by Calculated Risk on 3/22/2006 12:02:00 PM

Wednesday, March 22, 2006

Fannie Mae on Housing

David W. Berson and Molly Boesel, Fannie Mae economists, write: Economic & Mortgage Market Developments. Here are some excerpts on housing:

Housing: Home sales continue to ebb, with even slower activity likely.And their predictions:

Both new and existing home sales continued their downtrend through January, despite warmer-thannormal weather that typically would have boosted sales. Local real estate groups in many housing markets are reporting additional sales declines, increases in unsold inventories, and even price drops. Moreover, leading indicators of home sales point to slower activity in coming months. Purchase applications data from the weekly Mortgage Bankers Association (MBA) survey fell in February to the lowest levels in two years, while the monthly builder survey from the National Association of Homebuilders (NAHB) was unchanged in February at the lowest level since 2002.

• New home sales fell by 5.0 percent to 1.23 million units (seasonally adjusted annual rate, or SAAR) in January, the lowest level in a year. Despite the ongoing decline in sales, actual sales in January were still up by 1.1 percent from a year ago.

• Total existing home sales (single-family plus condos/co-ops) fell by 2.8 percent to 6.56 million units (SAAR) in January. Actual sales in January were 2.9 percent less than a year ago.

• Helped by warm weather, total housing starts jumped by 14.5 percent to 2.28 million units (SAAR) in January. Both single-family and large (five or more units) multifamily starts rose, but there was a modest decline in starts for structures with two-to-four units.

• After surging to meet the needs of hurricane evacuees, manufactured housing shipments fell to 167 thousand units (SAAR) in January, the lowest level in four months.

Housing Outlook: Less investor activity and lower affordability will slow the pace of home sales in 2006, while home price gains slow sharply.

Although job/income growth and demographics are expected to remain positive for housing this year, the decline in affordability over the past couple of years (caused by surging home prices) and a sharp pull-back of investor demand should cause sales to fall. We project a decline of nearly 9 percent for total home sales in 2006 (somewhat less for new sales and starts, somewhat more for existing sales), bringing sales down to 7.61 million units. This would still be the third-strongest year on record for home sales.

Although we don’t expect much of a rise in 30-year FRM rates, ARM rates should continue to increase as the Fed tightens monetary policy. Housing affordability declined significantly over the course of 2005, and rising mortgage rates (along with even higher home prices in many areas) should push affordability down a bit more. More importantly, we expect investor demand for housing to fall sharply from the record share of 2005. Fortunately, continued job and income growth as the overall economy grows around trend rates will partially offset the big decline in housing activity that otherwise would occur. Moreover, the age-structure of the population and the surge in the number of immigrants over the past 25 years will continue to put upward pressure on owner-occupied housing demand. Taken together, these components of housing demand suggest the modest decline in our outlook, rather than something more severe.

This falloff in housing activity, and the resulting slower home price gains, won’t be uniform across the country. Those areas with the strongest regional economies should continue to see positive in-migration and housing demand. But, those areas that have had the strongest investor demand are at risk for sharp declines in housing demand – as well as the potential for significant increases in the supply of homes for sale. As a result, overall home price gains are projected to slow sharply in 2006 – down to only 2.5-3.0 percent after a couple of years of double-digit growth. And in those areas with the biggest falloff in investor demand (and the largest corresponding rise in inventories of homes for sale), there is a risk of home price declines – especially in those markets without strong job gains to help offset investor selling.

MBA: Mortgage Application Volume Down Slightly

by Calculated Risk on 3/22/2006 10:56:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Down Slightly

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 565.0 – a decrease of 1.6 percent on a seasonally adjusted basis from 574.4 one week earlier. On an unadjusted basis, the Index decreased 1.6 percent compared with the previous week but was down 13.8 percent compared with the same week one year earlier.Fixed mortgage rates decreased:

The seasonally-adjusted Purchase Index decreased by 2.3 percent to 393.6 from 403.0 the previous week whereas the Refinance Index decreased by 0.6 percent to 1574.5 from 1583.6 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.31 percent from 6.42 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 5.68 percent from 5.64 percent ...

| Total | -13.8% |

| Purchase | -11.7% |

| Refi | -16.9 |

| Fixed-Rate | -7.0% |

| ARM | -27.1% |

Purchase activity is off 12% from the same week in 2005 and overall mortgage activity is off 14%.

CSM: 'Homeowners stretched perilously'

by Calculated Risk on 3/22/2006 01:42:00 AM

The Christian Science Monitor reports: Homeowners stretched perilously. Excerpts:

Fully 27.1 percent of [Boston's] homeowners with a mortgage spent at least half their gross income on housing in 2004, according to the latest census figures available. Those costs, which include utilities and insurance as well as mortgage payments, were more than double the national rate of 11.7 percent and topped New York (25.9 percent), Los Angeles (26.5), San Francisco (20.4), and Chicago (20.3). Of the 25 biggest cities, only Miami had a higher rate (35.8 percent).Whatever happened to the 33% / 40% guidelines? Lenders used to require that mortgage payments didn't exceed 33% of a borrowers gross income and total debt payments couldn't exceed 40%.

The number of homes sold in Massachusetts dropped a whopping 21 percent in January compared with a year ago, the largest year-to-year decrease in monthly home sales in a decade. As a result, home values have begun to soften. Statewide, they actually fell slightly in January compared with a year ago.And there is the risk from exotic loans:

Such pressures are forcing a rising number of homeowners to erase their debts by forfeiting their homes. Foreclosure filings in the county that includes Boston nearly doubled in January from a year ago, ForeclosuresMass. says.

Mortgages are also riskier for many today. When 30-year, fixed-rate mortgages were standard, a rise in interest rates would have little effect on current homeowners. But in an era of adjustable-rate loans, it can exact a toll.

...

"This is the first decade that we have had this culture of pricing risk in home lending," says Susan Wachter, professor of real estate at the University of Pennsylvania. "What happens if someone loses a job?... If you are already spending 50 percent of your income toward a mortgage, there is no cushion."

Tuesday, March 21, 2006

UAE, Saudi considering to move reserves out of dollar

by Calculated Risk on 3/21/2006 05:15:00 PM

Forex reports: UAE, Saudi considering to move reserves out of dollar

WASHINGTON — A number of Middle Eastern central banks said on Tuesday they would seek to switch reserves from the US greenback to euros.

The United Arab Emirates said it was considering moving one-tenth of its dollar reserves to the euro, while the governor of the Saudi Arabian central bank condemned the decision by the United States to force Dubai Ports World to transfer its ownership to a ‘US entity,’ the UK Independent reported.

“Is it protectionism or discrimination? Is it okay for US companies to buy everywhere but it is not okay for other companies to buy the US?” said Hamad Saud Al Sayyari, the governor of the Saudi Arabian monetary authority.

The head of the United Arab Emirates central bank, Sultan Nasser Al Suweidi, said the bank was considering converting 10 per cent of its reserves from dollars to euros.

“They are contravening their own principles,” said Al Suweidi. “Investors are going to take this into consideration (and) will look at investment opportunities through new binoculars.”

The Commercial Bank of Syria has already switched the state’s foreign currency transactions from dollars to euros, Duraid Durgham head of the state-owned bank said. The decision by the bank of Syria follows the announcement by the White House calling on all US financial institutions to end correspondent accounts with Syria due to money-laundering concerns.

Syria’s Finance Minister Mohammad Al Hussein said: “Syria affirms that this decision and its timing are fundamentally political.”

Housing: A 'Painful' Soft Landing?

by Calculated Risk on 3/21/2006 09:42:00 AM

Jonathan Lansner writes in the OC Register: Even a 'soft landing' for home prices can be painful [for Orange County]. A few excerpts:

The much-discussed "soft landing" – where home appreciation moderates down to historical norms, or slightly lower – may create heartburn in the business climate.On mortgage equity withdrawal:

This year, the local housing market has started off slowly. Prices are still at last August's level. And sales activity hasn't been this sluggish since 1997. Forget the doomsday predictions of a market in a downward spiral. Just imagine how difficult it could be for the economy to thrive in what some might call a normal housing market.

Everyday folks have reaped rewards in several ways. Most notable: Borrowing against the profits in their home.And on housing related employment:

For example, 72,000 Orange Countians last year took out $6.1billion worth of home-equity loans, according to DataQuick. Curiously – and a possible sign of a slowing real estate market – that's down from 88,500 equity loans worth $7.2billion in 2004.

The cold cash generated by real estate isn't the only thing that's let consumers shop until they drop. It's that perception of housing wealth that's allowed them to spend freely.

By my math, real estate of all sorts – from lending to building to brokers to swabbing the floors of office towers – employed 253,000 in the fourth quarter of 2005.See the article for a graphic on housing related employment in OC.

That's up almost 80 percent since 1995. The boom turned the real estate community, so to speak, into 17 percent of all workers employed in Orange County.

Sunday, March 19, 2006

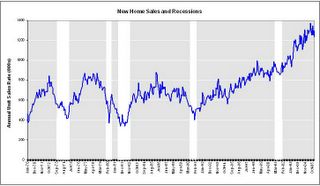

New Home Sales and Recessions

by Calculated Risk on 3/19/2006 11:30:00 PM

This is just a reminder of the historical relationship between falling New Home Sales (units) and recessions.

Click on graph for larger image.

The white columns are economic recessions as defined by NBER.

For consumer led recessions (all but the most recent recession in 2001), New Home Sales were falling prior to the onset of the recession. It appears that New Home Sales peaked last year and it would be concerning if they fell 20% or more from the most recent peak (to below 1.05 million units). New Home Sales for February will be released on Friday and are expected to be around 1.2 million units (SA, annual rate). It is also important to note that unit volumes have not fallen very far from the peak of 2005.

This doesn't imply a cause and effect relationship, but it is something to watch. If New Home Sales can stay above 1.1 million or so that probably increases the probabilities of a soft landing (just slower growth), as opposed to a hard landing (a recession).

Weird Creative Financing

by Calculated Risk on 3/19/2006 01:50:00 PM

David Streitfeld writes in the LA Times: For Home Loan Broker, Troubles Come With Creative Refinancing

Orange County homeowners ... essentially get paid to borrow money.Here is how it worked (completely legal):

Mark Gallagher, the founder and president of Park Place Funding in Laguna Hills, uses a technique ... to cut his customers in on the action, giving them a share of the premium he earns for placing loans with high interest rates.

The homeowners receive cash on a regular basis they can use for vacations, remodeling or to pay off that expensive house faster. Not surprisingly, they love their broker.

1) Park Place would charge a higher than normal interest rate (with customer approval).

2) Park Place would charge no fees and receive a rebate of upto 5% from the lender. On a $350K loan, Park Place would receive $17.5K.

3) Park Place would give a portion of the rebate to the customer (far more than enough to cover the extra interest payments for four months).

4) Four months later, Park Place would refinance the customer again and receive another rebate (the loan balance would stay the same). They had to wait four months or refund the rebate on the previous loan.

5) The lender (frequently National City Mortgage) would sell the loans to Freddie Mac. Freddie Mac would package the loans into investment pools. As long as the pools didn't have too many loans that were repaid early, everyone was happy.

Bizarre story! I expect that other problems will be exposed as the housing market slows.

Saturday, March 18, 2006

New Homes Sales vs. Construction Employment

by Calculated Risk on 3/18/2006 10:35:00 PM

For New Home Sales, it appears the peak of the housing cycle happened last year. However construction related employment is still rising. This is not unusual.

Click on graph for larger image.

The graph shows New Home Sales vs. Construction Employment since 1970.

Note that "Construction Employment" from the BLS includes all types of construction, not just residential construction.

Historically Construction Employment continued to rise for a year or more after the peak in housing transactions. Other housing related employment categories, like mortgage brokers, have already seen some layoffs - but based on historical data, construction will probably stay strong for most of 2006 unless sales fall dramatically.

Friday, March 17, 2006

UCLA: Housing Slowdown leads to "Great Uncertainty"

by Calculated Risk on 3/17/2006 06:32:00 PM

Drs. Leamer and Thornberg from UCLA's Anderson Forecast were quoted today on housing. From Contra Costa Times: Bay Area housing market cools

"We're at the peak and what happens next is a matter of great uncertainty," said Edward Leamer, director of UCLA Anderson Forecast.And from the San Francisco Chronicle: Bay Area housing market cools

... Christopher Thornberg, economist at the UCLA Anderson Forecast, predicts prices to hit a plateau later in the year, which could persist for an extended period. In addition, the downswing will have a direct impact on the construction, mortgage and real estate industries.It makes sense that a housing slowdown will impact the overall economy, but by how much remains unclear ... "a matter of great uncertainty".

"It's going to take the energy out of the economy, reducing the wealth effect and diminishing retail sales in [California], but it's not going to cause a recession," Thornberg said.

DQNews: Slowdown in Bay Area home sales, appreciation rate

by Calculated Risk on 3/17/2006 10:40:00 AM

DQNews reports: Slowdown in Bay Area home sales, appreciation rate

Bay Area home sales remained at their lowest level in five years in February, as price increases continued to slow, a real estate information service reported.

A total of 6,206 new and resale houses and condos were sold in the nine-county region last month. That was up 3.4 percent from 6,004 for January, and down 16.8 percent from 7,463 for February last year ... Last month was the eleventh in a row to see a year-over-year sales decline.

"We'll know more about what's going on once next month's numbers come in. March sales have a more typical purchase pattern than February's or January's. Right now we don't see anything ominous in the numbers, just a real estate cycle that is past the frenzy phase," said Marshall Prentice, DataQuick president.

The median price paid for a Bay Area home was $616,000 last month. That was up 1.5 percent from January's $607,000, and up 12.2 percent from $549,000 for February a year ago. The annual price increase was the lowest since prices rose 9.7 percent to $443,000 in January 2004.

It appears housing is in the 2nd stage of a slowdown - falling transactions (the first stage is rising inventories). On distress:

Indicators of market distress are still largely absent. The use of adjustable-rate mortgages has decreased significantly the last three months. Foreclosure rates are coming up from last year's low point, but are still below normal levels. Down payment sizes are stable and there have been no significant shifts in market mix ...