by Calculated Risk on 3/17/2006 06:32:00 PM

Friday, March 17, 2006

UCLA: Housing Slowdown leads to "Great Uncertainty"

Drs. Leamer and Thornberg from UCLA's Anderson Forecast were quoted today on housing. From Contra Costa Times: Bay Area housing market cools

"We're at the peak and what happens next is a matter of great uncertainty," said Edward Leamer, director of UCLA Anderson Forecast.And from the San Francisco Chronicle: Bay Area housing market cools

... Christopher Thornberg, economist at the UCLA Anderson Forecast, predicts prices to hit a plateau later in the year, which could persist for an extended period. In addition, the downswing will have a direct impact on the construction, mortgage and real estate industries.It makes sense that a housing slowdown will impact the overall economy, but by how much remains unclear ... "a matter of great uncertainty".

"It's going to take the energy out of the economy, reducing the wealth effect and diminishing retail sales in [California], but it's not going to cause a recession," Thornberg said.

DQNews: Slowdown in Bay Area home sales, appreciation rate

by Calculated Risk on 3/17/2006 10:40:00 AM

DQNews reports: Slowdown in Bay Area home sales, appreciation rate

Bay Area home sales remained at their lowest level in five years in February, as price increases continued to slow, a real estate information service reported.

A total of 6,206 new and resale houses and condos were sold in the nine-county region last month. That was up 3.4 percent from 6,004 for January, and down 16.8 percent from 7,463 for February last year ... Last month was the eleventh in a row to see a year-over-year sales decline.

"We'll know more about what's going on once next month's numbers come in. March sales have a more typical purchase pattern than February's or January's. Right now we don't see anything ominous in the numbers, just a real estate cycle that is past the frenzy phase," said Marshall Prentice, DataQuick president.

The median price paid for a Bay Area home was $616,000 last month. That was up 1.5 percent from January's $607,000, and up 12.2 percent from $549,000 for February a year ago. The annual price increase was the lowest since prices rose 9.7 percent to $443,000 in January 2004.

It appears housing is in the 2nd stage of a slowdown - falling transactions (the first stage is rising inventories). On distress:

Indicators of market distress are still largely absent. The use of adjustable-rate mortgages has decreased significantly the last three months. Foreclosure rates are coming up from last year's low point, but are still below normal levels. Down payment sizes are stable and there have been no significant shifts in market mix ...

Thursday, March 16, 2006

Congress Raises Debt Cap

by Calculated Risk on 3/16/2006 01:53:00 PM

This was just a formality, but ...

Bloomberg reports: Congress Raises Debt Cap, Fourth Increase Under Bush

The U.S. Congress approved a $781 billion increase in the federal government's debt limit, the fourth time lawmakers have raised the cap since President George W. Bush took office.This year will most likely set a new record with over $600 Billion added to the National Debt.

The Senate voted 52-48 to increase the legal limit on federal borrowing to $8.97 trillion, up from $8.18 trillion. The House approved the measure last year, meaning the legislation now goes to the president for his signature.

Wednesday, March 15, 2006

NAHB: Builder Confidence "Virtually Unchanged"

by Calculated Risk on 3/15/2006 07:59:00 PM

The National Association of Homebuilders reports: Builder Confidence Virtually Unchanged in March

Click on graph for larger image.

A one-point decline in the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for March indicates that housing demand and sales are gradually returning to a sustainable pace that is right in line with our forecasts, said NAHB today.There is plenty of happy talk about restoring "equilibrium", but the last time the market index was lower than March was right after 9/11/2001.

"Today’s HMI provides the latest evidence of a predicted and orderly cooling process for the nation’s single-family new-home market, which easily hit record highs in 2005," said NAHB President David Pressly, a home builder from Statesville, N.C.

Noting that the confidence gauge has remained within a narrow two-point range for four consecutive months following a retreat from its peak in mid-2005, NAHB Chief Economist David Seiders attributed March’s slight downshift to eroding affordability conditions as well as a gradual withdrawal of investor demand in some areas.

"Rising interest rates and high rates of home-price appreciation have raised the bar for homeownership to beyond what some families can reach," he noted. "Meanwhile, a retreat of short-term investors from certain markets is helping restore equilibrium between supply and demand."

FED's Beige Book

by Calculated Risk on 3/15/2006 07:21:00 PM

The Federal Reserve released the Beige Book today.

Most Districts said that residential construction and real estate activity slowed from high levels ...Here are some more housing related quotes:

Boston:

A couple of companies mention that a softening housing market may cause some erosion in demand for housing-related and other products this year.New York:

The Second District's economy continued to expand at a good pace, on average, across sectors in the first two months of 2006, though housing and consumer lending have softened.Richmond:

...

The region's housing market was mixed but, on balance, softer in early 2006. New Jersey homebuilders report a growing inventory of homes at the higher end of the market. The number of transactions has been well below comparable 2005 levels, selling prices have been basically flat since last autumn, and builders are offering more concessions.

Fifth District economic growth moderated in January and February as the pace of retail and housing activity slowed. ... Housing markets continued to cool; real estate agents told us that home sales slowed and noted that properties for sale were staying on the market longer. In the financial sector, bank lending expanded at a more moderate pace as growth in residential mortgage lending tapered off.Altanta:

Real estate contacts noted further slowing in several housing markets ...Dallas:

Contacts in both the construction and manufacturing sector are keeping their eyes on the housing market with optimistic trepidation. At this point there is little evidence that slowing in other housing markets has spread to this region.San Francisco:

Activity in residential real estate markets continued at high levels but showed further evidence of softening in some areas. The pace of home construction and sales was rapid in general, and sales prices held steady or increased in most areas. However, a decline in the pace of home sales and slowdowns in other indicators reflect significant cooling in some previously hot markets, notably in Hawaii, Arizona, and parts of California.

MBA: 30-year Fixed Rate Increases to Highest Level Since July 2002

by Calculated Risk on 3/15/2006 11:05:00 AM

The Mortgage Bankers Association (MBA) reports that the 30-year fixed rate mortgage increased to the highest level since July 2002. Mortgage application volume was steady for the week ending March 10th.

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 574.4 – a decrease of 0.2 percent on a seasonally adjusted basis from 575.6 one week earlier. On an unadjusted basis, the Index increased 0.2 percent compared with the previous week but was down 20.4 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 1.0 percent to 403.0 from 399.0 the previous week whereas the Refinance Index decreased by 1.9 percent to 1583.6 from 1614.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.42 percent from 6.31 percent...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs decreased to 5.64 percent from 5.69 percent ..

| Total | -20.4% |

| Purchase | -13.1% |

| Refi | -30.2 |

| Fixed-Rate | -16.1% |

| ARM | -29.3% |

Purchase activity is off 13% from the same week in 2005 and overall mortgage activity is off 20%. Those are significant declines in activity.

Tuesday, March 14, 2006

O.C. home prices rebound to $617K

by Calculated Risk on 3/14/2006 10:29:00 AM

The OC Register reports: O.C. home prices rebound

Orange County home prices rebounded in February, as the median sales price reached $617,000 – tying the second highest on record.

DataQuick reported early Tuesday that February's price was $35,000 higher than January's $582,000 – and 11.2 percent above year-ago prices. The record of $621,000 was set last December.

All told, 2,672 homes sold last month, down 7.5 percent from a year ago.

For more details, see Jonathan Lansner's real estate blog.

Monday, March 13, 2006

NAR: Housing Market Readjusting

by Calculated Risk on 3/13/2006 02:02:00 PM

The National Association of Realtors reports: Housing Market Readjusting to Normal Balance.

A lower level of home sales expected this year will create a more level playing field for buyers and sellers on the heels of a five-year sellers’ market, according to the National Association of Realtors®.

David Lereah, NAR’s chief economist, said the number of homes on the market has been improving nicely. "The cooling from overheated sales conditions in recent months is helping to bring inventory levels up to the point where buyers have more choices than they’ve seen in the last five years," Lereah said. "Annual price appreciation is still running at double-digit rates, but the cause of those sharp increases is going away. As the market readjusts, price appreciation should return to more normal rates of growth this year."

The national median existing-home price for all housing types is projected to rise 5.8 percent in 2006 to $220,300. The median new-home price should increase 5.4 percent this year to $250,200.

Existing-home sales are expected to fall 5.7 percent to 6.67 million in 2006 from the record 7.08 million last year. At the same time, new-home sales are forecast to decline 7.7 percent to 1.18 million from a record 1.28 million in 2005 – each sector would be at the third highest year following the tallies for 2005 and 2004. Housing starts are likely to total 1.98 million this year, down 4.3 percent from 2.06 million in 2005.

NAR President Thomas M. Stevens from Vienna, Va., said some home buyers and sellers have unrealistic expectations. "Some sellers in markets that have had rapid appreciation are listing the price of their home too high, but those homes are just languishing on the market," said Stevens, senior vice president of NRT Inc. "At the same time, some buyers who have believed hype about a housing bubble are hoping prices will drop, but that’s not happening either."

...

The 30-year fixed-rate mortgage should increase gradually to 6.9 percent in the fourth quarter.

Friday, March 10, 2006

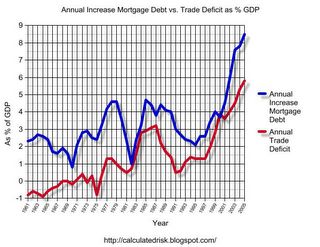

Mortgage Debt and the Trade Deficit

by Calculated Risk on 3/10/2006 09:18:00 PM

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."

Alan Greenspan, Current account, Feb 4, 2005 Click on graph for larger image.

Click on graph for larger image.

With the release of the Fed's Flow of Funds report, we can look at the relationship between the annual increase in household mortgage debt and the trade deficit.

Note: I'm using the trade deficit instead of the current account deficit, since the current account for '05 has not been released yet.

I expect the annual increase in mortgage debt to decline in 2006. This is because I expect new and existing home purchases to decline, and homeowners to extract less equity from their homes in 2006.

The drop in mortgage activity is is one of the reasons I expect the trade deficit to stabilize in 2006. From my 2006 predictions:

Trade Deficit / Current Account Deficit: I could be wildly wrong here too, but I think the trade deficit will stabilize or even decline slightly next year. As the economy slows, I think imports will slow.I should have been more clear. There is no way the trade deficit will decline on an annual basis in 2006, but I was expecting the deficit to stabilize or decline from the September to December level of $66 Billion per month.

The record January deficit of $68.5 Billion was a little disheartening, but mortgage extraction has just begun to slow. So far I've been wrong - but its early.

Drs. Brad Setser and Menzie Chinn are more pessimistic ...

Brad Setser: January trade data

Menzie Chinn: The downward march of the trade balance

Thursday, March 09, 2006

Geithner: U.S. Monetary Policy in the Global Financial Environment

by Calculated Risk on 3/09/2006 04:27:00 PM

New York Fed President Timothy Geithner spoke today on U.S. Monetary Policy in the Global Financial Environment

I will focus on two features of what is happening in the world economy and financial markets today ... These are, first, the behavior of forward interest rates in financial markets, and, second, the pattern of external imbalances.After discussing the possible causes for these two features, Giethner turns to the implications for policy:

These features are interesting, in part, because they seem somewhat anomalous, or inconsistent with what the past has led us to expect. They seem likely to be related to each other and both are a feature of the changes underway in global financial integration. Understanding the forces behind these phenomena or anomalies is important to thinking through what they mean for policy.

What might this mean for the conduct of monetary policy? To the extent that these forces act to put downward pressure on interest rates and upward pressure on other asset prices, they would contribute to more expansionary financial conditions than would otherwise be the case. And, if all else were equal, which of course is unlikely ever to be the case, monetary policy in the affected countries would have to adjust in response; policy would have to act to offset these effects in order to achieve the same impact on the future path of demand and inflation. To do otherwise would run the risk that monetary policy would be too accommodative, pulling resources from the future in a way that would alter the trajectory for the growth of the capital stock, perhaps amplifying the imbalances, and compromising the price stability.I suggest reading the entire speech.

...

Let me conclude by observing that a constellation of factors has aligned to produce the current combination of low world interest rates, low risk premia and large global imbalances. Most of these factors are outside the control of U.S. monetary policy, and we do not fully understand their implications for our economy and for policy. The process of global economic integration makes it ever more important that we work to improve our understanding of how this complex of global monetary arrangements affects our objectives.