by Calculated Risk on 1/05/2006 04:59:00 PM

Thursday, January 05, 2006

Mortgage Spread

The spread between the yields of a 30 year fixed mortgage (as reported by the MBA) and the Ten Year Treasury note has widened steadily over the past year.

Click on graph for larger image.

If the current spread was 145 bps, as in early 2005, the rate on a 30 year mortgage would be about 5.7% today.

Instead, the rate on a 30 year fixed mortgage is 6.15%.

That is a substantial increase in the spread and I'm guessing it indicates investors have become increasingly wary of mortgage backed securities.

Wednesday, January 04, 2006

UCLA's Thornberg expects 25% decline in housing construction

by Calculated Risk on 1/04/2006 06:56:00 PM

The Contra Costa Times reports: Home builders see flat housing starts

California's 12-year run of home building gains will likely end in 2006, as developers pause to clear out excess inventory during the early part of the year, according to a trade group's annual housing forecast.Dr. Thornberg is not so optimistic:

The Sacramento-based California Building Industry Association report released Wednesday also predicted the state's torrid pace of housing price advances will slow, to between 5 percent and 8 percent per square foot. That's well off the 25 percent to 30 percent increases of the past few years.

The first quarter in particular could promise some price relief, as home builders pony up concessions to slice their growing inventory levels, said Alan Nevin, CBIA chief economist.

...

Statewide, the CBIA projects 185,000 to 205,000 new housing permits in 2006, down from an estimated 212,000 last year. Most of the decline will likely be in the high-end segment in coastal areas. Transactions in the resale market will likely fall to between 550,000 and 600,000, down from a recent high of 650,000.

Given the decline in housing construction, the CBIA also expects to see a "modest pull-back" in construction employment, which accounted for 13 percent of the more than 400,000 new California jobs created in 2005.

Christopher Thornberg, senior economist with the UCLA Forecast, expects housing construction to drop by 25 percent next year, resulting in significant job loss for the construction industry.

He said the CBIA's pricing prediction could prove true, but he hopes it doesn't because he believes prices are already "out of whack with reality."

"The real question is, is it a good thing if they go up and the answer is clearly 'no,'" he said. "It will just make things that much worse and it will take that much longer to correct."

MBA: Mortgage Activity Declines

by Calculated Risk on 1/04/2006 11:50:00 AM

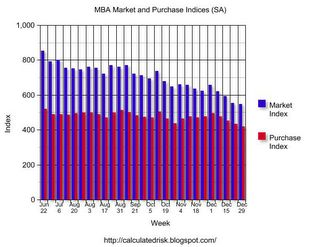

The Mortgage Bankers Association (MBA) reports: ARM Applications Down in Latest Survey

Click on graph for larger image.

The Market Composite Index - a measure of mortgage loan application volume was 545.9 -- a decrease of 1.5 percent on a seasonally adjusted basis from 554.1 one week earlier. A holiday adjustment was included in the seasonally adjusted numbers to help account for the reduced application activity during the holiday week. On an unadjusted basis, the Index decreased 20.8 percent compared with the previous week and was down 9.9 percent compared with the same week one year earlier.Rates on fixed rate mortgages decreased, while rates for ARMs increased:

The seasonally-adjusted Purchase Index decreased by 4.5 percent to 432.9 from 453.1 the previous week whereas the Refinance Index decreased by 11.2 percent to 1259.1 from 1418.1 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.15 percent from 6.21 percent on week earlier ...Activity is falling, but still reasonably strong. The YoY decline of 9.9% for the same week is concerning. These reports will be more informative after the holidays.

The average contract interest rate for one-year ARMs increased to 5.41 percent from 5.36 percent one week earlier...

Tuesday, January 03, 2006

Fiscal 2006: Record YTD Increase in National Debt

by Calculated Risk on 1/03/2006 07:25:00 PM

After three months, Fiscal 2006 continues to set new records for the YTD increase in National Debt. For the first three months of fiscal year 2006, the National Debt increased $237.7 Billion to $8.17 Trillion as of Dec 30, 2005.

Click on graph for larger image.

The previous record for the first three months was in fiscal 2004 with an increase in the National Debt of $218.1 Billion.

Each month I will plot the YTD increase in the National Debt and compare it to the proceeding years. I expect fiscal 2006 to set a new record for the annual increase in the National Debt.

Two Views: Debt, Deficit and Social Security

by Calculated Risk on 1/03/2006 01:53:00 PM

There are two distinct views of the US fiscal situation.

VIEW 1:

National Debt = $8.1 Trillion or about 63% of GDP.VIEW 2:

General Fund Deficit = ~$600 Billion per year (about 4.7% of GDP)

Social Security Insurance (SSI) has a small, but manageable shortfall.

Publicly held portion of the National Debt is $4.7 Trillion or 37% of GDP. The rest of the National Debt the US owes to itself.Dr. Thoma posted Mankiw's Guidelines for Policy Makers. Mankiw's first resolution for policy makers:

Unified Budget Deficit = ~ $350 Billion per year - a problem, but manageable.

Social Security Insurance is a massive problem.

Mankiw's #1: "This year I will be straight about the budget mess. I know that the federal budget is on an unsustainable path. I know that when the baby-boom generation retires and becomes eligible for Social Security and Medicare, all hell is going to break loose. I know that the choices aren't pretty -- either large cuts in promised benefits or taxes vastly higher than anything ever experienced in U.S. history. I am going to admit these facts to the American people, and I am going to say which choice I favor."Obviously Mankiw holds View #2 above. One of the unstated, but obvious components of View #2, is that the excess SSI taxes collected over the last 20+ years has really just been another General Fund tax. In the eyes of Mankiw, these extra payroll taxes have been a surreptitious method of instituting a flatter tax system.

Ostensibly the excess payroll tax is not a General Fund tax; it is a prepayment on future benefits. Legally, the General Fund receives most of its revenue from high income individuals, whereas the revenue burden for the SSI Trust Fund falls mostly on low and middle income wage earners.

Those holding View #1 see reversing the Bush tax shifts as the primary method for restoring fiscal balance. By bringing the General Fund back into balance, SSI is only a minor problem.

Those holding View #2 see cutting future benefits, primarily for low and middle income earners, as the solution for restoring fiscal balance.

So its a question of who pays: high income earners or low and middle income earners.

Although this is mostly a normative question, View #1 has the advantage of being straightforward. In fact, any politician who really explained View #2 to their constituents would likely be removed from office, tarred and feathered, or far worse.

Monday, January 02, 2006

G.R.E.B.B. Day

by Calculated Risk on 1/02/2006 03:53:00 PM

My friend, Ramsey, has started calling Feb 1, 2006 G.R.E.B.B. DAY (Greenspan real estate bubble bursting day). Very funny.

Although I think the slowdown will be gradual, Ramsey provided the following data today on the San Diego housing market:

San Diego real estate update:I've felt the housing slowdown would start with rising inventories, followed by falling transaction volumes, and then falling prices. Inventories for both new and existing homes have been rising for months. Now the second phase may be starting: from Ramsey's comparison of Dec 2005 to Dec 2004 for San Diego, transaction volumes dropped significantly (36%).

December 05 closings 2,107

That is 36.2% less than YTY Dec 04 of 3,300

That is 12.7% less than sequential Nov 05 of 2,414

2005 total closings 39,950

2004 total closings 42,809

December 05 avg sold price $633,223

That is 9.2% higher than YTY Dec 04 of $579,749

That is 1.3% higher than sequential Nov 05 of $625,172

December 05 closings averaged 63 days on market.

That is 16.6% longer than YTY Dec 04 of 54 days.

That is 6.8% longer than sequential Nov 05 of 59 days.

Avg days on market for all 2005 closings was 52 days.

Avg days on market for all 2004 closings was 33 days.

32.9% of Dec 05 sales were condos.

35.1% of all 2005 sales were condos.

December 05 pending sales 1,775

Jan 06 closings, based on Dec 05 pendings, are going to fall off the cliff unless sales miraculously pick up right now.

For sale inventory peaked at just over 15,000 early December 05 and dropped back to 13,876 on Dec 31, 05 due to the holidays. We should see a number of listings coming back on the market soon. How fast this inventory gets absorbed is going to tell us the health of the market.

It is no surprise that inventories fell in December. That happens every year as sellers take their houses off the market during the holidays. When the December existing homes numbers are released, I expect inventories to fall 10% to 20% from 2,903,000 in November (in 2004, inventories dropped 13% from November to December). That doesn't mean the market is recovering - it is just part of the seasonal pattern.

Sunday, January 01, 2006

Interesting Times

by Calculated Risk on 1/01/2006 09:18:00 PM

Happy New Year to All! It does appear we are living in interesting times. The biggest story of the New Year is the Constitutional Crisis concerning the warrantless surveillance of US citizens. And on the economic front, housing is still the hot topic.

The San Diego Union has a series of articles on housing:

Understand risks of 'creative' loans

Creative loans push overextended owners into dangerous waters

When she bought her two-bedroom condominium in Mira Mesa in mid-2004, Elizabeth Eure didn't envision herself one day sleeping on an egg-crate mattress in an empty unit.Pressure grows as market cools

The furniture was gone in December because Eure was preparing to move, awaiting the close of escrow. After living there less than a year and a half, she had sold her home to cut her losses. Her monthly mortgage payment of $2,500 was too much for her to handle.

"It was a mistake," Eure, 29, said of the purchase. "If I could do it all over again, I would have rented an apartment."

Richard Mehren, a real estate agent who specializes in condominiums, said Eure's predicament is a common one. Many recent buyers are beginning to realize they have taken on too much debt.

And from the Southwest Florida Herald Tribune: Clock is running down on 'cheap' mortgages

Lenders who started making those teaser-rate loans a few years ago are getting ready to charge real-world payments on them.

Starting in 2006 and accelerating into 2007, as much as $2.5 trillion worth of the fancy mortgages called "hybrids" are coming to the end of the free-lunch part of the deal.

And while prices in Southwest Florida are hovering at twice those of three years ago, the house party seems to have ended in July. Since then, as mortgage rates continue their upward creep, inventories are stacking up, while the rate of closings is slowing down.

Friday, December 30, 2005

Broken Promises

by Calculated Risk on 12/30/2005 02:51:00 PM

One of my predictions for top economic stories for 2006 concerned problems with pension plans. From the LA Times today: How Bedrock Promises Of Security Have Fractured Across America

...That's when Delphi Chief Executive Robert S. "Steve" Miller, citing global competition and crippling "legacy costs," ushered the $28.6 billion-a-year company into one of the largest industrial bankruptcies in U.S. history. In short order, Miller called for slashing workers' compensation by almost two-thirds, threatened to void the company's union contracts, and hinted broadly that he would follow the playbook he had used elsewhere of pushing responsibility for paying the firm's pensions to the federal government and dumping its retiree health benefits altogether.An excellent article. I was once the trustee of a retirement plan and I will write about my experiences in the new year.

Although Delphi has since backed off a bit — it says it's willing to negotiate with its unions and its former parent and largest customer, General Motors Corp. — the parts firm has left little doubt that its ultimate aim remains steep reductions in wages, benefits and retiree costs.

Delphi is at the cutting edge of a crisis that's engulfing the U.S. auto industry, much as it did steel and airlines. Its actions are adding to a gathering trend, a shift of economic risks once largely borne by business and government to the backs of working families.

Before the trouble is over, some believe, a corporate icon such as Ford Motor Co. or GM could be swept from the American landscape. So too could much of what remains of the already frayed relationship between millions of working people and their employers.

"When the history of this period is written, Delphi will be viewed as the tipping point where the auto industry either got its act together or failed," said David E. Cole, the son of a former GM president and head of the Center for Automotive Research, based in Ann Arbor, Mich. "The spillover to the rest of the economy is going to be tremendous."

Thursday, December 29, 2005

Snow: Raise Debt Limit

by Calculated Risk on 12/29/2005 06:47:00 PM

Reuters reports: Snow urges Congress to raise debt limit U.S. Treasury Secretary

John Snow warned lawmakers on Thursday that a legally set limit on the government's ability to borrow will be hit in mid-February and urged Congress to raise it quickly.

...

"The administration now projects that the statutory debt limit, currently $8.184 trillion, will be reached in mid-February 2006," Snow said in a letter to 21 members of the U.S. House of Representatives and Senate released by Treasury after financial markets had closed.

...

The debt limit was last raised in November 2004 by $800 billion to its current level. The letter to Congress does not specify an amount the Treasury wants the ceiling set at this time.

...

Treasury officials had said in November it was bracing for hefty borrowing needs in the January-March quarter, likely around a record $171 billion, and that it likely would hit the debt limit in that period.

Existing Homes: Sales Fall, Inventory Increases

by Calculated Risk on 12/29/2005 11:23:00 AM

The National Association of Realtors (NAR) reports: Existing-Home Sales Trend Lower in November

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – eased 1.7 percent to a seasonally adjusted annual rate of 6.97 million units in November from a pace of 7.09 million in October. Sales were 0.1 percent below the 6.98 million-unit level in November 2004.Inventories increased to a 5 month supply:

Total housing inventory levels rose 1.2 percent at the end of November to 2.90 million existing homes available for sale, which represents a 5.0-month supply at the current sales pace.This represents a 14% increase from November 2004, when the inventory of existing homes was 2.54 million.

Just a note for next month: Inventories usually fall in December as sellers take their houses off the market for the holidays.