by Calculated Risk on 1/11/2006 05:41:00 PM

Wednesday, January 11, 2006

FED's Geithner: Monetary policy must account for Asset Prices

From Reuters: Fed must take asset prices into account on policy

U.S. monetary policy must take asset price fluctuations into account even if it cannot target them explicitly, New York Federal Reserve President Timothy Geithner said on Wednesday.Here is the text of Geithner' speech: Some Perspectives on U.S. Monetary Policy

The comments set Geithner apart from others at the central bank who had been quicker to dismiss the impact of significant price rises in assets like stocks or housing.

Some economists worry that, like the stock market in the late 1990s, housing prices may haven gotten out of whack with the fundamental value of home assets after a five-year boom.

While some of his colleagues have argued that there is simply nothing the Fed can do about it, Geithner said action was indeed warranted under certain circumstances.

"When policy-makers have already witnessed a significant move in asset values and are confident in what that move means for the outlook, it (the Fed) should be prepared to adjust policy accordingly," Geithner told an economics luncheon at the Harvard Club.

Geithner also reiterated his concerns over the longer-term stability of the global financial system, saying that the calm of recent years should not be taken as a green light for complacency.

He said the U.S. current account deficit, and the eventual need for an adjustment, posed serious risks.

"It would be hard for anyone looking at the size of the U.S. current account deficit to not be worried," Geithner said.

MBA: Mortgage Activity Rebounds

by Calculated Risk on 1/11/2006 12:14:00 PM

The Mortgage Bankers Association (MBA) reports: Mortgage Rates Down for Fifth Consecutive Week

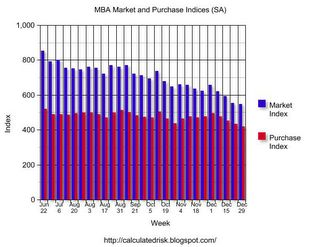

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 600.1 -- an increase of 9.9 percent on a seasonally adjusted basis from 545.9 one week earlier. A holiday adjustment was included in the seasonally adjusted numbers to help account for the reduced application activity during the holiday week. On an unadjusted basis, the Index increased 27.2 percent compared with the previous week but was down 19.1 percent compared with the same week one year earlier.Rates on fixed rate mortgages decreased, while rates for ARMs were steady:

The seasonally-adjusted Purchase Index increased by 9.3 percent to 457.4 from 418.3 the previous week whereas the Refinance Index increased by 9.9 percent to 1497.5 from 1363.2 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.08 percent from 6.15 percent on week earlier ...

The average contract interest rate for one-year ARMs increased to 5.42 percent from 5.41 percent one week earlier ...

Tuesday, January 10, 2006

China and the Dollar

by Calculated Risk on 1/10/2006 02:15:00 PM

It seems that every time there is a discussion of some foreign central bank diversifying away from the dollar, it is promptly denied by the rumored country. These two articles follow that pattern ...

From the WaPo: China Set To Reduce Exposure To Dollar

China has resolved to shift some of its foreign exchange reserves -- now in excess of $800 billion -- away from the U.S. dollar and into other world currencies in a move likely to push down the value of the greenback, a high-level state economist who advises the nation's economic policymakers said in an interview Monday.And from the AP: China's central bank denies dollar plans

As China's manufacturing industries flood the world with cheap goods, the Chinese central bank has invested roughly three-fourths of its growing foreign currency reserves in U.S. Treasury bills and other dollar-denominated assets. The new policy reflects China's fears that too much of its savings is tied up in the dollar, a currency widely expected to drop in value as the U.S. trade and fiscal deficits climb.

...

Some economists have long warned that if foreigners lose their appetite for American debt, the dollar would fall, interest rates would rise and the housing boom could burst, sending real estate prices lower.

The comments of the Chinese senior economist, made on the condition of anonymity because the government disciplines those who speak to the press without express authorization, confirmed an analysis in Monday's Shanghai Securities News stating that China is inclined to shift some its savings into other currencies such as the euro and the yen, or into major purchases of commodities such as oil for a long-discussed strategic energy reserve.

China said Tuesday it has no plans to sell dollars from its $800 billion-plus foreign reserves, rejecting speculation that had jolted financial markets and fed speculation about the possible impact on the U.S. dollar.

"We won't sell off our dollar-denominated assets," a central bank official, Tang Xu, told Dow Jones Newswires.

China's foreign currency regulator said last week its plans for 2006 include "widening the foreign exchange reserves investment scope." That sparked speculation that Beijing might shift some reserves from dollars, the bulk of its holdings, into other currencies.

...

Tang, director-general of the central bank's Research Bureau, said foreign reserves were expected to top $800 billion at the end of 2005, up from $769 billion when the last quarterly report was issued in September, according to Dow Jones.

ALSO: see Martin Feldstein's: Uncle Sam’s bonanza might not be all that it seems Note: Dr. Thoma provides excerpts: Martin Feldstein: Capital Inflows Primarily from Foreign Governments, not Private Investors

And Dr. Setser's comments: Martin Feldstein joins the dollar doomsday cult.

This is a key reason of why one of my top economic predictions of the year was that long rates would rise when the Fed starts cutting rates later this year.

Monday, January 09, 2006

The End of Defined Benefit Plans

by Calculated Risk on 1/09/2006 02:06:00 AM

First, my post on Angry Bear, Stiglitz and Bilmes: The Real Cost of Iraq War

The NY Times reports: More Companies Ending Promises for Retirement

The death knell for the traditional company pension has been tolling for some time now. Companies in ailing industries like steel, airlines and auto parts have thrown themselves into bankruptcy and turned over their ruined pension plans to the federal government.This will put the burden on the employee and from my experience, the employees that will probably need the benefits the most, will contribute the least (as a percentage of income), and invest poorly.

Now, with the recent announcements of pension freezes by some of the cream of corporate America - Verizon, Lockheed Martin, Motorola and, just last week, I.B.M. - the bell is tolling even louder. Even strong, stable companies with the means to operate a pension plan are facing longer worker lifespans, looming regulatory and accounting changes and, most important, heightened global competition. Some are deciding they either cannot, or will not, keep making the decades-long promises that a pension plan involves.

...the pension freeze is the latest sign that today's workers are, to a much greater extent, on their own. Companies now emphasize 401(k) plans, which leave workers responsible for ensuring that they have adequate funds for retirement and expose them to the vagaries of the financial markets.

When I was a trustee for a 401(k) plan, I saw the following behavior repeated many times: Less sophisticated investors would tend to be overly conservative putting most of their money in money market funds. Then they would occasionally invest in whatever went up in the most recent quarters. If they had a losing quarter, they would scurry back to the money market fund. Their overall results were poor.

This will leave Social Security Insurance as the only defined benefit portion of an individual's retirement income - an insurance policy for life's vagaries.

Friday, January 06, 2006

What will the Fed do?

by Calculated Risk on 1/06/2006 08:19:00 PM

Here is another Fed Watch from Dr. Duy: A Little Something for Everyone. Duy mostly looks at the employment report, but he also writes:

Wall Street's stamp of approval implies a wide expectation of "one and done" for this tightening cycle. That's not quite my interpretation, although I can't blame traders for looking for good news after a dreary December. Instead, I left the minutes with the sense that another rate hike at the end of the month is in the bag, but beyond that, future changes in policy are not automatic but instead data dependent. That is decidedly not the same thing as "done."Barring some drastic change in the data, I think two more rate hikes are "in the bag" and we will see 4.75% at the March meeting.

As a note: Dr. Duy's Fed Watch is a regular column on Economist's View. For weekly updates on market expectations for the Fed Funds rate, see Dr. Altig's Macroblog.

The reason I think the Fed will raise rates at least two more times is because: 1)the data will probably be inconclusive and 2) Dr. Bernanke has been heavily criticized (I think unfairly) for being an inflation dove based on this speech: Deflation: Making Sure "It" Doesn't Happen Here and, therefore, if the Fed pauses at Bernanke's first meeting in March that would inflame the criticism. So I believe Bernanke will lean towards one more hike to prove his inflation fighting credentials.

Click on graph for larger image.

Using the Cleveland Fed Median CPI, this graph shows the real Fed Funds rate by quarter for the last five years - the period of emergency interest rates.

I think the Fed would like to see inflation below 2% - median CPI was 2.6% annualized last month and 2.4% over the last 12 months. To achieve their goal, the Fed will probably have to raise the real Fed rate to 2% to 2.5% and that puts the nominal Fed Funds rate at 4.75% or even 5%.

After the January hike, the key data will be the various measures of inflation. If inflation is subsiding, then the Fed might stop. If its close, I expect another hike in March.

When will the Fed cut rates?

I've written several times that I expect a rate cut later this year. The reason I expect a cut is because of the impact of a housing slowdown. If there is no housing slowdown, as predicted by Wells Fargo, then I doubt we will see a rate cut in 2006. If there is a slowdown, I expect two things: 1) Mortgage equity withdrawal to decrease significantly and impact consumer spending (like what happened in England) and 2) housing related employment to fall.

The Fed doesn't like to change directions too quickly. Looking at the Fed's recent history:

Rates peaked at 6.5% on May 16, 2000 and the first rate cut was almost 9 months later, in January 2001.And speaking of England, the Bank of England repo rate peaked in August 2004 at 4.75% and the BOE cut the rate to 4.5% one year later.

Rates peaked at 6% on Feb 1, 1995 and the first cut was 5 months later in July.

So, if housing slows down, I expect a rate cut in late 2006.

Wells Fargo forecasts 6.5% 2006 SoCal House Appreciation

by Calculated Risk on 1/06/2006 04:43:00 PM

Wells Fargo is forecasting 6.5% house price appreciation in Southern California for 2006 compared to their estimate of 14.3% in 2005.

An internal forecast from a Wells Fargo Senior Economist:

| Wells Fargo Forecast | 2005(est) | 2006(f) |

| Median Existing Home Price | $489K | $521K |

| Percent Change in Prices | 14.3% | 6.5% |

| Housing Starts | 101.3K | 103.4K |

| Single Family Starts | 72.4K | 74.3K |

| Multifamily Starts | 28.8K | 29.K |

Christopher Thornberg, senior economist with the UCLA Forecast, expects housing construction to drop by 25 percent next year, resulting in significant job loss for the construction industry.Two very different views.

Employment Report

by Calculated Risk on 1/06/2006 02:37:00 PM

The BLS reported:

"Total nonfarm payroll employment increased by 108,000 in December, and the unemployment rate was little changed at 4.9 percent"Kash calls the report "disappointing" and pgl looks at the labor force participation rate and the employment-population ratio.

Click on graph for larger image.

Although the December report might be disappointing, the number of jobs created in 2005 seems solid.

A major concern going forward is the impact of a housing slowdown. Housing was once again a key driver for employment gains in 2005; construction alone added almost 250K jobs. Since construction usually accounts for around 5% of total employment, I would have expected around 100K construction jobs given the total employment growth.

The good news is the economy has been adding jobs at around the expected rate. The bad news is the economy is probably still too "housing centric".

Thursday, January 05, 2006

Mortgage Spread

by Calculated Risk on 1/05/2006 04:59:00 PM

The spread between the yields of a 30 year fixed mortgage (as reported by the MBA) and the Ten Year Treasury note has widened steadily over the past year.

Click on graph for larger image.

If the current spread was 145 bps, as in early 2005, the rate on a 30 year mortgage would be about 5.7% today.

Instead, the rate on a 30 year fixed mortgage is 6.15%.

That is a substantial increase in the spread and I'm guessing it indicates investors have become increasingly wary of mortgage backed securities.

Wednesday, January 04, 2006

UCLA's Thornberg expects 25% decline in housing construction

by Calculated Risk on 1/04/2006 06:56:00 PM

The Contra Costa Times reports: Home builders see flat housing starts

California's 12-year run of home building gains will likely end in 2006, as developers pause to clear out excess inventory during the early part of the year, according to a trade group's annual housing forecast.Dr. Thornberg is not so optimistic:

The Sacramento-based California Building Industry Association report released Wednesday also predicted the state's torrid pace of housing price advances will slow, to between 5 percent and 8 percent per square foot. That's well off the 25 percent to 30 percent increases of the past few years.

The first quarter in particular could promise some price relief, as home builders pony up concessions to slice their growing inventory levels, said Alan Nevin, CBIA chief economist.

...

Statewide, the CBIA projects 185,000 to 205,000 new housing permits in 2006, down from an estimated 212,000 last year. Most of the decline will likely be in the high-end segment in coastal areas. Transactions in the resale market will likely fall to between 550,000 and 600,000, down from a recent high of 650,000.

Given the decline in housing construction, the CBIA also expects to see a "modest pull-back" in construction employment, which accounted for 13 percent of the more than 400,000 new California jobs created in 2005.

Christopher Thornberg, senior economist with the UCLA Forecast, expects housing construction to drop by 25 percent next year, resulting in significant job loss for the construction industry.

He said the CBIA's pricing prediction could prove true, but he hopes it doesn't because he believes prices are already "out of whack with reality."

"The real question is, is it a good thing if they go up and the answer is clearly 'no,'" he said. "It will just make things that much worse and it will take that much longer to correct."

MBA: Mortgage Activity Declines

by Calculated Risk on 1/04/2006 11:50:00 AM

The Mortgage Bankers Association (MBA) reports: ARM Applications Down in Latest Survey

Click on graph for larger image.

The Market Composite Index - a measure of mortgage loan application volume was 545.9 -- a decrease of 1.5 percent on a seasonally adjusted basis from 554.1 one week earlier. A holiday adjustment was included in the seasonally adjusted numbers to help account for the reduced application activity during the holiday week. On an unadjusted basis, the Index decreased 20.8 percent compared with the previous week and was down 9.9 percent compared with the same week one year earlier.Rates on fixed rate mortgages decreased, while rates for ARMs increased:

The seasonally-adjusted Purchase Index decreased by 4.5 percent to 432.9 from 453.1 the previous week whereas the Refinance Index decreased by 11.2 percent to 1259.1 from 1418.1 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.15 percent from 6.21 percent on week earlier ...Activity is falling, but still reasonably strong. The YoY decline of 9.9% for the same week is concerning. These reports will be more informative after the holidays.

The average contract interest rate for one-year ARMs increased to 5.41 percent from 5.36 percent one week earlier...