by Calculated Risk on 3/21/2006 05:15:00 PM

Tuesday, March 21, 2006

UAE, Saudi considering to move reserves out of dollar

Forex reports: UAE, Saudi considering to move reserves out of dollar

WASHINGTON — A number of Middle Eastern central banks said on Tuesday they would seek to switch reserves from the US greenback to euros.

The United Arab Emirates said it was considering moving one-tenth of its dollar reserves to the euro, while the governor of the Saudi Arabian central bank condemned the decision by the United States to force Dubai Ports World to transfer its ownership to a ‘US entity,’ the UK Independent reported.

“Is it protectionism or discrimination? Is it okay for US companies to buy everywhere but it is not okay for other companies to buy the US?” said Hamad Saud Al Sayyari, the governor of the Saudi Arabian monetary authority.

The head of the United Arab Emirates central bank, Sultan Nasser Al Suweidi, said the bank was considering converting 10 per cent of its reserves from dollars to euros.

“They are contravening their own principles,” said Al Suweidi. “Investors are going to take this into consideration (and) will look at investment opportunities through new binoculars.”

The Commercial Bank of Syria has already switched the state’s foreign currency transactions from dollars to euros, Duraid Durgham head of the state-owned bank said. The decision by the bank of Syria follows the announcement by the White House calling on all US financial institutions to end correspondent accounts with Syria due to money-laundering concerns.

Syria’s Finance Minister Mohammad Al Hussein said: “Syria affirms that this decision and its timing are fundamentally political.”

Housing: A 'Painful' Soft Landing?

by Calculated Risk on 3/21/2006 09:42:00 AM

Jonathan Lansner writes in the OC Register: Even a 'soft landing' for home prices can be painful [for Orange County]. A few excerpts:

The much-discussed "soft landing" – where home appreciation moderates down to historical norms, or slightly lower – may create heartburn in the business climate.On mortgage equity withdrawal:

This year, the local housing market has started off slowly. Prices are still at last August's level. And sales activity hasn't been this sluggish since 1997. Forget the doomsday predictions of a market in a downward spiral. Just imagine how difficult it could be for the economy to thrive in what some might call a normal housing market.

Everyday folks have reaped rewards in several ways. Most notable: Borrowing against the profits in their home.And on housing related employment:

For example, 72,000 Orange Countians last year took out $6.1billion worth of home-equity loans, according to DataQuick. Curiously – and a possible sign of a slowing real estate market – that's down from 88,500 equity loans worth $7.2billion in 2004.

The cold cash generated by real estate isn't the only thing that's let consumers shop until they drop. It's that perception of housing wealth that's allowed them to spend freely.

By my math, real estate of all sorts – from lending to building to brokers to swabbing the floors of office towers – employed 253,000 in the fourth quarter of 2005.See the article for a graphic on housing related employment in OC.

That's up almost 80 percent since 1995. The boom turned the real estate community, so to speak, into 17 percent of all workers employed in Orange County.

Sunday, March 19, 2006

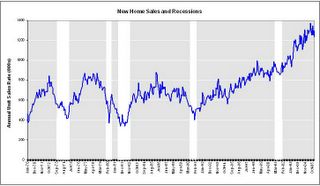

New Home Sales and Recessions

by Calculated Risk on 3/19/2006 11:30:00 PM

This is just a reminder of the historical relationship between falling New Home Sales (units) and recessions.

Click on graph for larger image.

The white columns are economic recessions as defined by NBER.

For consumer led recessions (all but the most recent recession in 2001), New Home Sales were falling prior to the onset of the recession. It appears that New Home Sales peaked last year and it would be concerning if they fell 20% or more from the most recent peak (to below 1.05 million units). New Home Sales for February will be released on Friday and are expected to be around 1.2 million units (SA, annual rate). It is also important to note that unit volumes have not fallen very far from the peak of 2005.

This doesn't imply a cause and effect relationship, but it is something to watch. If New Home Sales can stay above 1.1 million or so that probably increases the probabilities of a soft landing (just slower growth), as opposed to a hard landing (a recession).

Weird Creative Financing

by Calculated Risk on 3/19/2006 01:50:00 PM

David Streitfeld writes in the LA Times: For Home Loan Broker, Troubles Come With Creative Refinancing

Orange County homeowners ... essentially get paid to borrow money.Here is how it worked (completely legal):

Mark Gallagher, the founder and president of Park Place Funding in Laguna Hills, uses a technique ... to cut his customers in on the action, giving them a share of the premium he earns for placing loans with high interest rates.

The homeowners receive cash on a regular basis they can use for vacations, remodeling or to pay off that expensive house faster. Not surprisingly, they love their broker.

1) Park Place would charge a higher than normal interest rate (with customer approval).

2) Park Place would charge no fees and receive a rebate of upto 5% from the lender. On a $350K loan, Park Place would receive $17.5K.

3) Park Place would give a portion of the rebate to the customer (far more than enough to cover the extra interest payments for four months).

4) Four months later, Park Place would refinance the customer again and receive another rebate (the loan balance would stay the same). They had to wait four months or refund the rebate on the previous loan.

5) The lender (frequently National City Mortgage) would sell the loans to Freddie Mac. Freddie Mac would package the loans into investment pools. As long as the pools didn't have too many loans that were repaid early, everyone was happy.

Bizarre story! I expect that other problems will be exposed as the housing market slows.

Saturday, March 18, 2006

New Homes Sales vs. Construction Employment

by Calculated Risk on 3/18/2006 10:35:00 PM

For New Home Sales, it appears the peak of the housing cycle happened last year. However construction related employment is still rising. This is not unusual.

Click on graph for larger image.

The graph shows New Home Sales vs. Construction Employment since 1970.

Note that "Construction Employment" from the BLS includes all types of construction, not just residential construction.

Historically Construction Employment continued to rise for a year or more after the peak in housing transactions. Other housing related employment categories, like mortgage brokers, have already seen some layoffs - but based on historical data, construction will probably stay strong for most of 2006 unless sales fall dramatically.

Friday, March 17, 2006

UCLA: Housing Slowdown leads to "Great Uncertainty"

by Calculated Risk on 3/17/2006 06:32:00 PM

Drs. Leamer and Thornberg from UCLA's Anderson Forecast were quoted today on housing. From Contra Costa Times: Bay Area housing market cools

"We're at the peak and what happens next is a matter of great uncertainty," said Edward Leamer, director of UCLA Anderson Forecast.And from the San Francisco Chronicle: Bay Area housing market cools

... Christopher Thornberg, economist at the UCLA Anderson Forecast, predicts prices to hit a plateau later in the year, which could persist for an extended period. In addition, the downswing will have a direct impact on the construction, mortgage and real estate industries.It makes sense that a housing slowdown will impact the overall economy, but by how much remains unclear ... "a matter of great uncertainty".

"It's going to take the energy out of the economy, reducing the wealth effect and diminishing retail sales in [California], but it's not going to cause a recession," Thornberg said.

DQNews: Slowdown in Bay Area home sales, appreciation rate

by Calculated Risk on 3/17/2006 10:40:00 AM

DQNews reports: Slowdown in Bay Area home sales, appreciation rate

Bay Area home sales remained at their lowest level in five years in February, as price increases continued to slow, a real estate information service reported.

A total of 6,206 new and resale houses and condos were sold in the nine-county region last month. That was up 3.4 percent from 6,004 for January, and down 16.8 percent from 7,463 for February last year ... Last month was the eleventh in a row to see a year-over-year sales decline.

"We'll know more about what's going on once next month's numbers come in. March sales have a more typical purchase pattern than February's or January's. Right now we don't see anything ominous in the numbers, just a real estate cycle that is past the frenzy phase," said Marshall Prentice, DataQuick president.

The median price paid for a Bay Area home was $616,000 last month. That was up 1.5 percent from January's $607,000, and up 12.2 percent from $549,000 for February a year ago. The annual price increase was the lowest since prices rose 9.7 percent to $443,000 in January 2004.

It appears housing is in the 2nd stage of a slowdown - falling transactions (the first stage is rising inventories). On distress:

Indicators of market distress are still largely absent. The use of adjustable-rate mortgages has decreased significantly the last three months. Foreclosure rates are coming up from last year's low point, but are still below normal levels. Down payment sizes are stable and there have been no significant shifts in market mix ...

Thursday, March 16, 2006

Congress Raises Debt Cap

by Calculated Risk on 3/16/2006 01:53:00 PM

This was just a formality, but ...

Bloomberg reports: Congress Raises Debt Cap, Fourth Increase Under Bush

The U.S. Congress approved a $781 billion increase in the federal government's debt limit, the fourth time lawmakers have raised the cap since President George W. Bush took office.This year will most likely set a new record with over $600 Billion added to the National Debt.

The Senate voted 52-48 to increase the legal limit on federal borrowing to $8.97 trillion, up from $8.18 trillion. The House approved the measure last year, meaning the legislation now goes to the president for his signature.

Wednesday, March 15, 2006

NAHB: Builder Confidence "Virtually Unchanged"

by Calculated Risk on 3/15/2006 07:59:00 PM

The National Association of Homebuilders reports: Builder Confidence Virtually Unchanged in March

Click on graph for larger image.

A one-point decline in the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for March indicates that housing demand and sales are gradually returning to a sustainable pace that is right in line with our forecasts, said NAHB today.There is plenty of happy talk about restoring "equilibrium", but the last time the market index was lower than March was right after 9/11/2001.

"Today’s HMI provides the latest evidence of a predicted and orderly cooling process for the nation’s single-family new-home market, which easily hit record highs in 2005," said NAHB President David Pressly, a home builder from Statesville, N.C.

Noting that the confidence gauge has remained within a narrow two-point range for four consecutive months following a retreat from its peak in mid-2005, NAHB Chief Economist David Seiders attributed March’s slight downshift to eroding affordability conditions as well as a gradual withdrawal of investor demand in some areas.

"Rising interest rates and high rates of home-price appreciation have raised the bar for homeownership to beyond what some families can reach," he noted. "Meanwhile, a retreat of short-term investors from certain markets is helping restore equilibrium between supply and demand."

FED's Beige Book

by Calculated Risk on 3/15/2006 07:21:00 PM

The Federal Reserve released the Beige Book today.

Most Districts said that residential construction and real estate activity slowed from high levels ...Here are some more housing related quotes:

Boston:

A couple of companies mention that a softening housing market may cause some erosion in demand for housing-related and other products this year.New York:

The Second District's economy continued to expand at a good pace, on average, across sectors in the first two months of 2006, though housing and consumer lending have softened.Richmond:

...

The region's housing market was mixed but, on balance, softer in early 2006. New Jersey homebuilders report a growing inventory of homes at the higher end of the market. The number of transactions has been well below comparable 2005 levels, selling prices have been basically flat since last autumn, and builders are offering more concessions.

Fifth District economic growth moderated in January and February as the pace of retail and housing activity slowed. ... Housing markets continued to cool; real estate agents told us that home sales slowed and noted that properties for sale were staying on the market longer. In the financial sector, bank lending expanded at a more moderate pace as growth in residential mortgage lending tapered off.Altanta:

Real estate contacts noted further slowing in several housing markets ...Dallas:

Contacts in both the construction and manufacturing sector are keeping their eyes on the housing market with optimistic trepidation. At this point there is little evidence that slowing in other housing markets has spread to this region.San Francisco:

Activity in residential real estate markets continued at high levels but showed further evidence of softening in some areas. The pace of home construction and sales was rapid in general, and sales prices held steady or increased in most areas. However, a decline in the pace of home sales and slowdowns in other indicators reflect significant cooling in some previously hot markets, notably in Hawaii, Arizona, and parts of California.