by Calculated Risk on 3/29/2006 10:10:00 AM

Wednesday, March 29, 2006

MBA: Mortgage Application Volume Ticks Up

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Ticks Up

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 571.7, an increase of 1.2 percent on a seasonally adjusted basis from 565.0 one week earlier. On an unadjusted basis, the Index increased 1.0 percent compared with the previous week but was down 15.0 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 2.7 percent to 404.1 from 393.6 the previous week whereas the Refinance Index decreased by 1.0 percent to 1558.4 from 1574.5 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.36 percent from 6.31 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 5.83 percent from 5.68 percent ...

| Total | -15.0% |

| Purchase | -14.3% |

| Refi | -16.1 |

| Fixed-Rate | -4.3% |

| ARM | -33.4% |

ARM activity has fallen 33% from last year. ARM rates will probably rise again next week with the increase in the FED Funds rate.

Purchase activity is off 14% from last year. This provides further evidence that housing is slowing and suggests that the substantial drop in February New Home Sales was not a statistical anomaly.

Comment Period Ends: Interagency Guidance on Nontraditional Mortgage Products

by Calculated Risk on 3/29/2006 01:32:00 AM

The extended comment period on the "Interagency Guidance on Nontraditional Mortgage Products" ends March 29, 2006. Currently there are twenty two responses although some are just requesting an extension. Here are some excerpts from the America's Community Bankers response:

We do not believe the Proposed Guidance is necessary because depository institutions already employ sufficient controls to confirm that these necessities are fulfilled.I expect more responses to be filed on Wednesday.

However, if the Agencies intend to issue a final regulation on alternative mortgage instruments, it should be substantially modified before adoption. We believe that the Proposed Guidance imposes excessive regulatory burdens and restrictions that may impede an insured depository institution from offering the widest array of products available to serve their communities responsibly, without demonstration of a corresponding benefit to consumers.

...

We also believe that it is unreasonable to impose on insured depository institutions restrictive guidelines for alternative products that do not apply to non-regulated brokers and lenders.

Tuesday, March 28, 2006

Real General Fund Revenues & Outlays

by Calculated Risk on 3/28/2006 10:42:00 PM

UPDATE: Kash has a great post today: The True Fiscal Nightmare

The following graph shows the US Government General Fund Revenues and Outlays since 1992 in real terms (2000 dollars).

Click on graph for larger image.

The CBO is the source for all budget data. Revenues in 2005 have almost reached 1998 levels in real terms.

The upturn in 2005 was mostly related to significantly higher corporate taxes. Corporate taxes increased from $189 Billion in 2004 to $278 Billion in 2005 (nominal). It is doubtful that corporate taxes will continue to rise at such a rapid rate.

As Bruce Bartlett wrote today: Bush Tax Cuts Don't Pay For Themselves

It seems to me that the normal cyclical expansion after the end of the recession in 2001 has done far more to raise revenue than any Laffer curve effect. Revenues are simply returning to trend, nothing more.

In short, there is very little likelihood that revenues are rising because the 2003 tax cuts or would fall if they are not extended.

For outlays there has been a surge in spending since 2000. Most of the increase in real spending has been related to Defense and Medical expenditures (Medicare and Medicaid). And these spending increase don't include the impact of Bush's prescription drug benefit - so medical spending will even be worse going forward.

Part of the reason real outlays were flat in the '90s was because declining defense spending offset increases for medical spending (see graph for 1992 to 2000). From a demographics perspective this period was also very favorable (see The Best of Times).

This should offer some guidelines for fiscal policy: 1) reverse some or all of the Bush tax cuts (or at least let them expire), 2) reduce spending on defense, and 3) meaningful healthcare reform.

Joshua Bolten: "Budget Deficit Falling Fast"

by Calculated Risk on 3/28/2006 12:43:00 PM

Joshua Bolten, the Master of the Budget Disaster on July 14, 2005:

"The U.S. budget deficit is falling, and it is falling fast."Meanwhile back in the real world, the US General Fund deficit will set a new record this year of close to $600 Billion. More Bolten:

"...the budget deficit is forecast to continue to fall, to $162 billion in 2009, or 1.1 percent of GDP - less than half the size of the average deficit over the last 40 years."This statement isn't just wrong, its dishonest. Until about 20 years ago, the Unified budget deficit and the General Fund deficit were about the same size. When Reagan (following the advice of the Greenspan Commission) upped the SS payroll tax, SS started running huge surpluses. These surpluses are not included in the General Fund. But Bolten is using the Unified Budget - and masking the General Fund deficits with SS surpluses. Over a period of 40 years Bolten should be comparing to the General Fund deficit as a percentage of GDP, not the Unified Budget deficit. That is dishonest.

Besides, Bolten was also wrong. The way things are going, the US might have a $1 Trillion General Fund budget deficit in 2009 (probably more like $800 Billion).

Boltie, you're doing a heck of a job!

Avian Flu

by Calculated Risk on 3/28/2006 01:48:00 AM

The NYTimes Science Section has a series of articles on the Avian Flu today.

On the Front: A Pandemic Is Worrisome but 'Unlikely'

Having observed A(H5N1) for many years in Asia, he thinks it is unlikely that the virus is poised to jump species, becoming readily transmissible to humans or among them. Nor does he believe the mantra that a horrific influenza pandemic is inevitable or long overdue. He points out that the only prior pandemic with a devastating death toll was in 1918, and he says that may have been "a unique biological event."At the U.N.: This Virus Has an Expert 'Quite Scared'

"For years, they have been telling us it's going to happen — and it hasn't," said Dr. Farrar, director of the Oxford University Clinical Research Unit at the hospital in Vietnam. "Billions of chickens in Asia have been infected and millions of people lived with them — we in Asia are intimate with our poultry — and less than 200 people have gotten infected.

"That tells you that the constraints on the virus are considerable," he continued. "It must be hard for this virus to jump."

...Dr. Nabarro describes himself as "quite scared," especially since the disease has broken out of Asia and reached birds in Africa, Europe and India much faster than he expected it to.From the Chickens' Perspective, the Sky Really Is Falling

"That rampant, explosive spread," he said, "and the dramatic way it's killing poultry so rapidly suggests that we've got a very beastly virus in our midst."

...

But he repeatedly said that he is more scared than he was when he took the job in September. In October, he predicted that the virus would reach Africa, where surveillance is so poor that deaths of chickens or humans could easily go undiagnosed for weeks. Last month, he was proved right.

The infection of millions more birds in many more countries "has led to an exponential increase of the load of virus in the world," he said. And influenza is a fast-mutating virus. Each infected bird and person is actually awash in minutely different strains, and it takes lengthy genetic testing to sequence each one — so if a pandemic strain were to appear, "it might be quite difficult for us to pick up that change when it happens."

"If you're a chicken," Dr. Julie Gerberding, director of the Centers for Disease Control and Prevention, said at a recent conference on avian flu, "this is a pandemic."At least there is some good news; I'm not a chicken.

...

By some estimates, more than 200 million domestic chickens, ducks and geese have already either died of the disease or been killed on the order of public health authorities to prevent its spread.

Saturday, March 25, 2006

Economists on Housing: 'Sky not Falling'

by Calculated Risk on 3/25/2006 02:15:00 PM

From Leslie Berkman at The Press-Enterprise - a few quotes:

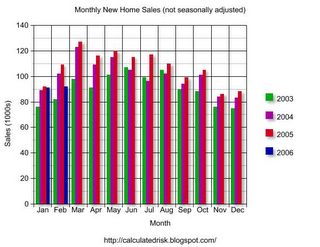

"There are an awful lot of analysts and think tanks out there telling everybody in the world the sky is falling, and they have been consistently wrong," said John Karevoll, an analyst with DataQuick.These seem like reasonable arguments, except February is typically not that slow of a month. The monthly rankings are as follows over the 2000-2005 period (listed in order of number of transcations):

Karevoll questioned the Department of Commerce home-sales statistics, which he said are based on a small sampling projected over a national market. February is an extremely slow month and not good for making predictions, he said.

Karevoll and other analysts said the performance of the housing market in March will better indicate the trend.

Top months: March, May, April, June (the Spring buying season)

Middle Months: August, July, February, October, September

Slow Months: January, November, December.

"One month doesn't count," Alan Nevin, chief economist for the California Building Industry Association, said of the Commerce Department February results. He called the cooling of the national housing market "miniscule."I agree that one month doesn't count and February may be revised significantly. But I think the MBA Purchase Index shows there has been a double digit percentage drop in transactions from late last year. That is not "miniscule".

Chris Thornberg, senior economist for the UCLA Anderson Forecast, also was unimpressed by the reported February drop in national new-home sales.And from the Commerce Department:

"What I see is that the overall sales numbers are high, but they do seem like they have peaked and they are beginning to trend down slowly," he said.

Steve Berman, survey statistician for the U.S. Department of Commerce, said that finding has a statistically large margin of error. More significant, he said, is that in the 12 months ending in February, the nation's new-home sales declined 13.4 percent.The sky may not be falling, but as both Berman and Thornberg point out: housing sales are clearly trending down.

Berman said concerns about February being an atypical sales month are unfounded because the department's sales numbers are adjusted for seasonal differences so they will project an annual trend.

Berman said, according to his figures, national new-home sales have been declining since reaching a record level in July.

New-home sales in February, he said, represents "a significant drop but still a historically high number. Is the sky falling? Not really."

Friday, March 24, 2006

New Home Sales and Recessions: Part II

by Calculated Risk on 3/24/2006 02:34:00 PM

The following graph is an update to my previous post and includes the data for February. Its important to note that New Home Sales data can be heavily revised and February is just one data point.

Click on graph for larger image.

The white periods are recessions as defined by NBER. The New Home Sales economic indicator is now flashing yellow.

I'd be very concerned if New Home Sales fall below about 1.05 million units annual rate for several months.

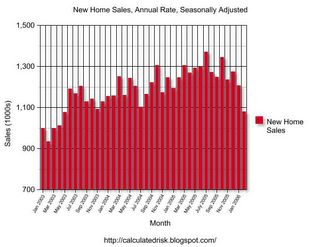

February New Home Sales: 1.08 Million

by Calculated Risk on 3/24/2006 10:00:00 AM

According to the Census Bureau report, New Home Sales in February were at a seasonally adjusted annual rate of 1.08 million. January's sales were revised down slightly to 1.207 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

The Not Seasonally Adjusted monthly rate was 92,000 New Homes sold, slightly higher than the revised 91,000 in January.

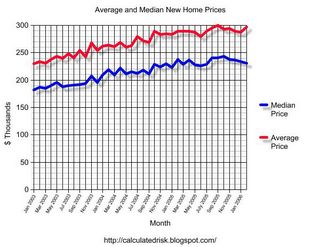

On a year over year basis, February 2006 sales were 15.5% lower than February 2005.

The median and average sales prices are steady.

The median sales price of new houses sold in February 2006 was $230,400; the average sales price was $296,700.

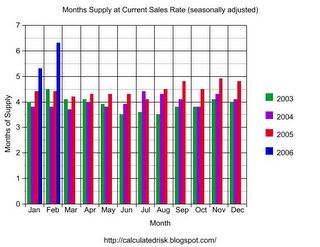

The seasonally adjusted estimate of new houses for sale at the end of February was 548,000. This represents a supply of 6.3 months at the current sales rate.

The 548,000 units of inventory is another all time record for new houses for sale. On a months of supply basis, inventory is significantly above the level of recent years.

This report is very weak, except for the median and average prices. One month does not make a trend, but New Home Sales have fallen in six of the last seven months.

Thursday, March 23, 2006

FDIC: Scenarios for the Next U.S. Recession

by Calculated Risk on 3/23/2006 09:37:00 PM

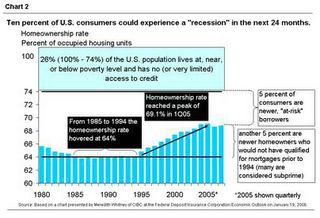

From the FDIC: Scenarios for the Next U.S. Recession. On housing:

The risk of a housing slowdown is another area of concern going forward. The recent housing boom has been unprecedented in modern U.S. history.2 It has been suggested by many analysts that the housing boom has been a significant contributor to gains in consumer spending in recent years. Indeed, a number of the FDIC roundtable panelists pointed to the apparent connection between rising real estate wealth during the past four years and the sustained strength in consumer spending during that period. Because consumer spending accounts for over two-thirds of U.S. economic activity, any shock to consumer spending, such as that which might be caused by a housing slowdown, is a concern to overall economic growth.Much more in article.

It is very likely that housing wealth has been a significant factor behind growth in consumer spending. Through the use of cash-out refinancing, increased mortgage balances, and greater use of home equity lines of credit, as well as through owners selling homes outright and cashing in on their accumulated equity, it is estimated that anywhere from $444 billion to $600 billion was liquidated from housing wealth during 2005.3 Whichever estimate one uses, the total almost surely eclipses the $375 billion gain in after-tax income for the year. While probably not all of the home equity liquidated during 2005 fed consumption spending (much of it was invested into other assets, including second or vacation homes), these statistics illustrate how important home equity has become as a source of household liquidity.

There are concerns, however, that changes in the structure of mortgage lending could pose new risks to housing. These changes are most evident in the rising popularity of interest-only and payment-option mortgages, which allow borrowers to afford more expensive homes relative to their income, but which also increase variability in borrower payments and loan balances. To the extent that some borrowers with these innovative mortgages may not fully understand the potential variability in their payments over time, the credit risk associated with these instruments could be difficult to evaluate. In addition, the degree of effective leverage in home-purchase loans has risen in recent years with the advent of so-called “piggy-back” mortgage structures that substitute a second-lien mortgage for some or all of the traditional down payment. Meredith Whitney noted at the roundtable that the recent use of revolving home equity lines of credit in lieu of down payments has enabled an increasing number of first-time buyers to qualify for homes that they otherwise could not afford. (Click here to link to the complete text of Ms. Whitney’s remarks in the transcript.)

Overall, Ms. Whitney’s research suggests that a group that includes approximately 10 percent of U.S. households may be at heightened risk of credit problems in the current environment. This group mainly includes households that gained access to mortgage credit for the first time during the recent expansion of subprime and innovative mortgage loan programs. Not only do many borrowers in this group have pre-existing credit problems, they may also be more vulnerable than other groups to rising interest rates because of their reliance on interest-only and payment-option mortgages. These types of mortgages have the potential for significant payment shock that occurs when low introductory interest rates expire, when index rates rise, or when these loans eventually begin to require regular amortization of principal including any deferred interest that has accrued (see Chart 2).

Because of the importance of mortgage lending to bank and thrift earnings, the large-scale changes that have taken place in this sector will clearly have implications for the banking outlook. Bank exposure to mortgage and home equity lending is now at peak levels. As reported in the FDIC’s latest Quarterly Banking Profile (http://www2.fdic.gov/qbp/index.asp), 1-4 family residential mortgages and home equity lines of credit accounted for a combined 38 percent of total loans and leases in fourth quarter 2005, well above the roughly one-third share maintained at the beginning of the decade.

Housing analysts are in disagreement as to whether or not recent signs point to a moderation in housing activity or the beginning of a more significant correction. Currently, inventories of unsold homes and sales volumes are among the indicators pointing to a housing slowdown. Inventories of unsold existing homes rose from under four months of supply at current sales volume in early 2005 to 5.3 months of supply as of January 2006. Meanwhile, the pace of existing home sales has been trending lower since last summer. A clear trend in the direction of home sales and prices may not be evident until the completion of the peak spring and summer selling season later this year.

Many analysts argue that home prices in the hottest coastal markets, especially in the Northeast and California, could be poised to decline in the near future. For example, PMI Mortgage Insurance Company analysts place essentially even odds that home prices will decline during the next two years in a dozen cities in California and the Northeast.4 Should home prices either stop rising or begin to fall in these areas, local banks and thrifts would need to look to non-residential loans to support revenue growth.

Art McMahon of the OCC outlined the banking industry’s reliance on mortgage lending during his remarks at the FDIC roundtable. (Click here to link to the full text of Mr. McMahon’s remarks in the transcript.) Mr. McMahon acknowledged that previous historical episodes of large metro-area home price declines were generally the result of severe local economic distress.5 Should some regional housing market downturns occur, banks may be hard-pressed to generate non-residential loans in great volume. Historically, regional housing price declines have tended to be associated with a slowdown in small business activity, with banks making fewer commercial and industrial loans in addition to suffering mortgage and consumer portfolio stress.

Existing Home Sales

by Calculated Risk on 3/23/2006 10:05:00 AM

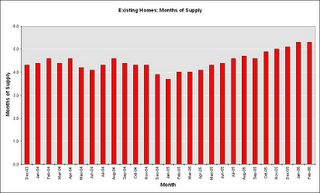

UPDATE: The National Association of Realtors (NAR) released their data for Existing Home Sales in February. NAR reported:

Existing-home rose in February following five months of decline, indicating a stabilization is taking place in the market, according to the National Association of Realtors®.Existing Home Sales are a trailing indicator. The sales are reported at close of escrow, so February sales reflect agreements reached in January. That is why weather in January is important.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 5.2 percent to a seasonally adjusted annual rate1 of 6.91 million units in February from an upwardly revised pace of 6.57 million in January, but were 0.3 percent below a 6.93 million-unit level in February 2005.

David Lereah, NAR’s chief economist, said mild weather appears to be responsible for some of the gain. “Weather conditions across much of the country were unseasonably mild in January and likely were a factor in higher levels of buyer activity, which boosted sales that closed in February,” he said. “Higher interest rates had been tapping the breaks, notably in higher-cost housing markets since mortgage interest rates trended up last fall, but we’re seeing signs of stabilization in the market now with the sales rebound. Home sales should level-out in the months ahead.”

Also note that mortgage applications fell about 10% in February and March (compared to January). This probably indicates that existing home sales will fall in the coming months on a seasonally adjusted (SA) basis.

The MBA Purchase Index averaged 455 in December, 453 in January, 407 in February and 399 so far in March (all numbers SA).

Click on graph for larger image.

Existing Home inventories rose to over 3 million units in February. This is the start of the listing season, and I expect inventories to continue to rise. If sales fall about 10% (as indicated by the MBA purchase index) and the inventory continues to rise that could put the months of supply over 6 months.

If sales fall about 10% (as indicated by the MBA purchase index) and inventories continues to rise at the current pace, the months of supply could be over 6 months by Summer. Usually 6 to 8 months of inventory starts causing pricing problem - and over 8 months a significant problem.

New Home sales (released tomorrow) is usually a better indicator of the housing market.