by Calculated Risk on 3/01/2006 10:00:00 AM

Wednesday, March 01, 2006

OFHEO: House Price Appreciation Continues at Robust Pace

The Office of Federal Housing Enterprise Oversight (OFHEO) released the Q4 2005 House Price Index.

HOUSE PRICE APPRECIATION CONTINUES AT ROBUST PACEUPDATE: From a bubble perspective, three of the most closely watched cities have been Boston, Sacramento and San Diego - all three have shown signs of a housing slowdown.

OFHEO House Price Index Shows Annual Rise of Nearly 13 Percent;

Unprecedented Increases in 26 Metropolitan Areas

WASHINGTON, D.C. – Average U.S. home prices increased 12.95 percent from the fourth quarter of 2004 through the fourth quarter of 2005. Appreciation for the most recent quarter was 2.86 percent, or an annualized rate of 11.4 percent. The increase during 2005 is similar to the revised increase of 12.55 percent for the year ended with the third quarter of 2005, showing no evidence of a slowdown. The figures were released today by OFHEO Acting Director Stephen A. Blumenthal, as part of the House Price Index (HPI), a quarterly report analyzing housing price appreciation trends.

"Despite recent indications that a slowdown may be forthcoming, house price appreciation during 2005 continued to hover at near-record levels," said OFHEO Chief Economist Patrick Lawler.

House prices continued to grow considerably faster over the past year than did prices of non-housing goods and services reflected in the Consumer Price Index. House prices rose 12.95 percent, while prices of other goods and services rose only 4.3 percent.

"While deceleration continues in some areas, appreciation generally is still extremely strong," said Lawler. "Mortgage rates climbed significantly during the second half of last year, but the effect of that increase on price appreciation so far appears to be limited."

This HPI report ranks 10 additional Metropolitan Statistical Areas (MSAs) due to an increase in the number of mortgage transactions in those areas.

Significant findings in the HPI:

1. Four-quarter appreciation rates were at record levels in 26 metropolitan areas including Orlando-Kissimmee, FL; El Paso, TX; and Myrtle Beach-

Conway-North Myrtle Beach, SC.

2. Phoenix-Mesa-Scottsdale, AZ continues to be the MSA with the greatest appreciation rate of 39.7 percent.

3. Appreciation in Arizona continues to surpass price growth in other parts of the country by a wide margin. Appreciation was 34.9 percent between the fourth quarter of 2004 and the fourth quarter of 2005. This is more than eight percentage points greater than the rate in Florida, the second fastestappreciating state.

4. The Mountain Census Division became the fastest appreciating area of the country, edging out the Pacific Census Division. The area with the slowest price growth continues to be the East North Central Division, which includes Michigan, Wisconsin, Illinois, Indiana and Ohio.

5. Price growth in the South Atlantic Census Division which includes East Coast states from Maryland to Florida, was at its highest rate since 1975, the beginning of the period covered in OFHEO’s House Price Index. Home prices grew by 17.81 percent between the fourth quarter of 2004 and the fourth quarter of 2005.

6. For the first time since the third quarter of 2003, one of the MSAs included in OFHEO’s appreciation-rate ranking experienced a four-quarter price decline. Prices in Burlington, NC fell by approximately one percent between the fourth quarter of 2004 and the fourth quarter of 2005.

Boston prices increased 1.5% in Q4 2005 and 7.3% for 2005.

Sacramento prices increased 2.7% for the quarter, and 18.7% for the year.

San Diego prices increased 2.2% for the quarter, and 11% for the year.

Any housing slowdown for these areas is not evident in the Q4 House Price Index.

FED's Geithner Warns Financial Tools Outpacing Controls

by Calculated Risk on 3/01/2006 01:14:00 AM

The Washington Post reports: Fed Official Warns of Changes

A top Federal Reserve official warned yesterday that the U.S. financial system is evolving faster than the ability of investors, lenders and regulators to evaluate and manage the risks involved.Geithner's speech: Risk Management Challenges in the U.S. Financial System

... he said, "there are aspects of the latest changes in financial innovation that could increase systemic risk" -- the danger that the losses of a few investors could set off a chain reaction of events that disrupts the broader financial system, as did the near-collapse of a heavily leveraged hedge fund in 1998.

...

"The complexity of many new instruments and the relative immaturity of the various approaches used to measure the risks in those exposures magnify the uncertainty involved," he said.

...

Many analysts have worried that the Fed's success in managing ... financial crisis ... during Alan Greenspan's 18-year tenure as Fed chairman have lulled many investors into underestimating financial risks.

...

Geithner said recent financial innovations have helped the economy absorb various financial shocks, "but they have not eliminated risk." He added, "They have not eliminated the possibility of failure of a major financial intermediary. And they cannot fully insulate the broader financial system from the effects of such a failure."

Tuesday, February 28, 2006

Standard Pacific Corp.: Declining Sales

by Calculated Risk on 2/28/2006 12:39:00 AM

Standard Pacific reported declining year over year New Home Orders Through February 26.

New home orders companywide for the year-to-date period ended February 26, 2006, excluding joint ventures, were down 13% from the level achieved a year ago. The overall decline in orders resulted from the slowing of demand in some of our markets from the unsustainable pace of the past few years, a trend that we began to experience in the fourth quarter of last year. This slowing of sales activity is particularly evident in markets which have experienced significant price increases and investor-driven demand in recent years, such as California and Florida.

New home orders were down 24% year over year in Southern California on a 29% increase in active selling communities. The lower level of sales activity in Southern California was due to: (1) a softening in buyer demand, most notably in San Diego and, to a lesser degree, in Orange County, (2) reduced product availability, particularly in our Los Angeles division, and (3) an increase in the cancellation rate. New orders were up, however, year over year in the Inland Empire, our largest and most affordable division in the region.

In Northern California, new home sales were down 60% on a 12% lower active community count. The year-over-year decrease in new home orders during the period reflected a slowdown in order activity which began in the latter half of 2005 from the robust pace experienced in 2004 and the first half of 2005, combined with a reduction in the number of active selling communities. The decrease in community count is particularly pronounced in our South Bay division where we experienced rapid sellouts in 2004 and 2005, and where a number of our new projects are targeted for 2006. While the Company saw a noticeable slowing of demand in Sacramento in the second half of 2005, orders for the year-to-date period ended February 26, 2006 were up slightly compared to the year earlier period.

New home orders were down 37% in Florida on a 12% decrease in community count. A number of factors contributed to the year-over-year decrease in Florida order activity: (1) reduced product availability in certain divisions, particularly in Orlando and Jacksonville, (2) a softening in buyer demand, most notably in South Florida and Southwest Florida, (3) continued intentional slowing of orders to better align production and sales, particularly in Tampa, and (4) a modest increase in the cancellation rate. The Company has 73% of its 2006 targeted deliveries for the state in its backlog or closed as of February 26, 2006.

...

The Company's cancellation rate for the year-to-date period ended February 26, 2006 was 26%, up from the year earlier rate of 18%.

Monday, February 27, 2006

January New Home Sales: 1.233 Million Annual Rate

by Calculated Risk on 2/27/2006 10:26:00 AM

UPDATE: For more on housing, please see my Angry Bear post: Slowing, but Not Crashing.

According to the Census Bureau report, New Home Sales in January were at a seasonally adjusted annual rate of 1.233 million. December's sales were revised upwards slightly to 1.298 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

The Not Seasonally Adjusted monthly rate was 93,000 New Homes sold, slightly higher than the 89,000 in December.

On a year over year basis, January 2006 sales were 1% higher than January 2005.

The median and average sales prices are steady.

The median sales price of new houses sold in January 2006 was $238,100; the average sales price was $291,600.

The seasonally adjusted estimate of new houses for sale at the end of January was 528,000. This represents a supply of 5.2 months at the current sales rate.

The 528,000 units of inventory is another all time record for new houses for sale. On a months of supply basis, inventory is above the level of recent years.

This report is still reasonably strong, except for the record inventory and months of inventory.

Sunday, February 26, 2006

Merrill Lynch's Rosenberg: Five Macro Misperceptions

by Calculated Risk on 2/26/2006 06:03:00 PM

Merril Lynch economist David Rosenberg discusses (pdf): Reassessing Hard Landing Risks

... I’d just like to go through briefly what I took away from a week-long marketing swing through Europe last week, because everywhere I went, I was greeted with these five macro beliefs, or what I call major macro misperceptions:See the link for Rosenberg's discussion and many interesting graphs. Here are his comments on the US consumer:

(i) that the U.S. economy is booming;

(ii) the consumer is going to remain underpinned by record wealth even as the Fed raises rates and the housing market slows;

(iii) that high-end retailing stocks will be safe because the ‘well off’ homeowner did not play a role in the housing boom;

(iv) interest rates are still far too low to generate any weakness in the economy;

(v) the tight labor market is on the precipice of triggering wage inflation, and therefore the Fed has much more to do.

Misperception #2 – "don’t worry about the consumer; the level of household net worth is at a record high."

We heard that all the time, household net worth is over $50 trillion, and the level of bank deposits and money market fund holdings, are at record highs and somehow this accumulated savings will keep the consumer afloat even if the Fed tightens further. Well, we went back into the history books and found that U.S. household net worth hit a RECORD level in the quarter before every recession in the post-war era. Not only that, but in every recession outside of the 2001 episode when the equity market melted, household net worth rose throughout the entire period of negative GDP growth. So basically, net worth goes up before, during and after recessions, and it would make sense that with personal income setting new records practically every quarter, that the level of savings would too. In other words, the level of net worth is a pretty useless leading economic indicator, and the notion that households will draw down their level of savings – savings hopefully intended to fund retirement – to satisfy current consumption instead sounds pretty spurious to me.

Friday, February 24, 2006

CNN: Jump in Cancelled Orders for New Homes

by Calculated Risk on 2/24/2006 07:26:00 PM

CNN Money reports: Cancelled home orders: Latest bubble prick?

Home builders are growing concerned about an increasing number of cancelled new home orders, which experts say could be a sign of an underlying weakness in the recent run in home prices."One in 5" and "4 percent ... saying increase ... has been significant" doesn't seem too ominous. And so far, most cancellations are not job related:

Specifically, the cancelled orders could be the latest warning sign that buyers who were turning to real estate as an investment, rather than for their own housing needs, are shifting out of real estate. And that could mean that in many hot markets, the air is about to come out of over-inflated real home prices overall.

A survey recently conducted by the National Association of Home Builders of its members found one in 5 reporting more cancellations than six months ago, with 4 percent of the overall group saying the increase in cancellations has been significant.

... only 15 percent citing job losses by buyers as a cause for the cancellations. The survey, which allowed the builders to cite more than one cause for cancellations, found 45 percent saying it was due to a buyer's inability to sell their existing home and a third citing the buyers not being able to qualify for financing at a time of rising mortgage rates.If its really speculators that are cancelling orders that is probably healthy for the housing market over the next few years.

But Seiders and others say a big concern is a factor not cited on the survey, the fear that cancellations are being driven by real estate investors who were ordering new homes with the intention of selling them quickly in a hot real estate market. And Seiders said many of the 72 percent of those surveyed not yet reporting an increase in cancellations are already worried.

Thursday, February 23, 2006

FDIC: What the Yield Curve Does (and Doesn’t) Tell Us

by Calculated Risk on 2/23/2006 07:11:00 PM

FDIC economist Nathan Powell writes: What the Yield Curve Does (and Doesn’t) Tell Us

Some Excerpts:

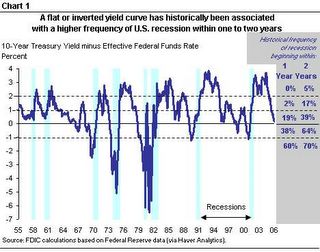

Historically, the yield curve spread, or the difference between short-term and long-term interest rates, has had some predictive power for the performance of the U.S. economy and banking industry. In the past, a narrowing, or flattening, of the spread has tended to foretell both slower economic growth and increased pressure on bank earnings. Furthermore, the yield curve generally has inverted—a condition where short-term rates exceed long-term rates—up to two years ahead of a recession. Based on this historical context, the flattening in the yield curve since mid-2004 has been on the minds of many economists and banking analysts. Sometimes, however, the yield curve flattens or inverts for reasons that may not necessarily foreshadow slower economic growth.

The shape of the yield curve spread also has held implications for bank margins and profits. Historically, bank net interest margins have tended to decline one to two quarters after a decline in the yield curve spread. While many banks have found ways of reducing their sensitivity to changes in yield curve spreads in recent years, the largest banks have seen their margins squeezed substantially by the recent flattening in the yield curve. And although smaller banks have been less affected so far, the earnings of all lenders will likely be affected should the yield curve remain flat for several more quarters. This issue of FYI examines the historical relationships of the yield curve with economic growth and how changes in the spread have affected banks.

The Yield Curve and the U.S. Economy

A yield curve is simply a graph depicting the yields of similar debt instruments of differing maturities. There are many yield curves and many ways of measuring the difference, or spread, in short- and long-term interest rates along these curves. A common measure of this difference is the spread between the federal funds rate, which is set by the Federal Reserve and used in pricing overnight interbank loans, and the 10-year Treasury note yield, which is linked to the pricing of traditional fixed-rate mortgages. Two other common measures of the spread take the difference between 3-month and 10-year Treasury yields or the difference between 2-year and 10-year Treasury yields. Some research indicates that calculating spreads using very short-term rates, such as the federal funds rate or 3-month Treasury yield, is a more useful indicator of future economic activity than using a 2-year Treasury yield as a short-term rate.1 In keeping with this prior research, we will focus on the spread between the federal funds rate and the 10-year Treasury yield when measuring the shape of the yield curve.

Inverted Yield Curves Sometimes Precede Recessions

Historically, the shape of the yield curve has been a useful leading indicator of economic growth. For instance, the beginning of a recession has seldom followed a period with a steep (positively sloped) yield curve within two years (see Chart 1). In fact, during months in which the spread has measured at least 200 basis points (2 percentage points), a recession has ensued within two years only 5 percent of the time. The shape of the yield curve has also told us when recessions may be more likely. In Chart 1, we see that the yield curve has inverted significantly, or by at least 100 basis points, within two years prior to each of the past six recessions.

Click on graph for larger image.

Nathan Powell concludes:

ConclusionThe author argues that the yield curve can be flat for reasons not related to a future economic slowdown. These include low term premium, low inflation expectations, demand from foreign banks, and investment activities by pension funds and hedge funds.

History suggests that the odds of recession increase when the yield curve spread flattens or becomes inverted. But past recessions only occurred with a high frequency after the curve inverted by a significant amount for a sustained period of time. Further, the yield curve spread can invert for reasons other than the possibility of slower economic growth. We have presented some of these possible explanations, which include expectations of lower long-term inflation, a recent reduction in the term premium, strong demand for longer-term debt by foreign central banks, and investment activities by pension and hedge funds. As a result, the flat yield curve spread may not be signaling increased odds of a recession at present. By the same token, the structural forces holding long-term interest rates down may be with us for some time, even as the cyclical increase in short-term rates subsides. The presence of these structural forces suggests that a flat yield curve could persist for some time.

Similarly for banks, flat or inverted yield curves have historically been associated with narrowing NIMs and lower earnings. Many smaller banks thus far have been able to insulate themselves from changes in the yield curve spread, because they have only slowly raised the interest rates they pay on their liabilities. In contrast, the largest banks have seen their liability costs rise more rapidly, while at the same time their asset yields have lagged those for smaller banks. This situation has resulted in a classic margin squeeze for the largest banks as the yield curve has flattened. Even so, it may be just a matter of time before margins for smaller banks begin to be squeezed, especially if the flat yield curve persists. Regardless of the slope of the existing yield curve—positive, flat, or negative—bankers will benefit from strategies designed to cope with the uncertainty of changing interest rates.

None of these reasons seems compelling to me. I think it is likely that long rates are low because of foreign CB activities, but what if their economies slow? Then foreign CBs will probably lower their investment in US securities leading to higher US rates.

And the low term premiums can easily reverse. Remember Greenspan's remarks at Jackson Hole?

The lowered risk premiums--the apparent consequence of a long period of economic stability--coupled with greater productivity growth have propelled asset prices higher. ... Such an increase in market value is too often viewed by market participants as structural and permanent. ... But what they perceive as newly abundant liquidity can readily disappear. Any onset of increased investor caution elevates risk premiums and, as a consequence, lowers asset values and promotes the liquidation of the debt that supported higher prices. This is the reason that history has not dealt kindly with the aftermath of protracted periods of low risk premiums.There is much more in the FDIC article, especially concerning bank margins.

Oil Prices Slide As U.S. Supplies Rise

by Calculated Risk on 2/23/2006 12:53:00 PM

The AP reports: Oil Prices Slide As U.S. Supplies Rise

Crude futures prices fell below $60 a barrel Thursday after U.S. government data showed an increase in domestic supplies of oil.

The market remained on edge, though, because of supply disruptions in Nigeria and by worries over Iran's nuclear program.

Light sweet crude for April delivery fell $1.16 cents to $59.85 a barrel on the New York Mercantile Exchange. The contract fell more than $1 Wednesday to settle at $61.01 a barrel.

This graph is from the Dept of Energy.

The supply of crude oil is above normal levels (the blue band) and rising.

The graph for gasoline also shows inventories are well above normal for this time of year and have recovered from the hurriance disruptions last year.

The agency's report also showed that gasoline demand over the past four weeks was 2.3 percent higher than during the same period a year ago -- a sign that higher prices were not slowing down motorists.US gasoline production appears back to normal, but imports are still at an elevated level. Higher gasoline demand is being offset by higher gasoline imports.

The Lady in Red

by Calculated Risk on 2/23/2006 01:37:00 AM

Good luck Sasha! Have Fun!

For the Ladies' Free Skate, Sasha will be wearing a new red velvet dress and perform to Nina Rota’s soundtrack of "Romeo and Juliet". Enjoy.

Photo by Dave Black for Newsweek

Sasha in blue leads after the short program.

Photo from Newsweek's Can Sasha Cohen Save the Olympics?

NOTE: I will not post a spoiler. Enjoy the competition: the three top skaters in the world over the last two years are essentially tied. Irina is the 2005 World Champion. Shizuka is the 2004 World Champion. And Sasha is the 2004 and 2005 World Silver medalist and reigning US Champion.

Wednesday, February 22, 2006

FED Vice Chairman Roger W. Ferguson Resigns

by Calculated Risk on 2/22/2006 11:20:00 AM

From the Federal Reserve:

Roger W. Ferguson, Jr., submitted his resignation Wednesday as Vice Chairman and as a member of the Board of Governors of the Federal Reserve System, effective April 28, 2006.Resignation letter.

Ferguson, who has been a member of the Board since November 5, 1997, submitted his letter of resignation to President Bush. He will not attend the March 27-28 meeting of the Federal Open Market Committee.

"Roger has made invaluable contributions to the Federal Reserve and to the country," said Federal Reserve Board Chairman Ben S. Bernanke. "He led the Fed's first response to the 9/11 terrorist attacks, was a strong advocate for increased transparency of monetary policy, and ably represented the Federal Reserve in important international fora. I value his friendship and counsel greatly and wish him all the best in his new endeavors."

Ferguson, 54, was first appointed to the Board by President Clinton to fill an unexpired term ending January 31, 2000. He was then appointed by President Bush to a full term that expires on January 31, 2014.

I am surprised.