by Calculated Risk on 12/14/2005 10:40:00 AM

Wednesday, December 14, 2005

MBA: Mortgage Refinance Applications Continue To Decline

The Mortgage Bankers Association (MBA) reports: Refinance Applications Continue To Decline

Market Composite Index — a measure of mortgage loan application volume was 619.3 -- a decrease of 5.7 percent on a seasonally adjusted basis from 656.7, one week earlier. On an unadjusted basis, the Index decreased 8.1 percent compared with the previous week and was down 11.0 percent compared with the same week one year earlier.

The seasonally-adjusted Purchase Index decreased by 3.5 percent to 477.9 from 495.1 the previous week whereas the Refinance Index decreased by 9.7 percent to 1441.8 from 1596.4 one week earlier.

Click on graph for larger image.

The graph shows overall and purchase activity since June. Overall activity has fallen significantly due to the drop in refis. Purchase activity is steady.

Mortgage rates decreased slightly last week:

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.28 percent from 6.32 percent on week earlier ...Overall this report shows purchase activity is steady at a very high level.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.83 percent from 5.84 percent ...

Tuesday, December 13, 2005

October U.S. Trade Deficit at Record $68.9 Billion

by Calculated Risk on 12/13/2005 08:48:00 PM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reports that the U.S. trade deficit for October was $68.9 Billion. Imports increased to a record $176.4 billion from $171.8 Billion in September.

Click on graph for larger image.

The October record was the result of the significant increase in imports and only a small increase in exports.

Imports from China set another record of $24.4 Billion, while exports to China increased slightly to $3.9 Billion. Imports from Japan increased to $12.2 billion from $10.9 Billion in September.

The Petroleum deficit set another record of $24.2 Billion, up from the previous record of $22.3 Billion in September. The increase in the petroleum deficit was mostly due to a 25% surge in the import of refined products that added almost $2 Billion to the October deficit.

November retail sales fall short

by Calculated Risk on 12/13/2005 01:24:00 PM

Reuters reports:

U.S. retail sales rose a smaller-than-expected 0.3 percent in November and fell when a surge in auto purchases was excluded, setting the stage for what could be a disappointing holiday shopping season, government data showed on Tuesday.I hope these two posts make the retail outlook clear.

Sales of motor vehicles and parts rose for the first time since July, surging 2.6 percent. But without the auto sales, retail demand fell 0.3 percent, the Commerce Department said. That was the first decline since April 2004.

...

"A report like this will continue to fuel the debate about how strong consumer spending will be over the holiday season," said Alan Gayle, a managing director at Trusco Capital Management in Atlanta.

...

Much of the weakness in November's sales was due to a 5.9 percent drop in sales at gasoline stations -- a direct result of the decline in gas prices last month and hardly bad news for consumers.

...

"Excluding autos, spending growth looks healthy -- not a blockbuster holiday season, but far better than it appeared a couple of months ago when gasoline prices were over $3 per gallon," economist Nigel Gault said.

When the drop in sales at gasoline stations is excluded, retail sales rose 1.0 percent in November.

October sales were also revised higher, helping take some sting out of the disappointing result. Total sales rose 0.3 percent that month, up from the 0.1 percent decline initially reported.

...

Still, with October and November sales weaker than expected, analysts said there could well be an outright decline in retail sales in the fourth quarter -- which in turn would hurt economic growth in the final three months of 2006.

"This was a disappointing number relative to expectations and certainly consistent with the idea that consumer spending is going to be a much smaller contributor to economic growth in the fourth quarter than in the third," said Chris Probyn, chief economist at State Street Global Advisors in Boston.

...

"Seasonal business remains below expectations," Redbook said. "An early-December lull was factored into most sales plans for the month, so retailers remained cautiously optimistic as they continued to sit out the pre-Christmas wait."

NRF: Strong November Retail Sales Surpass Expectations

by Calculated Risk on 12/13/2005 11:06:00 AM

The National Retail Federation reports:

Consumers started their holiday shopping with a bang, responding well to retailers' aggressive promotions. According to the National Retail Federation (NRF), retail industry sales for November (which exclude automobiles, gas stations, and restaurants) rose a strong 7.4 percent unadjusted over last year and increased 0.5 percent seasonally adjusted from the previous month. The increase is in line with NRF's holiday sales forecast of 6.0 percent growth.

"Consumers shook off concerns about higher energy costs and responded well to the seasonal promotions," said NRF Chief Economist Rosalind Wells. "If November is any indication of what consumers are capable of, retailers can expect a very happy holiday season."

November retail sales released today by the U.S. Commerce Department show that total retail sales (which include non-general merchandise categories such as autos, gasoline stations and restaurants) rose 0.3 percent seasonally adjusted from November, and increased 6.3 percent unadjusted year-over-year. Gasoline sales, which NRF does not include in its calculation of retail industry sales, rose 17.0 percent unadjusted from last November.

The rosy report was boosted by strong year-to-year growth across nearly every retail industry category, including building material and garden equipment and supplies stores, which jumped a whopping 14.3 percent over last year. The main drivers for this holiday, apparel and electronics, also experienced solid growth. Sales at clothing and clothing accessories stores rose 7.6 percent year-over year and electronics and appliance stores jumped 7.4 percent from November 2004.

Additionally, strong year-over-year gains were seen at health and personal care stores (6.7%), general merchandise stores (7.1%), furniture and home furnishing stores (5.9%) and grocery stores (5.3%).

NRF expects retail industry sales to increase 5.6 percent this year over 2004. Holiday sales, which are defined as retail industry sales in the full months of November and December, are expected to rise 6.0 percent to $438.5 billion.

Monday, December 12, 2005

Household Debt Service and "Parabolic Debt"

by Calculated Risk on 12/12/2005 05:00:00 PM

Reuters quotes Prudent Bear fund manager David Tice expressing concern today that 'credit market debt as a percent of U.S. gross domestic product "has essentially gone parabolic"'.

I'm more concerned that Household Debt Service is at an all time high, even with low interest rates. See my Angry Bear post: FED: Household Debt Service Sets Record in Q3

First, here are some quotes from the Reuters article:

A possible hard landing for the U.S. housing market poses the risk of a secular bear market for equities, mutual fund manager David Tice said on Monday at the Reuters Investment Outlook 2006 Summit.

"The rollover in real estate could happen pretty quickly," said Tice, who runs the the Prudent Bear, a mutual fund which seeks to benefit from falling share prices.

The United States has leaned heavily on housing and related industries for economic growth in recent years.

That virtuous circle, fueled by rounds of cash-out mortgage refinancing that has propped up consumer spending, will give way in 2006 or 2007 to a vicious cycle that drags down corporate earnings and employment, he said.

...

"The excesses in mortgage finance are just astounding," he said at the summit, which is being held in New York this week.

...

Years of cheap credit provided by an accommodative Federal Reserve has made more difficult the task of running a bear fund and picking the right stocks to short, Tice said.

...

Tice said credit market debt as a percent of U.S. gross domestic product "has essentially gone parabolic," and policy-makers have seemed prepared to prevent recession at all costs.

"If you continue to goose the economy with more debt it's like keeping an eight-year-old on a sugar high," he said.

Click on graph for larger image.

Tice is referring to all debt, but it might be helpful to look at the fastest growing segment; mortgage debt. This graph shows the growth of mortgage debt as a % of GDP since 1999.

Although mortgage debt has grown substantially, both nominally and as a % of GDP, I wouldn't call it "essentially ... parabolic".

I think the greater concern is the recent rise in household debt service and financial obligations ratios. Both ratios are already at record levels.

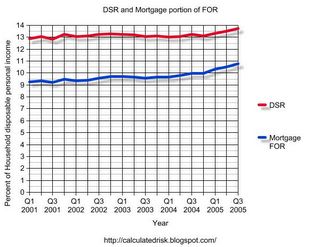

DEFINITIONS: The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

Note: The graph only shows the mortgage portion of the FOR.

It appears households initially took on debt and kept their payments steady as interest rates dropped. However, recently the portion of disposable personal income dedicated to debt service has risen steadily. As interest rates rise, and with the new credit card minimum payments, the DSR and FOR will probably continue to rise, putting more pressure on household finances.

Saturday, December 10, 2005

GDP Growth: With and Without Mortgage Extraction

by Calculated Risk on 12/10/2005 12:39:00 AM

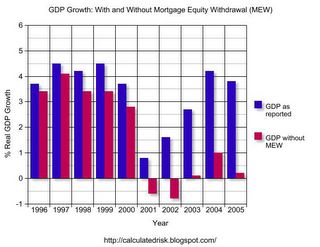

The recent Flow of Funds report showed that household mortgages increased a record $289.5 Billion in Q3 2005. Using a simple formulation for Mortgage Equity Withdrawal (MEW), MEW was $171 Billion in Q3. Note: to calculate MEW, I simply subtracted new single family construction spending from the increase in household mortgages. This is close to other methods.

Click on graph for larger image.

Using Goldman's estimate of about 2/3 of MEW flowing through to personal consumption expenditures, it is possible to estimate the impact of MEW on GDP. Note: Some estimates are only about 50% of MEW flows through to consumption.

The graph clearly shows the importance of MEW over the last few years. For 2005, I used YTD compared to 2004.

Many observers estimate that MEW will fall significantly in the next few years. If so, this will be a drag on GDP as the growth of personal consumption expenditures slows.

The two most direct impacts of a housing slowdown are:

1) the loss of housing related employment.

2) lower MEW and the impact on personal consumption expenditures.

Earlier I posted two articles on the loss of housing related employment:

LA Times: Mortgage Industry Job Losses May Rise With Interest Rates

CNN: There go 800,000 jobs out the door

A significant drop in MEW will lead to the loss of retail related employment too.

Friday, December 09, 2005

Minimum-Payment Loans Get Maximum Crackdown

by Calculated Risk on 12/09/2005 07:27:00 PM

The WaPo reports: Minimum-Payment Loans Get Maximum Crackdown

Federal financial regulators appear to be on the verge of reining in one of the most popular mortgages in hot housing markets nationwide -- loans that allow 1 percent to 2 percent payment rates leading to "negative amortization."The author is basing this article on John Dugan's remarks last week (Comptroller of the Currency).

UPDATE: I linked to the wrong speech ... here is the correct one:

For excerpts see: Remarks by John C. Dugan, Comptroller of the Currency

And here is the complete text of Dugan's remarks (pdf).

The bottom line for 2006: Look for tougher standards on popular 1 percent and 2 percent minimum-payment plans, and fewer qualified buyers in high-cost markets where wild appreciation has been sustained in part by reality-bending rate-reduction programs

Housing and Jobs

by Calculated Risk on 12/09/2005 03:18:00 PM

The LA Times reports: Mortgage Industry Job Losses May Rise With Interest Rates

As interest rates have risen, refinancings have faded and applications for loans to purchase homes have begun to decline, according to the Mortgage Bankers Assn.And the impact from these job losses could ripple through the economy:

Many borrowers already have taken out equity from their homes through refinancings and second mortgages. If home prices level off, as many predict, these homeowners will have less equity to extract and less incentive to refinance.

Mortgage Bankers Assn. economist Doug Duncan said jobs would be lost as some companies pared their staffs and others were acquired or went out of business. The number of job reductions will depend on how high rates go, he said, with as many as 80,000 positions eliminated should 30-year fixed rates climb to 8.25%, up from 6.32% currently.

In addition to layoffs, experts also expect a shakeout in the ranks of mortgage brokers, the independent loan originators whose numbers have swollen along with the home-lending boom that began in 2001.

These brokers aren't counted in the payroll surveys conducted by the government. John Marcell, president of the California Assn. of Mortgage Brokers, believes that they now total about 25,000 in the state, but predicts that's about to change radically as ill-trained brokers who got into the business during the boom now find it harder to make a living.

"I would say probably half of what's out there today could wash out," Marcell said.

By reducing spending power and demand for office space, the loss of mortgage jobs can cause ripple effects through local economies like Orange County's. Ryan Ratcliff, an economist for the Anderson Forecast at UCLA, said studies of the early 1990s recession showed that regions with large employment in the mortgage industry were hurt disproportionately in economic downturns.When I first started looking at the housing market, I wrote this on Angry Bear: After the Housing Boom: Impact on the Economy. So far employment and mortgage equity withdrawal are still solid, but those are areas to watch closely.

Best of Times II

by Calculated Risk on 12/09/2005 12:37:00 AM

For a related post, see Kash's: The Role of Spending Growth in the Deficit

Many people think of the "Baby Bust" as the period right after the "Baby Boom". The real Baby Bust happened from 1925 to 1939. See this animation:

This has important implications for policy. Those people born between 1925 and 1939 are now 66 to 80 years old - the peak years for receiving retirement benefits.

The Baby Boomers are 40 to 60 - their peak earning years.

So these are the Best of Times for fiscal policy: fewer than the normal percentage of the population are recipients of elderly social programs, and a larger than normal percentage are in their peak earning years.

Social Security should be running a large surplus, and it is!

Medicare should be running a large surplus, but it is only breaking even.

The Federal Government should be running a large surplus, but it is running a large deficit.

From the prespective of demographics, the US Government needs to address the General Fund deficit NOW. America also needs to reform the health care system. These are the two most pressing long term fiscal issues for America.

Thursday, December 08, 2005

Household Valuation Change: FED vs. OFHEO

by Calculated Risk on 12/08/2005 09:11:00 PM

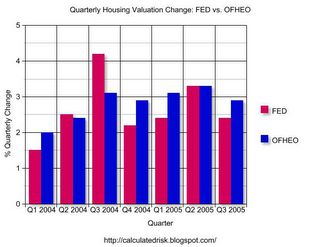

With the release of the Flow of Funds report today, I decided to compare the FED's estimate of the total value of household real estate with the OFHEO House Price Index (HPI). Of course OFHEO only reports the nominal change in house prices, so the comparison is really between the changes in valuation (either annually or quarterly).

I thought this might be interesting, mostly to see if there is a difference between the two approaches. The FED reports the total valuation of household real estate. This includes any new stock put into place and improvements to existing stock. OFHEO reports the change in the price of existing stock.

To compute the annual change for the FED for existing stock, I started with year N. For year N+1, I subtracted construction estimates from the Census Bureau of new private single family construction and improvements.

Click on graph for larger image.

The first graph shows the annual change from both the FED (subtracting new construction as above) and the OFHEO HPI. Clearly both methods yield similar results and I don't see any systemic bias either way.

The second graph is for the last seven quarters, and shows the quarterly change for both sets of data.

Once again both methods yield similar results with no discernible bias. This gives me a little more confidence in both data sets, unless the FED uses the OFHEO HPI as part of their calculation!