by Calculated Risk on 11/18/2005 05:47:00 PM

Friday, November 18, 2005

ARMs Coming Due

CNN reports: Homeowners with ARMs face big bill jump

The Mortgage Bankers Association estimates that some $330 billion worth of ARMs will adjust in 2006 and $1 trillion worth will reset by the end of 2007.For more details on adjusting ARMs, see this NY Times article from June: The Trillion-Dollar Bet

Since the average ARM loan is about $300,000, according to Freddie Mac, a trillion dollars probably represents more than 3 million homeowners who will face bigger bills in the next two years.

If you took out an 3/1 ARM for $300,000 back in late 2002, your initial interest rate was probably around 5 percent and your monthly payment has been about $1,610.

...

Your new payment: $1,995 a month -- a difference of $385, or more than $4,600 a year.

Financial Times: Opec set to lift secrecy about oil production

by Calculated Risk on 11/18/2005 05:13:00 PM

The Financial Times reports:

The Organisation of the Petroleum Exporting Countries, the cartel that controls 40 per cent of world oil exports, will on Saturday lift a four-decade veil of secrecy and begin regularly to reveal how much oil it is actually pumping.More transparency is a positive for the oil market, but it doesn't appear this will lead to more transparency on reserves - the key to peak oil predictions.

China and India, the fastest growing major oil consumers, will also supply consumption and storage data for the first time.

The Joint Oil Data Initiative (Jodi), which will be launched on Saturday in Riyadh by energy and finance ministers of the biggest oil producing and consuming countries, will meet a persistent demand of the Group of seven industrialised countries for more transparent energy data.

The price rise of the past three years, which this year saw oil hit nominal highs of $70.85 a barrel, could in part have been avoided by better data, analysts said. It would provide a more accurate basis for industry investment decisions, which in turn help determine long term supplies.

But analysts also suggested that the new database was unlikely to transform the currently unscientific art of guessing world demand and supply into a simple task.

One person close to Saturday's event said that the data would reveal little difference to existing output estimates for some countries including Saudi Arabia, the world's biggest oil producer but would show a five to 10 per cent disparity in the production levels of other Opec countries.

Traders said they would have to wait until the numbers came out to know whether they would move the oil price when markets reopen on Monday.

Thursday, November 17, 2005

More on California Bay Area Housing

by Calculated Risk on 11/17/2005 10:15:00 PM

The SF Chronicle on the DataQuick report: Gaming the housing peak

A few added quotes:

"I don't get the feeling that prices have declined," [a potential buyer] said. "Homeowners are seeking prices that are in line with comps (comparable listings) of homes that sold a few months ago.''

John Karevoll, an analyst with DataQuick, said that is exactly what happens at the end of a real estate cycle. "We always see people trying to game the peak -- trying to get the most for their properties,'' he said.

According to Karevoll, this doesn't indicate a housing bubble about to burst but rather the end of a cycle in which sales will drop off and prices will reach a plateau.

In effect, the market had been robust because house seekers who would have waited to buy purchased this year instead because of low interest rates. "We were stealing (housing activity) from the future,'' he said.

Karevoll now expects a long lull in the market as it stabilizes.

Tapan Munroe, an economist and director for LECG, a worldwide consulting firm, agreed. "Sales are flattening, and prices are also going down a bit, but I doubt very much it is a bursting of a bubble. It's more like a slowdown and a soft landing.''

But Munroe said the situation could change if interest rates were to reach 7 to 8 percent. "That would certainly create a significant slowdown.''

Economists say U.S. housing market in downdraft

by Calculated Risk on 11/17/2005 04:41:00 PM

Reuters reports: Economists say U.S. housing market in downdraft

The U.S. housing market has peaked and a slowdown appears underway after a five-year rally that toppled all construction and sales records and sent home prices soaring, economists said on Thursday.But its not all doom and gloom:

A string of new economic data from the government and private sector show rising interest rates tugged the reins on housing activity in October and the first part of November.

The Commerce Department said on Thursday both home construction and permits for future building tumbled last month while an industry group said mortgage applications slid last week as rising interest rates dampened home buyers' demand.

Those reports follow a host of data over the past month indicating an increase in the supply of homes for sale, waning demand and some falling prices.

Add to that growing anecdotal evidence that homes are staying on the market longer and buyers are bidding below sellers' asking prices, and it cements an impression that the long-anticipated cooling has begun.

"All of that suggests this is now a buyers' market," said Nariman Behravesh, chief economist at Global Insight. "It is a big change from a year ago."

"The level of housing activity remains quite solid but we just might be seeing the end of the boom," said Joel Naroff, president and chief economist at Naroff Economic Advisors Inc.But there is concern about the impact on the overall economy:

...

"It's not like it's going to be a lousy market for housing next year," said Frank Nothaft, chief economist at Freddie Mac. "It will just be normal as opposed to these abnormal levels we've seen these last couple years."

Softening in the housing market will have a spillover effect on the broad economy and is likely to play a major role in an expected slide in consumer spending in the months ahead.

Real personal consumption expenditures -- about 70 percent of gross domestic product -- are forecast to grow just 2.8 percent next year, slower than this year's 3.5 percent and the smallest increase since 2002, according to the Blue Chip survey of more than 50 top forecasters.

DataQuick on Bay Area: Lower Sales, Flat Prices

by Calculated Risk on 11/17/2005 03:16:00 PM

DataQuick reports: Continued sales slowdown in Bay Area, appreciation flat

The number of homes sold in the nine-county Bay Area declined on a year-over-year basis for the seventh month in a row in October, the result of rising mortgage interest rates and reduced demand, a real estate information service reported.

A total of 10,508 new and resale houses and condos were sold in the region last month. That was down 6.2 percent from 11,205 for September, and down 6.0 percent from 11,180 for October last year, according to DataQuick Information Systems.

Sales have been lower compared to 2004 every month since April. So far this year 107,099 Bay Area homes have been sold, 5.1 percent fewer than 112,873 for the same ten-month period last year.

"We look at today's market as normalizing. Everybody seems to have gotten used to the records set last year and the year before. The fact is that last month was the third-strongest October since we started keeping records in 1988. It was about twenty percent above average," said Marshall Prentice, DataQuick president.

The median price paid for a Bay Area home was $614,000 last month. That was down 0.3 percent from $616,000 in September, and up 17.2 percent from $524,000 for October a year ago. Annual price increases so far this year have ranged from 17.2 percent to 20.5 percent.

West Coast Ports: October Imports Mixed, Exports Up

by Calculated Risk on 11/17/2005 10:32:00 AM

The Ports of Long Beach and Los Angeles reported mixed import traffic for October.

Import traffic at the Port of Long Beach decreased 4.5% compared to September. A total of 299 thousand loaded cargo containers came into the Port of Long Beach, compared to 313.5 thousand in September.

The Port of Los Angeles import traffic increased 5% in October. Imports were 368.8 thousand containers, setting a new all time record for the Port of Los Angeles.

For both ports, outbound traffic recovered from the September slump. For Long Beach, outbound traffic was up 6.6% to 103 thousand containers. At Los Angeles, outbound traffic was up 5.5% to 98 thousand containers.

The quantity of containers says nothing about the content value, but provides a rough guide on imports from China and the rest of Asia. Given these numbers, I expect imports from Asia to be about the same in October as in September.

Wednesday, November 16, 2005

NAHB: Builder Confidence Falls

by Calculated Risk on 11/16/2005 02:11:00 PM

The National Association of Home Builders reports: Builder Confidence Declines In November

Responding to sharply lower measures of consumer confidence as well as rising mortgage rates and other factors in recent months, single-family home builders are adjusting their market expectations downward to a still favorable perspective, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for November, released today.Here is the table of the HMI components.

The index declined eight points to rest at 60, a level well above the midpoint that indicates the majority of builders still see conditions as positive in their markets.

“It’s important to keep today’s report in perspective,” said NAHB President Dave Wilson, a custom home builder from Ketchum, Idaho. “Many builders still have substantial backlogs of unfilled orders and will remain quite busy in coming months. But we’re well aware that some slowing of demand is inevitable following the record-breaking sales activity that has prevailed for some time.”

“No huge drop is in the cards – the sharp decline in the HMI probably overstates the actual degree of deterioration in the single-family market, and it’s most likely that we’re engaged in an orderly cooling process that will lead to somewhat lower home sales and production in the future,” added NAHB Chief Economist David Seiders. “We’re looking for a 5 or 6 percent decline in home sales next year, compared to 2005.”

Derived from a monthly survey that NAHB has been conducting for approximately 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

Each of the HMI’s component indexes registered declines this time around. The index gauging current sales activity fell eight points to 66, while the index gauging sales expectations for the next six months dropped nine points to 64 and the index gauging traffic of prospective buyers fell five points to 46.

Seiders cited deterioration in consumer attitudes in recent months, spurred by the recent hurricanes and resulting higher energy prices, as a significant factor in November’s builder confidence gauge. He also cited rising interest rates on both fixed- and adjustable-rate mortgages. Fixed rates averaged 6.35 percent in the survey period compared to 6 percent in the prior month and 5.7 percent in the month before that.

“In addition, affordability problems have arisen as house price gains have accumulated in many parts of the country,” he said. “So while the balance of builder attitudes is still positive, most are less exuberant than at the HMI’s last peak in the middle of this year” (the index hit 72 in June). The last time the HMI hit 60 was in May of 2003.

Though builder confidence was down across all regions of the country, ongoing trends prevailed to keep those in the West at the highest end of the confidence scale and those in the Midwest at the lower end. In the West, the HMI fell from a very high level of 91 in October to a still-impressive 78 in November, while in the South, it declined from 76 to 68. In the Northeast, the gauge slipped six points to 61, while continued job-market weakness in the Midwest brought that region’s HMI down from 45 to 38.

MBA: Mortgage Activity Steady

by Calculated Risk on 11/16/2005 11:30:00 AM

The Mortgage Bankers Association (MBA) released its weekly survey today:

The Market Composite Index — a measure of mortgage loan application volume – was 657.6 a decrease of 0.6 percent on a seasonally adjusted basis from 661.3, one week earlier. On an unadjusted basis, the Index decreased 12.1 percent compared with the previous week and was down 13.7 percent compared with the same week one year earlier.

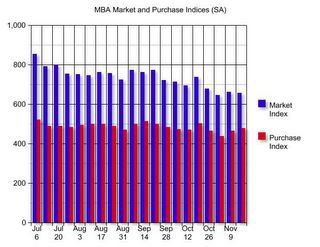

Click on graph for larger image.

This graph show the seasonally adjusted MBA Market and Purchase indices since the beginning of July. The market index had been steadily declining for several months, mostly reflecting a slowing in refinance activity, but has been flat over the last couple of weeks.

The purchase index had stayed steady, reflecting the continued strength in new and existing homes sales. The Purchase index started to fall early this month, probably indicating slowing home sales, but has risen slightly over the last couple of weeks (these numbers are seasonally adjusted).

Mortgage interest rates continued to rise:

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.33 percent from 6.31 percent on week earlier...This is up from 6.06 percent three weeks ago.

The average contract interest rate for 15-year fixed-rate mortgages increased to 5.87 percent from 5.85 percent...This is up from 5.37 percent three weeks ago.

Tuesday, November 15, 2005

DataQuick: Southland home sales, prices still near peak

by Calculated Risk on 11/15/2005 06:32:00 PM

DataQuick reports on Southern California: Southland home sales, prices still near peak

Southland home sales were up slightly for the third month in a row, led by strong sales in the Inland Empire and increased inventory levels regionwide. Appreciation rates remain in the mid-teens, a real estate information service reported.DataQuick President Marshall Prentice remains optimistic:

A total of 28,489 new and resale homes were sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 10.2 percent from 31,470 in September, and up 1.1 percent from 28,189 for October last year.

"The big question is still whether or not the real estate market will end this cycle with a crash, or with a soft landing. Right now the latter scenario is still the most likely. Home values have doubled in the past four years and almost all, if not all, of those gains are here to stay."

Orange County: Home Prices Decline for 2nd Month

by Calculated Risk on 11/15/2005 12:32:00 PM

The OC Register reports: Sales price for O.C. housing drops for second month

Orange County's housing market continues to cool as overall sales prices fell for the second straight month.These numbers are not seasonally adjusted:

DataQuick reported today that the median sales price for all types of O.C. residences in October was $606,000 -- that's down $4,000 from September and down $11,000 from the record high set in August, $617,000.

Still, October's price was up 14 percent from the median a year before.

Sales of 3,614 homes and condos -- resales and new construction -- closed last month. That's up 3 percent from October of last year.

October's overall 0.7 percent price drop is no big surprise. Since 1988, Orange County home prices have fallen on average by 0.4 percent in the month of October. Prices have dropped in October in 11 out of the past 18 years.

October is one of four months where home prices typically drop, according to DataQuick figures. July, September and October –- three months with historically falling prices -- reflect a typical sales slowdown after the spring's peak selling season. From 1988 to 2004, home prices appreciated a combined 6.7 percent in February through June –- but just 0.4 percent the rest of the year.