see is a permanent shock that is going to continue... and countries need to adjust to that,” said David Robinson, deputy IMF chief economist.

UPDATE:

This graph shows the average price of regular unleaded in California and the US for the last 2 years. The graph is from GasBuddy. Give it a try for prices in your area (by state or city). Thanks to Jim Teter!

Note that the DOE prices were for April 4th ($2.22 for US, $2.46 for California). This graph shows that prices have climbed over the last 3 days, especially in California.

UPDATE 2:

Kash at Angry Bear has an interesting chart tracking economists' predictions, "Oil Prices and Recession".

Dave at Macroblog also has an interesting post "Energy Prices: Not The 1970s Redux (?)" on oil today.

With all this commentary, does that mean prices have peaked?

Housing Bubble: Foreclosures up 57%, Mostly Non-Bubble States

by Calculated Risk on 4/07/2005 12:30:00 AM

In a new report, U.S. foreclosures are up 57% from March 2004.

"The hardest hit states: Ohio, Texas, Michigan and Georgia, with more than 2,300 new foreclosures each."What is interesting is these are the non-bubble states according to an analysis by Richard J. DeKaser, Chief Economist at National City Corporation. Borrowers in these non-bubble states are getting in trouble first, probably because of job losses (their local economies are not as strong as the bubble states without the booming RE business) and they were not able to extract as much equity during the refinancing boom. The article cited higher interest rates and job losses:

Non-mortgage debt may help explain the troubling trend, [Marquette University economist David E. Clark] said. Most consumers opt for fixed-rate mortgages and thus are immune to rising interest rates, Clark noted. But their credit cards and home equity lines of credit carry variable interest rates - rates that have climbed in recent weeks.I am not surprised that the non-bubble states are seeing the impact of the housing slowdown first. But I think the real problem will start when the bubble states see a slowdown and a drop in transaction volumes.

"These (easy credit avenues) may have allowed people to get in rather dire straits financially, get overextended, and this is the final chapter of that process," Clark said.

Jim Houston, vice president with Foreclosure.com, said March's figures involve "the highest spike we've ever seen" in new foreclosures.

UPDATE: Here is the foreclosure.com press release with numbers by state.

Wednesday, April 06, 2005

Talk of the Nation: Schiller on Real Estate

by Calculated Risk on 4/06/2005 07:27:00 PM

Robert Schiller, Yale economics professor and author of "Irrational Exuberance" was on NPR's Talk of the Nation today. Click on listen.

A few Schiller quotes:

"In a sense the irrational exuberance never left the housing market. The housing market started to boom in the late '90s and it continues to go up. It wasn't interrupted by the earnings drop that we saw in stocks in 2001. It has just kept going."How much overvalued is the Real Estate market?

"I think its one of the amazing facts about statistics and econometrics that no one had collected a long time series of home prices in the U.S.. How can you get perspective about whether there are bubbles or not, if no one collects the data?

What I did is I went back and I found various fragmentary home price indexes that kept quality constant and linked them together and added, filled a gap. So I have a series back to 1890. When I plotted that I was quite surprised to see what happened.

The U.S. has basically has never been in a bubble like the one we are in now, with the possible exception of the period right after WWII when the soldiers came home and were bidding up home prices. It is a very rare phenomenon. So people who claim to have done statistical analysis - they can't have done it, they haven't had the data!"

"Some of these people will realize that their mortgage is worth - that the debt is greater than the value of the house and they will walk away. They will say that 'I'm making payments, huge payments on this house and its not even worth what I'm owing". If, as I expect, in many places prices will fall, defaults on mortgages will go up. There will be some disruption in people's lives."

"That varies very much by city. We looked at ratios of median home price to per capita personal income. We find that in many places in the U.S. that is only about 2, the median home is only like 2 years income or 3 years income. But in other cities it is 10 years income. So - I think that is getting a little - more than a little high. What supports it? Why would you live in a city were homes cost 10 years income, when you can live in a city were they cost 3 years income or 2 years income? You might say some cities are better than others and they have better job opportunities than others. But I think they are a bit overrated."In answer to a question:

"Miami had one of the most famous home price bubbles in 1925. In that year people began to think that land was running out in Florida and that you'd better buy now or it will be too late. Promoters started traveling all over the country and people started flowing in - there was a huge immigration into Florida at that time - but then the bubble burst in 1926. And it didn't rekindle in Florida until recently.

I think what is happening in Florida then and now are similar. Its a glamour story, a story of excitement, a story that land is running out that suddenly becomes prominent in people's minds."

Much more in interview. Enjoy!

World Bank: Economic Recovery Globally Has 'Peaked'

by Calculated Risk on 4/06/2005 11:04:00 AM

The World Bank warned Wednesday that the global economic recovery has "peaked" and said the severity of the coming slowdown will depend on the extent to which foreign investors lose their nerve about buying U.S.-dollar-denominated assets.And more:

"The global economy is at a turning point," said Francois Bourguignon, the bank's chief economist, in a foreword to the report. "Growth has peaked, and pressures to address global imbalances are growing, exposing important risks facing both developed and developing countries as the needed adjustments occur."

The bank said its best-case scenario calls for a mild slowdown in global economic growth over the next few years. The annual growth rate of gross domestic product, 3.8% in 2004, is likely to drop to 3.1% this year and hover about that level through 2007. Among developing countries, the rate is likely to slip from 6.6% last year to 5.7% in 2005, and 5.2% in 2006.

Still, the bank said, a new global recession is a possibility. "A reduction in the pace at which central banks are accumulating dollars, a weakening in investors' appetite for risk, or a greater-than-anticipated pickup in inflationary pressures could cause interest rates to rise farther than projected, providing a deeper-than-expected slowdown or even a global recession," it said.

The R word is starting to raise its ugly head. I'll be back to the Mug's game soon.