by Calculated Risk on 11/09/2005 09:47:00 PM

Wednesday, November 09, 2005

Remarks by John C. Dugan, Comptroller of the Currency

Here is the text of John Dugan's recent remarks at the OCC Credit Risk Conference. It is an easy read and well worth the few minutes. Dugan makes several key points:

1) This is the top of the credit cycle and standards are slipping.

2) Risk is overly concentrated in commercial real estate and residential mortgages.

3) Certain loans are especially risky.

4) The goal for the new interagency guidance is the end of 2005.

This is the "top of the credit cycle":

"... it’s at the top of the credit cycle where stresses and weaknesses typically appear, so what we are seeing today should not surprise anyone. With liquidity pouring into the market, we would expect to see increased competition for loan customers – and we are. With competition intensifying, we would expect to see underwriting standards easing – and we are. And we would expect to find emerging concentrations in some loan categories, such as commercial and residential real estate. We are most definitely seeing that."And there is concern about mortgage risk:

"Today’s non-traditional mortgage products – interest-only, payment option ARMs, no doc and low-doc, and piggyback mortgages, to name the most prominent examples – are a different species of product, with novel and potentially risky features.And more on Option ARMs:

...

This dominance is increasingly reflected in the numbers. By some estimates, interest-only products constituted approximately 50 percent of all mortgage originations last year. In the first half of 2005, IOs started to decline in favor of payment-option ARMs, which, according to one source, comprised half of new mortgage originations. And roughly every other mortgage these days is also a “piggyback” or reduced documentation mortgage, which points to another development that concerns us: the trend toward "layering" of multiple risks. There is no doubt that when several risky features are combined in a single loan, the total risk is greater than the sum of the parts.

We can readily understand why these new products have become fixtures in the marketplace in such a short time. One reason is that they have helped sustain loan volume that would otherwise almost certainly be falling, because rising interest rates have brought an end to the refinance boom. More important, lenders have scrambled to find ways to make expensive houses more affordable – although there’s now a concern that the very availability of this new type of financing has done its share to help drive up house prices, which in turn stimulates demand for even more non-traditional financing."

"And then there are payment-option ARMs, which take us to another level of risk. ... borrowers can easily treat payment-option ARMs in the same manner as a traditional mortgage, simply by selecting the fully amortizing option rather than the minimum payment option each month.And on the new interagency mortgage guidance project:

In practice, however, few borrowers treat them that way. Recent studies show that a significant number of borrowers are frequently choosing to pay the minimum amount possible, a payment amount that typically falls short of the interest accruing on the loan. Even more disturbing, this choice does not seem limited to high quality, affluent borrowers who may be using the product as a payment flexibility tool. The research indicates that borrowers at both ends of the FICO spectrum make this choice, with riskier borrowers resorting to it most frequently. Because such minimum payments fall considerably short of the total interest accruing each month, the unpaid interest is added to the loan principal, and negative amortization occurs. Thus, it should come as no surprise that, of the least creditworthy holders of payment-option ARMs, nearly 50 percent have current balances above their original loan amount."

"This guidance will focus on underwriting standards, appropriate disclosure, and portfolio management concerns. Our current goal is to ready the guidance for release by year’s end, although serious interagency discussions about the initial draft have only just begun."Well worth reading.

Bernanke and the Housing Bubble

by Calculated Risk on 11/09/2005 08:51:00 PM

The Center for Economic and Policy Research released a new report today: "Will a Bursting Bubble Trouble Bernanke? The Evidence for a Housing Bubble". Dean Baker and David Rosnick conclude:

This paper has briefly examined three trends that strongly support the view that the recent run-up in house prices is driven by a speculative bubble, rather than fundamentals. First, it notes the unusual gap between the run-up in home sale prices and rents at both the national level and in many of the most inflated metropolitan markets. .... When such gaps have developed in the past, they usually have been followed by sharp declines in house sale prices.

The second factor suggesting that the current run-up reflects a bubble is the extraordinary pace of home construction in recent years. ... This pace of construction substantially exceeds that rate of new household formation. It is also worth noting that virtually no economists projected a sharp price in home construction in the mid-nineties, so most of the economists who expect the current pace of housing construction to persist, badly erred in their projections for housing construction in the past.

Finally, the wealth effect resulting from the recent run-up in house prices has led to a sharp decline in the savings rate. In recent months, the savings rate has turned negative. If construction continues at its recent pace and real house prices stay at current levels, then the savings rate will become even more sharply negative over the next decade.

...

It is not plausible that an economy will sustain a negative savings rate for any substantial period of time. This would imply that households’ non-housing wealth is continually declining. The more likely scenario is that housing prices will fall back in line with their historic values.

...

The costs of a collapse of the housing bubble will be even greater than the costs of the collapse of the stock bubble, because housing wealth is much more evenly held. The failure of the economics profession to adequately warn of the stock bubble was an act of extraordinary negligence. Missing the housing bubble is an even bigger mistake.

Prediction: September Trade Deficit

by Calculated Risk on 11/09/2005 06:14:00 PM

The Census Bureau will report the Trade Balance tomorrow morning. The concensus forecast is for a record trade deficit of $61.3B for September.

The impact of the hurricanes is a little uncertain. The Census Bureau has released preliminary trade information for the Gulf Region showing that exports were off about $1 Billion for the Port of New Orleans in September. However, imports were also off (about $0.5 Billion) and other Gulf ports picked up some of the export and import slack. My guess is exports will be impacted slightly - maybe $0.5 Billion.

Crude oil imports were off, but the volume of more expensive refined products increased. My prediction for the petroleum trade deficit is $21.1 Billion SA; a slight increase from the August record of $20.6 Billion.

The West Coast ports of Los Angeles and Long Beach reported record inbound traffic for September. Export traffic was down. Seasonally adjusted, imports from China were probably around the August level.

My prediction: A record trade deficit of $60.5 Billion.

DiMartino: Follow the Housing insiders' money

by Calculated Risk on 11/09/2005 04:38:00 PM

DiMartino follows the money:

...it's a good thing the people running the homebuilding companies got out when they did.

So far this year, insiders at Toll have sold $588 million worth of the company's stock – representing nearly 10 percent of the current market capitalization. Robert Toll, chief executive, has liquidated north of $110 million.

As a group, Thomson Research senior quantitative analyst Mark LoPresti said, industry insiders have sold $976 million in 2005.

...

In the last six months, homebuilders have sold, on average, $347 for every dollar they've spent purchasing their own stock. Compare that to all industries, where insiders have sold $31 in stock for every dollar they bought.

Mr. LoPresti said July was the key month for homebuilder shareholders to watch what insiders were doing with their own shares.

"In July alone, homebuilding insiders liquidated 4.8 million shares of stock, the largest number in history, raising $333 million," Mr. LoPresti said.

The last time homebuilder insiders were this aggressive was May 1991, when they sold off 3.1 million shares in one month. This was followed by a 27 percent decline in homebuilder stocks over the next four months.

Tuesday, November 08, 2005

WSJ Econoblog: Changing Times at the Fed

by Calculated Risk on 11/08/2005 10:32:00 PM

Drs. Tim Duy and William Polley discuss Bernanke and the FED: Changing Times at the Fed This is an excellent discussion of a number of topics: Fed credibility, inflation targeting, inflation measures, "global savings glut" and more.

NOTE: Here is Dr. Polley's blog and Dr. Duy writes the regular Fed Watch feature on Dr. Thoma's Economist's View.

From the WSJ Econoblog: Both Drs. Duy and Polley believe Bernanke's "helicopter drop" comments were misunderstood by the general public. See this 2002 Bernanke speech: Deflation: Making Sure "It" Doesn't Happen Here

Dr. Polley comments:

In one line of his speech, Mr. Bernanke uses the illustration of the "helicopter drop" of money -- an illustration first used by Milton Friedman -- to describe a money-financed tax cut that should have the desired effect of ending the deflation. It was, of course, widely acknowledged that the risk of deflation was slight and that this was a "worst case" scenario.Dr. Duy concurs:

Fortunately, deflation did not materialize, but many people worried that Mr. Bernanke's use of this illustration weakened his credentials as an inflation fighter. I don't share that concern, but beliefs and expectations are very important in central banking. Any doubt about the Fed's credibility means that they will have to raise the real rate further to re-establish those credentials.

I have worried that continued allegations of Mr. Bernanke as an inflationist -- allegations that I believe are false -- are increasing the possibility of policy error in the months ahead. That said, I believe that my worries will prove to be unfounded at the end of the day.An excellent discussion.

Housing and the Economy

by Calculated Risk on 11/08/2005 06:31:00 PM

Here are some interesting comments today on the impact of a housing slowdown on the economy:

Marketwatch: Bell 'Toll-ing' for housing market?

Toll Bros. warning fuels worries bubble set to finally pop

"If housing prices do not go up as much and interest rates are rising at the same time, fewer people will be able to take equity out of their homes," said Simon at Pimco.Reuters: U.S. stocks fall on concern about housing slowdown

"People are not only going to feel a lot less rich but they are going to have less money to spend," he added. "That can definitely hurt GDP."

"A soft real-estate market is not good for the consumer. It is not going to bode well going forward," said Weston Boone, vice president of listed trading at Legg Mason Wood Walker. "You have to take into consideration the rising interest-rate environment. There aren't a lot of catalysts for positive sentiment in the market."Investors Squeamish on Housing Outlook

"It would be a bit ominous for the economy if we see a dramatic slowdown in the housing sector," said Michael Metz, chief investment strategist at Oppeheimer & Co.What comes next? A slowdown in retail spending or real estate related job losses?

"The whole economy has been built on the wealth impact of the housing sector," Metz said.

Toll Brothers Warns

by Calculated Risk on 11/08/2005 10:53:00 AM

AP reports: Toll Brothers Cuts 2006 Home Deliveries View; Sees Weakened Demand in Some Markets

Toll Brothers Inc. cut its home deliveries forecast for fiscal 2006 on Tuesday, citing fewer than expected selling communities and weakened demand in several markets. Shares of the luxury home builder tumbled more than 11 percent in morning trading.

Toll Brothers projected home deliveries between 9,500 and 10,200 homes in fiscal year 2006, down from an earlier target of 10,200 to 10,600 homes. In fiscal 2005 it reported 8,769 deliveries.

"The shortage of selling communities, coupled with some softening of demand in a number of markets, negatively impacted our contract results," Toll Brothers said. "It appears we may be entering a period of more moderate home price increases, more typical of the past decade than the past two years."

Monday, November 07, 2005

Leaving California

by Calculated Risk on 11/07/2005 12:58:00 AM

My most recent post is up on Angry Bear: Will Boston Lead the Housing Bust?

Also, one of my friends is leaving California to take a job in Indiana. He currently lives in the Inland Empire and had a choice of living in Orange County or Indiana. The price of housing was the determining factor.

Apparently this is becoming more common - from the NY Times: Saying Goodbye California Sun, Hello Midwest

A growing number of people are leaving California after a decade of soaring home prices, according to separate data from the Census Bureau, the Internal Revenue Service and the state's finance department.

Last year, a half million people left California for other parts of the United States, while fewer than 400,000 Americans moved there. The net outflow has risen fivefold, to more than 100,000, since 2001, an analysis by Economy.com, a research company, shows, although immigration from other countries and births have kept the state's population growing.

The number of people leaving Boston, New York and Washington is also rising, and skyrocketing house prices appear to be a major reason, said Mark Zandi, chief economist at Economy.com. From New York, the net migration to Philadelphia more than doubled between 2001 and 2004, with 11,500 more people leaving New York for Philadelphia last year than vice versa. The number of New Yorkers who have moved to Albany, Charlotte, N.C., and Allentown, Pa., among other places, has also increased sharply.

Friday, November 04, 2005

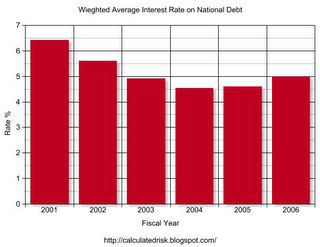

Interest on the National Debt

by Calculated Risk on 11/04/2005 05:49:00 PM

The average weighted interest rate on the National Debt will most likely rise in fiscal 2006. For fiscal 2005 (ended Sept 30th), the average interest rate was 4.6%. The rate rose to 4.74% in October.

Click on graph for larger image.

With continued heavy borrowing, a significant amount of debt due to rollover in early 2006, and rising interest rates, the weighted average rate will probably rise to 5% or more for fiscal 2006.

NOTE: 2006 is estimated at 5%.

The implications for the budget deficit are serious. The National Debt has increased substantially in recent years, while interest rates have been falling. This has kept the debt service payments in the low to mid $300 Billion range.

Now that interest rates are rising, the additional interest payments will add significantly to the General Fund deficit. A small increase to 5% of the weighted average interest rate will add $59 Billion to the fiscal 2006 General Fund deficit compared to fiscal 2005 debt service.

NOTE: Graph shows an estimated fiscal 2006 interest payment of $411 Billion.

Debt service is part of the reason I believe the National Debt will increase by a record $650 Billion in fiscal 2006. The US set an October record debt increase of $94.4 Billion - well on the way to an annual record.

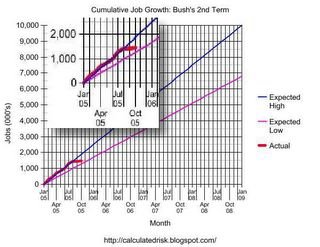

October Jobs Report

by Calculated Risk on 11/04/2005 11:24:00 AM

The BLS released the Emploment Situation Summary this morning.

On Housing: Kash has some interesting comments on construction employment at Angry Bear: Disappointing Job Growth Here are some stats for October: Total jobs added: 56K.

1.8K .... Residential building

20.0K .. Residential specialty trade contractors

5.4K ... Depository credit intermediation (includes mortgage brokers)

3.3K ... Real estate

Total RE related = 30.5K

Previous economic releases have shown that construction spending and new home starts are still rising. This employment report is further confirmation that the building boom is continuing, even though the housing market appears to be slowing.

On overall employment: Bush's first term, with a net loss of 759K private sector jobs (a gain of 119K total jobs), was a disappointment. For Bush's 2nd term, anything less than 6.8 Million net jobs will have to be considered poor. And anything above 10 million net jobs as excellent. Of course, in additional to the number of jobs, the quality of the jobs and real wage increases are also important measures.

Click on graph for larger image.

For the quantity of jobs, this graph provides a measurement tool for job growth during Bush's 2nd term.

The blue line is for 10 million jobs created during Bush's 2nd term; the purple line for 6.8 million jobs.

The insert shows net job creation for the first 9 months of the 2nd term - the last three months have moved job creation towards the lower end of the acceptable range.