by Calculated Risk on 4/22/2005 05:08:00 PM

Friday, April 22, 2005

Fed's Kohn: Imbalances, Risks

Fed Governor Donald L. Kohn spoke today at the Hyman P. Minsky Conference in New York. Kohn made several cautionary comments on global imbalances. A few excerpts:

... beneath this placid surface are what appear to be a number of spending imbalances and unusual asset-price configurations. At the most aggregated level, the important imbalance is the large and growing discrepancy between what the United States spends and what it produces. This imbalance, measured by the current account deficit, has risen to a record level, both in absolute terms and as a ratio to GDP.

...

The sustainability of these large and growing imbalances has become especially suspect because it would require behavior that appears to be inconsistent with reasonable assumptions about how people spend and invest.

...

The current imbalances will ultimately give way to more sustainable configurations of income and spending. But that leaves open the question of the nature of that adjustment. Ideally, the transition would be made without disturbing the relatively tranquil macroeconomic environment that we now enjoy. But the size and persistence of the current imbalances pose a risk that the transition may prove more disruptive.

And on Real Estate:

A couple of years ago I was fairly confident that the rise in real estate prices primarily reflected low interest rates, good growth in disposable income, and favorable demographics. Prices have gone up far enough since then relative to interest rates, rents, and incomes to raise questions; recent reports from professionals in the housing market suggest an increasing volume of transactions by investors, who (along with homeowners more generally) may be expecting the recent trend of price increases to continue.In other words, a BUBBLE!

I take some comfort from the continuing disagreement among close students of the market about whether houses are overvalued, and, given the widespread press coverage of this issue, from my expectation that people should now be aware of the risks in the real estate market.

A very interesting speech and an extension of recent hard landing discussion. (see macroblog for a summary here, here and here)

Oil Prices Hurting less Developed Countries

by Calculated Risk on 4/22/2005 11:26:00 AM

It appears that oil prices have started to slow the US economy. But less developed countries are really feeling the pinch. Speaking at the Asia-Africa summit in Jakarta, Indonesia, Philippine President Gloria Macapagal-Arroyo warned that oil prices could lead to a "global recession".

Arroyo told the meeting in Jakarta, featuring some of the world’s leading oil consumers, that unsustainable prices were driving many countries to the brink of financial instability.

“There’s no question that the rising price of oil has the potential to put the brakes on economic expansion,” Arroyo said, urging delegates to work together to “prevent such a crisis”.

The rising trend of oil prices could worsen to levels that could halt economic growth or even prompt global economic recession, Arroyo said.

“It is stripping oil-importing Asia and Africa of our ability to manage for global competitiveness. It is preventing us from pursuing our economic development programmes with vigor. It is requiring us to face the spectre of economic decline,” she said.

Philippine Foreign Affairs Secretary Alberto Romulo made similar comments at the ministerial meeting of the conference.

"The current trend in oil prices points toward a situation that could halt global economic growth and further widen the gap between the rich and poor countries," Romulo said.

Spot oil prices reached $55 per barrel earlier today.

Thursday, April 21, 2005

Markets and Recessions

by Calculated Risk on 4/21/2005 09:01:00 PM

It is common wisdom on Wall Street that the market predicts recessions. This story today quoted a market analyst as saying: "The market typically turns down six months to a year before a recession. We could be seeing a recession in 2006."

We might see a recession in 2006, but the markets are not a good predicting tool.

Click on graph for larger image.

Here is the DOW's performance before and after the start of the last 5 recessions. For each recession, the DOW's value was normalized to 100 12 months prior to the start of the recession. The graph shows the median value, and the minimum and maximum for the DOW.

The best that can be said for the market is that it is a solid coincident indicator of a recession.

Here is a graph from a previous post about recession indicators. This shows the SP500's performance and the 1990's recession. The SP500 rallied into the recession and only sold-off after the recession started.

This is another common Wall Street "wisdom" that is incorrect. UPDATE: Fixed typo on graph.

"There are serious pocketbook issues lurking in America"

by Calculated Risk on 4/21/2005 02:36:00 AM

"There are serious pocketbook issues lurking in America," said Rep. Jim Leach (R- Iowa).

On the front page of Thursday's Washington Post is this analysis by Weisman and Balz, "Economic Worries Aren't Resonating on Hill" The authors make the argument that main street concerns are being ignored by Washington and the media.

The disconnect between pocketbook concerns of ordinary Americans and the preoccupations of their politicians has helped send President Bush's approval ratings on the economy down, while breeding discontent with Congress.And more:

"Many are rather upset at the Terri Schiavo issue," [Rep. Vernon Ehlers (R-Michigan)] said, even "moderately pro-life" voters. "I'm getting a lot of the, 'Why are you spending time on that when we don't have jobs?' type of thing."And this piece only scratches the surface of the serious economic challenges facing America.

In Michigan, jobs and the economy have vaulted to the No. 1 concern of 34 percent of voters, with the closest other issues, health care and education, at a distant 15 percent, said Ed Sarpolus, an independent Michigan pollster. "I haven't seen anything like that since the early '90s and crime," he said.

Wednesday, April 20, 2005

RE Executives: The Boom that won't Bust

by Calculated Risk on 4/20/2005 10:04:00 PM

At the Milken Institute Global Conference 2005 in LA, several Real Estate executives argued that there is no real estate bubble. A few comments from the "Real Estate: Investing for the Future" panel:

"We're in a market with real depth and real legs on it," said M.D.C. Chief Executive Larry Mizel.

"The big boom of the last 10 years was not seen all through the United States," KB Home Chief Executive Bruce Karatz said. "There's a supply-and-demand balance that I think will stay good for many years."

"The housing bubble has been created more by the business press than reality," said Sam Zell, chairman of Equity Office Properties Trust and Equity Group Investments LLC. "You can't have a crash without oversupply."

I will address the supply issue in a future post. But the final comment from the article is worth highlighting:

"The executives pegged the southwestern U.S. and Florida as best real estate buys"Enough said.

The Economist on House Prices

by Calculated Risk on 4/20/2005 05:36:00 PM

The Economist asks: Will the walls come falling down?

A few excerpts:

The increasing riskiness of mortgages is not the only sign that America is experiencing a housing bubble. The ratio of house prices to rents is well above its historical average, as is the ratio of prices to median incomes. And people seem increasingly to be basing their house-buying decisions on the notion that the large capital returns of the past few years—house prices in America are up by 65% since 1997—will continue indefinitely. As with a stockmarket bubble, if this confidence is shaken, prices could begin to fall rapidly.More likely prices will deflate slowly over a multi-year period. Housing: After the Boom on Angry Bear looked at the impact on prices and volume transactions in previous busts. Prices deflated slowly, but transactions dropped precipitously.

A fall in American house prices could be bad news not just for American homeowners, but for the rest of the world. Robust American demand has supported export-driven growth in many economies, particularly emerging markets and Asia. If American consumers have to raise their abysmal savings rate, exporting nations will feel the pinch.

And finally this:

Most worryingly, a collapse in American export demand could trigger a vicious cycle. In order to keep their currencies low against the dollar, and thus boost exports to America, Asian central banks have been accumulating dollar reserves, which they have poured into Treasury bonds. This has increased the supply of capital in America, and thus been at least partly responsible for the borrowing binge that fuelled the housing boom. If house prices fall, and suddenly poorer Americans have to cut back on their purchases, this will shrink the supply of cheap credit from Asian central banks, pushing up interest rates and causing house prices to fall even further. Those who thought that housing was a haven may be in for a nasty surprise.Emphasis added.

For a diagram on how this might work, see Housing and Trade: Virtuous Cycle about to Become Vicious? Check out The Economist article and the interesting chart on the global nature of the housing boom.

Bruce Bartlett Whispers the "R" Word

by Calculated Risk on 4/20/2005 01:22:00 AM

Bartlett believes that talk of a recession is "premature", but he expresses his general concerns that "the financial sector of the economy is under growing strain that could burst and spill over into the real economy suddenly and without warning."

He concludes:

... there are the dreaded “twin deficits” looming over financial markets. Huge budget and current account deficits mean that vast amounts of capital flows are necessary to keep them funded. So far, this has gone well, but that is largely because the Chinese have been so accommodating about financing them—effectively financing their own exports by buying large quantities of U.S. Treasury securities with their export earnings.My question: Great skill? By whom? Is there anyone in the Administration even thinking about these issues?

But now the U.S. is strongly pressuring China to stop doing this in order to allow its currency to rise against the dollar. It is hoped that this will reduce China’s production advantage in dollar terms and bring down the bilateral trade deficit. However, the cost to the U.S. economy if this happens could be greater than the potential gain. At least in the short run, any scale-back in China’s buying of Treasury securities might cause interest rates to spike very quickly. This could prick the housing bubble and bring down home prices, eroding personal wealth and putting a squeeze on those with floating rate mortgages.

Hopefully, this can all be managed smoothly and without either a recession or a market break. But it will take great skill and a lot of luck to avoid both.

UPDATE: pgl and William Polley add some comments. Make sure to read the comments in response to pgl's post.

Tuesday, April 19, 2005

Housing Starts

by Calculated Risk on 4/19/2005 06:29:00 PM

Angry Bear and Macroblog have commented on housing starts being lower than expected. Usually sales are a better indicator than starts, so look for the New Home Sales announcement next week.

This was an interesting comment buried in the story:

One concern among builders, [Dave Seiders, chief economist with the National Association of Home Builders] said, is that speculators are buying in new housing developments, which drives demand in the short term but could show up as excess supply down the road. "If the investor community should get worried, we could have a wholesale tumbling."I believe speculation is the key to any bubble. This post on Angry Bear discussed the storage aspect of speculation - the "excess supply down the road" that Mr. Seiders is discussing. From the Angry Bear post:

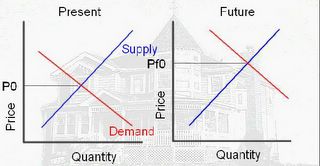

Click on diagram for larger image.

This diagram shows the motive for the speculator. If he buys today, at price P0, he believes he can sell in the future at price Pf0 (price future zero), because of higher future demand. The speculation would return: Profit = Pf0-P0-storage costs (the storage costs are mortgage, property tax, maintenance, and other expenses minus any rents).

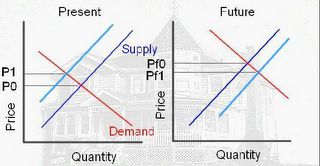

In this model, speculation is viewed as storage; it removes the asset from the supply. The following diagram shows the impact on price due to the speculation:

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

However, if the price does not rise, the speculator must either hold onto the asset or sell for a loss. If the speculator chooses to sell, this will add to the supply and put additional downward pressure on the price.

There is more in the Angry Bear post including a discussion of leverage as speculation.

I know I repeat myself sometimes - an old habit - sometimes I think certain ideas are worth revisiting. Best Regards to All.

Monday, April 18, 2005

Inflation Preview

by Calculated Risk on 4/18/2005 04:15:00 PM

UPDATE: Macroblog has a nice review of today's numbers. Look to Angry Bear tomorrow after the CPI is released.

The BLS reports PPI tomorrow and CPI on Wednesday. Over the last year, both the CORE PPI and CPI, less Food and Energy, have been steadily increasing on a year over year basis.

Click on graph for larger image.

Also plotted is the intended FED Funds Rate. A neutral Fed Funds rate would probably be about 150 to 200 basis points above CPI less food and energy. The Fed funds rate is currently at 2.75% with core inflation running about 2.5% to 3%.

The Fed Funds rate is still very accommodative unless the FED expects future inflation rates to fall. Dr. Krugman suggested that we may be seeing "A Whiff of Stagflation"; a slowing economy with rising inflation.

UPDATE: I probably should have include the FED's favorite measure of inflation, the PCE deflator (around 1.6%). The PCE is also steadily increasing and still puts the neutral rate around 3.25% to 3.5%.

The PPI and CPI numbers deserve close scrutiny this week.

Bubble Employment

by Calculated Risk on 4/18/2005 11:12:00 AM

Here are a couple of charts on real estate related employment.

Click on graph for larger image.

This graph is from The Big Picture.

For RE agents, California alone has added 113,307 licensed RE agents since July 2000. The total RE agents in California (427,389) represents 1.9% of the total working population of California. Many of these agents only work part-time, but that is still a substantial loss of income if RE volumes drop 30 to 40% - like a typical RE slowdown.

Thanks to ild and Elroy for the second chart.

Just like RE agents, there has been a significant increase in mortgage brokers. There has been a similar increase in residential building trades, appraisers, home inspectors and other housing related occupations. The impact of a housing slowdown on employment will be significant.