by Calculated Risk on 4/03/2006 04:30:00 PM

Monday, April 03, 2006

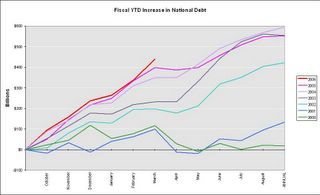

Record Increase in National Debt

Another month, another record increase in the National debt.

UPDATE: For a related post, see pgl's Snow Must Go.

Click on graph for larger image.

For the first six months of the 2006 fiscal year (starts Oct 1st), the National Debt has increased $438.4 Billion. The previous record was $397.8 Billion for the first six months of fiscal 2005.

"The U.S. budget deficit is falling, and it is falling fast."

Joshua Bolten, July 14, 2005, as OMB Director (soon to be Chief of Staff)

Pending Homes Sales Index Slightly Lower

by Calculated Risk on 4/03/2006 11:27:00 AM

The National Association of Realtors (NAR) released their Pending Home Sales Index today: Pending Home Sales Leveling Out, Market Balancing

The Pending Home Sales Index, based on contracts signed in February, slipped 0.8 percent to a level of 117.7 from an upwardly revised index of 118.6 in January, and is 5.2 percent below February 2005.The purpose of this index was to provide more timely data similar to New Home Sales. The index is reported when the contract is signed, as opposed to when escrow closes (as for Existing Home Sales). I haven't found the Index useful, except apparently as a marketing tool for NAR.

David Lereah, NAR’s chief economist, said most of the cooling in the housing market has already occurred. "We can expect a historically strong housing market moving forward, earmarked by generally balanced conditions across the country and fairly stable levels of home sales with some month-to-month fluctuations," he said. "This normalization is healthy because it is taking a lot of the pressure off of the decision process for both home buyers and sellers – pressure that was driving abnormal rates of price growth across much of the country over the last few years."

Friday, March 31, 2006

Housing Posts

by Calculated Risk on 3/31/2006 12:01:00 PM

Recent housing posts of interest:

Shiller on Housing: From the Berkeley Electronic Press, Dr. Robert Shiller writes Long-Term Perspectives on the Current Boom in Home Prices (require email address). Dr. Thoma provides some excerpts here and graphs. UPDATE: Professor Thoma also has excerpts of Dr. Baker's: Government Should Preemptively Burst the Housing Bubble

New Home Sales and Recessions See graph for relationship between New Home Sales and recessions.

MBA Mortgage Application Volume See graph.

Purchase activity is off 14% from last year. This provides further evidence that housing is slowing and suggests that the substantial drop in February New Home Sales was not a statistical anomaly.

February New Home Sales: 1.08 Million. See graphs.

This report is very weak, except for the median and average prices. One month does not make a trend, but New Home Sales have fallen in six of the last seven months.

Comment Period Ends: Interagency Guidance on Nontraditional Mortgage Products

Update on the new mortgage guidance and the comments from banks and lenders (mostly negative).

February: Negative Savings Continues

by Calculated Risk on 3/31/2006 10:32:00 AM

The Bureau of Economic Analysis (BEA) reported Personal Income and Outlays for February today.

Personal income increased $31.5 billion, or 0.3 percent, and disposable personal income (DPI) increased $21.7 billion, or 0.2 percent, in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $13.1 billion, or 0.1 percent.The AP's Crutsinger on consumer spending:

Consumer spending, which had soared because of unusually warm weather in January, slowed sharply in February while Americans' incomes grew by the smallest amount in three months.Also, personal savings remained negative: -0.5% (as a percent of disposable personal income) for both January and February. This is worse than the Q4 2005 rate of -0.2%. In dollars, personal savings was -$43.8 Billion (SA annual rate) for February.

The Commerce Department reported Friday that personal consumption spending rose by a tiny 0.1 percent last month, the weakest gain in six months. It followed a huge 0.8 percent surge in January that had reflected a mild winter that lured shoppers to the stores to spend their Christmas gift cards.

Consumers had to borrow more (or dip into savings) as the increase in spending slowed.

Thursday, March 30, 2006

Shiller on Housing

by Calculated Risk on 3/30/2006 06:17:00 PM

From the Berkeley Electronic Press, Dr. Robert Shiller writes Long-Term Perspectives on the Current Boom in Home Prices.

UPDATE: The Economist's Voice needs your email address to access the artilce. Fortunately Dr. Thoma provides some excerpts here.

Dr. Dean Baker also has an article on housing in this month's Economist's Voice: The Menace of an Unchecked Housing Bubble

Why are Borrowers Still Using ARMs?

by Calculated Risk on 3/30/2006 02:11:00 PM

The MBA noted this week that 28.7% of mortgage applications were for ARMs. That number seems very high and I'm wondering why borrowers are still using ARMs.

In the weekly Freddie Mac interest rate report, 'the 30-year fixed-rate mortgage averaged 6.32 percent' and the 'one-year Treasury-indexed ARMs averaged 5.41 percent' for the previous week.

Ignoring borrowing costs (slightly higher for ARMs), borrowers would save 0.91% in interest payments the first year by using an ARM. The margin on the ARM is 2.79%, so the current fully adjusted rate would be 7.62%. Usually the interest rate adjustment is capped to 1% per year, so the ARM borrowers would be paying 6.41% next year and 7.41% the following year (assuming rates stay steady).

So when would an ARM make sense? Here are some ideas:

1) If the borrower is only going to own the home for one or two years.

2) If borrowers expects interest rates to decline - the yield on the One Year treasury would have to decline from 4.8% to an average of 3.5% over the course of the loan to break even.

3) If the borrower is leveraging themselves into a more expensive home, expecting the extra home price appreciation to make up for the higher payments in the future.

None of these reasons make much sense to me in the current environment.

Wednesday, March 29, 2006

UCLA: Economists Predict California Slowdown

by Calculated Risk on 3/29/2006 11:43:00 AM

The LA Times reports: Economists Predict State Slowdown

A slowdown in the California economy will begin late this year and continue for the next two years as a cooling housing market leads to job losses in construction and related industries, according to the latest UCLA Anderson Forecast, to be released today.A few tidbits:

But there is no evidence that a recession is near, the widely watched quarterly forecast said.

"We see the housing crunch as a force that will slow growth, not stop it," said Christopher Thornberg, senior economist and author of UCLA's state forecast.

...

Now, the trend is becoming clear: The housing boom that has driven the state economy has peaked and is starting to soften, Thornberg said.

"The only debate now is how hard a landing there will be and what will it mean for the general economy," said Thornberg,

...

Over the last two years, construction jobs have made up nearly a fourth of all new payroll jobs in the state — "far above any normal level," Thornberg said.

...

As many as 200,000 jobs in construction and related fields will be lost in the state, including contractions in real estate sales and mortgage banking positions, the report said.

...

Although UCLA forecasters have consistently been more pessimistic about the housing boom and California's economy than many other analysts, their views are notable because they were among the first economists to predict the 2001 recession.

...

"There is no justification for the prices we're seeing now," Thornberg said.

He predicts that annual home-price appreciation will slow to 6% by the end of this year and will flatten in 2007.

He also sees a 27% decline in home sales this year and next

MBA: Mortgage Application Volume Ticks Up

by Calculated Risk on 3/29/2006 10:10:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Ticks Up

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 571.7, an increase of 1.2 percent on a seasonally adjusted basis from 565.0 one week earlier. On an unadjusted basis, the Index increased 1.0 percent compared with the previous week but was down 15.0 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 2.7 percent to 404.1 from 393.6 the previous week whereas the Refinance Index decreased by 1.0 percent to 1558.4 from 1574.5 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.36 percent from 6.31 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 5.83 percent from 5.68 percent ...

| Total | -15.0% |

| Purchase | -14.3% |

| Refi | -16.1 |

| Fixed-Rate | -4.3% |

| ARM | -33.4% |

ARM activity has fallen 33% from last year. ARM rates will probably rise again next week with the increase in the FED Funds rate.

Purchase activity is off 14% from last year. This provides further evidence that housing is slowing and suggests that the substantial drop in February New Home Sales was not a statistical anomaly.

Comment Period Ends: Interagency Guidance on Nontraditional Mortgage Products

by Calculated Risk on 3/29/2006 01:32:00 AM

The extended comment period on the "Interagency Guidance on Nontraditional Mortgage Products" ends March 29, 2006. Currently there are twenty two responses although some are just requesting an extension. Here are some excerpts from the America's Community Bankers response:

We do not believe the Proposed Guidance is necessary because depository institutions already employ sufficient controls to confirm that these necessities are fulfilled.I expect more responses to be filed on Wednesday.

However, if the Agencies intend to issue a final regulation on alternative mortgage instruments, it should be substantially modified before adoption. We believe that the Proposed Guidance imposes excessive regulatory burdens and restrictions that may impede an insured depository institution from offering the widest array of products available to serve their communities responsibly, without demonstration of a corresponding benefit to consumers.

...

We also believe that it is unreasonable to impose on insured depository institutions restrictive guidelines for alternative products that do not apply to non-regulated brokers and lenders.

Tuesday, March 28, 2006

Real General Fund Revenues & Outlays

by Calculated Risk on 3/28/2006 10:42:00 PM

UPDATE: Kash has a great post today: The True Fiscal Nightmare

The following graph shows the US Government General Fund Revenues and Outlays since 1992 in real terms (2000 dollars).

Click on graph for larger image.

The CBO is the source for all budget data. Revenues in 2005 have almost reached 1998 levels in real terms.

The upturn in 2005 was mostly related to significantly higher corporate taxes. Corporate taxes increased from $189 Billion in 2004 to $278 Billion in 2005 (nominal). It is doubtful that corporate taxes will continue to rise at such a rapid rate.

As Bruce Bartlett wrote today: Bush Tax Cuts Don't Pay For Themselves

It seems to me that the normal cyclical expansion after the end of the recession in 2001 has done far more to raise revenue than any Laffer curve effect. Revenues are simply returning to trend, nothing more.

In short, there is very little likelihood that revenues are rising because the 2003 tax cuts or would fall if they are not extended.

For outlays there has been a surge in spending since 2000. Most of the increase in real spending has been related to Defense and Medical expenditures (Medicare and Medicaid). And these spending increase don't include the impact of Bush's prescription drug benefit - so medical spending will even be worse going forward.

Part of the reason real outlays were flat in the '90s was because declining defense spending offset increases for medical spending (see graph for 1992 to 2000). From a demographics perspective this period was also very favorable (see The Best of Times).

This should offer some guidelines for fiscal policy: 1) reverse some or all of the Bush tax cuts (or at least let them expire), 2) reduce spending on defense, and 3) meaningful healthcare reform.