by Calculated Risk on 2/15/2006 10:47:00 AM

Wednesday, February 15, 2006

MBA: Mortgage Application Volume Down

The Mortgage Bankers Association (MBA) reports that mortgage applications declined for the week ending Feb 10th.

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 574.1 – a decrease of 7.3 percent on a seasonally adjusted basis from 619.3 one week earlier. On an unadjusted basis, the Index decreased 4.4 percent compared with the previous week and was down 21.7 percent compared with the same week one year earlier.Mortgage rates were steady:

The seasonally-adjusted Purchase Index decreased by 7.9 percent to 391.7 from 425.1 the previous week, whereas the Refinance Index decreased by 6.5 percent to 1636.7 from 1751.0 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages remained at 6.25 percent ...Activity continues to fall and mortgage rates are expected to rise again this week. The unadjusted Purchase Index is 401.9, off from 437.2 for the same week last year.

The average contract interest rate for one-year ARMs increased to 5.52 percent from 5.48 percent...

Tuesday, February 14, 2006

Retail Sales Strong

by Calculated Risk on 2/14/2006 01:20:00 PM

Bloomberg reports: Retail Sales May Spur Faster Expansion

Retailers rang up their biggest sales gains since May 2004 last month, more than doubling forecasts and helping the U.S. economy snap back from its worst quarter in three years.I'm not really surprised. The weather has been nice and mortgage activity is still robust. With the recent increases in the Ten Year yield, I expect mortgage rates to increase this week. It will be interesting to see if higher rates slow mortgage activity (the MBA report is due tomorrow).

The 2.3 percent rise came as the warmest January in more than a century encouraged Americans to buy more cars and redeem holiday gift cards. The gain followed a 0.4 percent increase in December, the Commerce Department said today in Washington. Excluding autos, sales rose 2.2 percent, the most in six years.

The fifth straight increase in sales reflects the higher wages U.S. workers are enjoying as the economy adds more jobs and unemployment declines. Treasury notes fell on speculation the economic rebound will give Federal Reserve Chairman Ben Bernanke more reason to raise interest rates next month.

"We're definitely going to see a very strong first quarter," said Brian Bethune, an economist at Global Insight Inc., a forecasting firm in Lexington, Massachusetts. "It looked like consumers were hibernating in December, and all they needed was an excuse to go on a spending spree. The weather provided that."

Economists expected sales to rise 0.9 percent, after an originally reported 0.7 percent gain in December, according to the median of 71 forecasts in a Bloomberg News survey. The rise exceeded the highest estimate of 1.5 percent.

"There's no question it's exaggerated by the record mild temperatures in January," said Jim O'Sullivan, a senior economist at UBS Securities LLC in Stamford, Connecticut. "We expect some payback" for February, he said.

And it looks like rates are even going higher. Based on the FED funds futures, the market is now expecting at least two more rate hikes (See Macroblog: Betting On Ben, Market Version)

For more on retail, see Kash's Consumption: Full Steam Ahead

Monday, February 13, 2006

Good Luck Sasha!

by Calculated Risk on 2/13/2006 08:40:00 PM

Sasha practices in Torino. / Photo by Kevork Djansezian

Schedule:

Tuesday, Feb. 21, Ladies short program, 7 p.m. (Italy time), (2 p.m. ET)

Thursday, February 23, Ladies free skate, 7 p.m. (Italy time) (2 p.m. ET)

Photo from the current People Magazine: Ready to Ice the Competition

Credit: Patrik Giardino

Please pardon this off topic post (see Nationals). Hopefully this will be the first of a few off topic posts during the Olympics as I cheer for Sasha.

Good luck Sasha! Have fun!

KB Home: "May Moderate Revenue Guidance"

by Calculated Risk on 2/13/2006 02:18:00 PM

In last Friday's 10-K filing with the SEC, KB Home (KBH) summarized their outlook:

There are signs ... that consumer demand in the United States for residential housing at current prices is softening. For example, the U.S. Census Bureau reported that single-family housing starts in December 2005 were approximately 12% lower than in November 2005 and approximately 8% lower than in December 2004. The Bureau also reported that the median sales price for new homes fell approximately 3% in December 2005 relative to the median sales price in December 2004.Emphasis added.

Our results to date in fiscal year 2006 reflect these broader market trends. In the first two months of the year, we have experienced an increase in home order cancellations and a decline in net orders for new homes when compared to the same period last year.

It is too early in our prime selling season (February through June) to forecast whether our experience in the first two months of the year will continue. Historically, demand for new homes in the United States has been strong during periods of economic expansion and growth in employment, and we continue to believe that the state of the U.S. economy is the single most important long-term indicator of our future financial performance.

If the current trends do not improve, we may be required to moderate our revenue guidance for fiscal year 2006. At the same time, we do not anticipate changing our diluted earnings per share guidance for fiscal year 2006.

Sunday, February 12, 2006

Housing Slowdown Threatens Inland Empire's Economy

by Calculated Risk on 2/12/2006 03:15:00 PM

UPDATE: Please see my Angry Bear post: Krugman: Debt and Denial

The Press Enterprise reports: A drop in real estate prices could have far-reaching effects, economists warn.

Inland Southern California's surging real estate prices have done more than create hefty equities for hundreds of thousands of homeowners.

They've also kept thousands of people working.

But if prices start to drop in Riverside and San Bernardino counties, and homes stay on the market for five months instead of five days, it hurts more than just sellers. It also leads to less work for the people who build new homes and to those who help sell, finance and insure them.

If those jobs slow, economists question which, if any, industries of the region's economy have enough strength to pick up the slack.

Several economists who watch the two counties did not hesitate when asked to name a potential landmine for the economy in 2006.

"Real estate is a big concern, and we're going to have to watch it carefully," said Chapman University economist Esmael Adibi.

...

"The markets are starting to cool, and everyone says we may be sliding down the backside of a hill," said UCLA economist Christopher Thornberg.

He said there's a "substantial risk" in the second half of the year when he expects home prices to drop. He was one of the first economists to suggest that a slowdown in the market could bring on conditions seen in a recession.

The Inland area relied heavily on housing-related jobs in 2005.

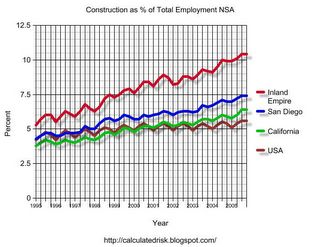

Click on graph for larger image.

This graph is from my Angry Bear post last November: Construction Employment in the Inland Empire

As the housing market slows areas like California's Inland Empire that have been heavily dependent on Real Estate related employment will suffer the most.

Friday, February 10, 2006

More on Yield Curve

by Calculated Risk on 2/10/2006 02:50:00 PM

Here is a graph comparing the the yield curve for one year ago (Feb, 2005), six months ago (Aug, 2005), and yesterday. The data is from the US Treasury. (thanks to Doctorwho for link).

Click on graph for larger image.

The yield curve has definitely flattened out with a small inversion in the 6 months to 3 year time frame.

For some perspective, and a long term graph, see Dr. Kash's Interest Rate Update. To add to Kash's graph, the current spread between the 10 year yield and 6 month yield is -0.12.

For more long term graphs, see Dr. Hamilton's Inverted yield curve edges closer also from last November.

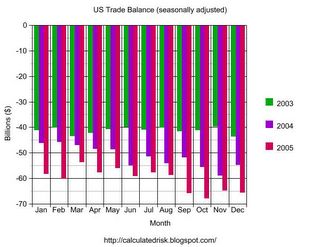

December U.S Trade Deficit: $65.7 Billion

by Calculated Risk on 2/10/2006 10:34:00 AM

Please see Dr. Setser's comments: Big, and getting bigger.

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reports that the U.S. trade deficit for December was $65.7 Billion.

Click on graph for larger image.

And on an annual basis, the AP reports: U.S. Trade Deficit Hits All-Time High

The U.S. trade deficit soared to an all-time high of $725.8 billion in 2005, pushed upward by record imports of oil, food, cars and other consumer goods. The deficit with China hit an all-time high as did America's deficits with Japan, Europe, OPEC, Canada, Mexico and South and Central America.

The Commerce Department reported Friday that the gap between what America sells abroad and what it imports rose to $725.8 billion last year, up by 17.5 percent from the previous record of $617.6 billion set in 2004.

It marked the fourth consecutive year that America's trade deficit has set a record as American consumers continued their seemingly insatiable demand for all things foreign from new cars to televisions and electronic goods.

...

The U.S. trade deficit with China rose to a record $201.6 billion last year, the highest deficit ever recorded with any country and 24.5 percent above the previous record of $161.9 billion set in 2004. Part of that increase reflected a 42.6 percent increase in imports of Chinese clothing and textiles, which soared at the beginning of the year after the removal of global quotas.

...

The United States also recorded record deficits with Japan at $82.7 billion. Until it was surpassed by China in 2000, Japan was the country that had the largest trade gap each year with the United States.

America's trade deficit set records with much of the rest of the world as well. Among those records was a $122.4 billion gap with the 25-nation European Union, a $92.7 billion deficit with the nations that belong to the Organization of Petroleum Exporting Countries, a $76.5 billion deficit with Canada and a $50.1 billion deficit with Mexico. Canada and Mexico are America's partners in the North American Free Trade Agreement. The deficit with the countries of South and Central America rose to a record $50.7 billion last year.

A huge 39.4 percent jump in petroleum imports, which rose to $251.6 billion, was a major factor contributing to last year's deficit increase. The price of those imports rose to an all-time high, reflecting tight global supplies. The United States was forced to import more oil in the fall after Hurricane Katrina caused widespread shutdowns of Gulf Coast production.

Thursday, February 09, 2006

The 30 Year Bond and the Flat Yield Curve

by Calculated Risk on 2/09/2006 03:24:00 PM

The Treasury Department today issued 30-year bonds for the first time since 2001. From the AP: 30-Year Bond Sold for 1st Time in 5 Years

The Treasury Department sold $14 billion of the bonds with a yield of 4.53 percent.Here are some recent quotes:

FED Funds Rate: 4.5%

Five Year Note: 4.54%

Ten Year Note: 4.54%

30 Year Bond: 4.53%

I don't think we need a graph to visualize a flat line!

Wednesday, February 08, 2006

Bush Budget: Confusing Reporting

by Calculated Risk on 2/08/2006 07:57:00 PM

Yesterday, the Wisconsin State Journal presented this graphic on their front page (pdf).

Click on graphic for larger image.

The first mistake is to include off-budget items (mostly SSI) in the Bush budget. Obviously the Journal is just following the confusing Bush budget document, but this distorts the proposed percentages for revenues and expenditures.

Look at interest payments. The graphic indicates interest payments will be 9% of the budget. This is completely bogus as interest payments are accelerating rapidly.

The International Herald Tribune quotes our friend Dr. Brad Setser: Effect of rising debt soon to be felt in U.S.

"Up until now, rising debt has been offset by a falling interest rate," said Brad Setser, an economist at Roubini Global Economics in New York. "Now, debt is still rising and the interest rate is no longer falling. The consequence of rising debt will no longer be masked."In fact, the budget estimates interest payments will be $441 Billion in ficsal 2007. So if we take the Bush budget estimate (including SSI), then $441 Billion divided by $2.77 Trillion is 16% of the budget.

So how did the Journal get 9%? Easy. They include SSI in the budget expenditures and exclude interest payments from the General Fund to SSI Trust Fund. So they use $247 billion in interest payment on debt held by the public and a budget of $2.77 Trillion = 9%. Two compounding errors.

Here is the real percentage: The Bush on-budget expenditures are $2.1 Trillion. Interest payments are $441 Billion. So interest payments are 21% of on-budget expenditures (see Table 1.4 pdf)

Mortgage Application Volume Declines, Rates Rise

by Calculated Risk on 2/08/2006 09:50:00 AM

The Mortgage Bankers Association (MBA) reports that mortgage applications declined for the week ending Feb 3rd.

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 619.3 – a decrease of 1.2 percent on a seasonally adjusted basis from 626.8 one week earlier. On an unadjusted basis, the Index increased 2.2 percent compared with the previous week but was down 16.4 percent compared with the same week one year earlier.

The seasonally-adjusted Purchase Index decreased by 2.4 percent to 425.1 from 435.7 the previous week whereas the Refinance Index increased by 0.2 percent to 1751.0 from 1747.2 one week earlier.

Rates on mortgages increased: The average contract interest rate for 30-year fixed-rate mortgages increased to 6.25 percent from 6.20 percent one week earlier ...

The average contract interest rate for one-year ARMs was steady at 5.48 percent ...

Activity is still high, but falling again as mortgage rates are once again rising.