by Calculated Risk on 4/04/2006 11:54:00 AM

Tuesday, April 04, 2006

More Comments on Interagency Guidance on Nontraditional Mortgage Products

UPDATE: Finally, here is the MBA's response to the new guidance.

Mortgage lenders, operating within this country’s sophisticated real estate finance system, respond to a number of influences in determining their ability to originate mortgages in manner that is profitable, as well as safe and sound. The primary influence for lenders are the signals received from secondary mortgage market investors. A lender originating a large number of mortgages with an unacceptable level of risk will find itself facing significant price disadvantages in the market. These signals prompt lenders to alter product features, introduce new features and remove features that do not work. These product changes are immediate. In this manner, the private market can and does correct for excess risk more quickly than can a regulator who necessarily must move at a more deliberate pace. MBA believes that market signals have already addressed many of the concerns expressed by the Agencies in the Proposed Guidance.Emphasis added.

In simple English: Let the market provide guidance.

Original Post: The comment period ended on March 29th. Today the FDIC posted some more comments (35 total).

From the American Bankers Association:

While the banking industry agrees that these products need to be carefully managed, the industry has a number of concerns about the proposed Guidance. In brief, we believe that:Looks like fun reading. Enjoy.

1. The Guidance overstates the risks of these mortgage products.

2. The Guidance is overly prescriptive and needs to be made more flexible and clearer.

3. The Guidance combines safety and soundness guidance with consumer protection guidance, creating confusion that is best addressed by separating them.

4. The Guidance's detailed consumer protection recommendations add a layer of additional disclosure before and around the legally required Regulation Z disclosures, thereby perhaps creating significant compliance problems.

5. The Guidance's new consumer protection will only apply to regulated financial institutions and their affiliates and not to other lenders, which is inconsistent with other consumer provisions under Regulations B and Z and Section 5 of the Federal Trade Commission ACT (unfair and deceptive practices) and which leaves a significant portion of the mortgage industry unaffected.

FDIC State Profiles

by Calculated Risk on 4/04/2006 11:00:00 AM

The FDIC released their Spring state economic profiles this morning. Check out your state here.

Here are some excerpts from the California profile on employment, housing and construction jobs.

* Elevated home price growth contributed to strong employment gains in the state’s construction sector which increased 6.7 percent in fourth quarter, compared to 1.5 percent for all other sectors, and accounted for about 1 in 5 new jobs (see Chart 1). But, higher interest rates, reduced housing affordability, and rising building costs may limit new construction and slow job growth in this sector going forward.

* California home prices continued to increase at a robust pace of 21.1 percent in fourth quarter 2005, up from the third quarter and well above the national average. Similar to employment patterns, price gains in Central Valley markets typically topped the state average, but San Diego area home price growth slumped from year-ago levels to the slowest pace among California metropolitan markets.

* Innovative mortgages and investors may be buoying California housing demand. Interest-only and negative amortization loans accounted for 69 percent of non-prime mortgage originations in California in the first 11 months of 2005. During the same period, investors and second-home purchasers accounted for 15 percent of California Alt-A mortgage originations.

Monday, April 03, 2006

Construction Spending and New Home Sales

by Calculated Risk on 4/03/2006 06:16:00 PM

My new post is up on Angry Bear: Housing: Construction Spending Up, Sales Down

Check out the second graph showing the divergence between sales and single family construction spending.

Best to all.

Record Increase in National Debt

by Calculated Risk on 4/03/2006 04:30:00 PM

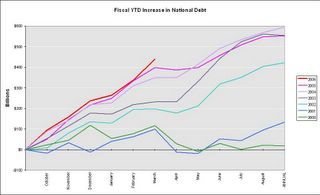

Another month, another record increase in the National debt.

UPDATE: For a related post, see pgl's Snow Must Go.

Click on graph for larger image.

For the first six months of the 2006 fiscal year (starts Oct 1st), the National Debt has increased $438.4 Billion. The previous record was $397.8 Billion for the first six months of fiscal 2005.

"The U.S. budget deficit is falling, and it is falling fast."

Joshua Bolten, July 14, 2005, as OMB Director (soon to be Chief of Staff)

Pending Homes Sales Index Slightly Lower

by Calculated Risk on 4/03/2006 11:27:00 AM

The National Association of Realtors (NAR) released their Pending Home Sales Index today: Pending Home Sales Leveling Out, Market Balancing

The Pending Home Sales Index, based on contracts signed in February, slipped 0.8 percent to a level of 117.7 from an upwardly revised index of 118.6 in January, and is 5.2 percent below February 2005.The purpose of this index was to provide more timely data similar to New Home Sales. The index is reported when the contract is signed, as opposed to when escrow closes (as for Existing Home Sales). I haven't found the Index useful, except apparently as a marketing tool for NAR.

David Lereah, NAR’s chief economist, said most of the cooling in the housing market has already occurred. "We can expect a historically strong housing market moving forward, earmarked by generally balanced conditions across the country and fairly stable levels of home sales with some month-to-month fluctuations," he said. "This normalization is healthy because it is taking a lot of the pressure off of the decision process for both home buyers and sellers – pressure that was driving abnormal rates of price growth across much of the country over the last few years."

Friday, March 31, 2006

Housing Posts

by Calculated Risk on 3/31/2006 12:01:00 PM

Recent housing posts of interest:

Shiller on Housing: From the Berkeley Electronic Press, Dr. Robert Shiller writes Long-Term Perspectives on the Current Boom in Home Prices (require email address). Dr. Thoma provides some excerpts here and graphs. UPDATE: Professor Thoma also has excerpts of Dr. Baker's: Government Should Preemptively Burst the Housing Bubble

New Home Sales and Recessions See graph for relationship between New Home Sales and recessions.

MBA Mortgage Application Volume See graph.

Purchase activity is off 14% from last year. This provides further evidence that housing is slowing and suggests that the substantial drop in February New Home Sales was not a statistical anomaly.

February New Home Sales: 1.08 Million. See graphs.

This report is very weak, except for the median and average prices. One month does not make a trend, but New Home Sales have fallen in six of the last seven months.

Comment Period Ends: Interagency Guidance on Nontraditional Mortgage Products

Update on the new mortgage guidance and the comments from banks and lenders (mostly negative).

February: Negative Savings Continues

by Calculated Risk on 3/31/2006 10:32:00 AM

The Bureau of Economic Analysis (BEA) reported Personal Income and Outlays for February today.

Personal income increased $31.5 billion, or 0.3 percent, and disposable personal income (DPI) increased $21.7 billion, or 0.2 percent, in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $13.1 billion, or 0.1 percent.The AP's Crutsinger on consumer spending:

Consumer spending, which had soared because of unusually warm weather in January, slowed sharply in February while Americans' incomes grew by the smallest amount in three months.Also, personal savings remained negative: -0.5% (as a percent of disposable personal income) for both January and February. This is worse than the Q4 2005 rate of -0.2%. In dollars, personal savings was -$43.8 Billion (SA annual rate) for February.

The Commerce Department reported Friday that personal consumption spending rose by a tiny 0.1 percent last month, the weakest gain in six months. It followed a huge 0.8 percent surge in January that had reflected a mild winter that lured shoppers to the stores to spend their Christmas gift cards.

Consumers had to borrow more (or dip into savings) as the increase in spending slowed.

Thursday, March 30, 2006

Shiller on Housing

by Calculated Risk on 3/30/2006 06:17:00 PM

From the Berkeley Electronic Press, Dr. Robert Shiller writes Long-Term Perspectives on the Current Boom in Home Prices.

UPDATE: The Economist's Voice needs your email address to access the artilce. Fortunately Dr. Thoma provides some excerpts here.

Dr. Dean Baker also has an article on housing in this month's Economist's Voice: The Menace of an Unchecked Housing Bubble

Why are Borrowers Still Using ARMs?

by Calculated Risk on 3/30/2006 02:11:00 PM

The MBA noted this week that 28.7% of mortgage applications were for ARMs. That number seems very high and I'm wondering why borrowers are still using ARMs.

In the weekly Freddie Mac interest rate report, 'the 30-year fixed-rate mortgage averaged 6.32 percent' and the 'one-year Treasury-indexed ARMs averaged 5.41 percent' for the previous week.

Ignoring borrowing costs (slightly higher for ARMs), borrowers would save 0.91% in interest payments the first year by using an ARM. The margin on the ARM is 2.79%, so the current fully adjusted rate would be 7.62%. Usually the interest rate adjustment is capped to 1% per year, so the ARM borrowers would be paying 6.41% next year and 7.41% the following year (assuming rates stay steady).

So when would an ARM make sense? Here are some ideas:

1) If the borrower is only going to own the home for one or two years.

2) If borrowers expects interest rates to decline - the yield on the One Year treasury would have to decline from 4.8% to an average of 3.5% over the course of the loan to break even.

3) If the borrower is leveraging themselves into a more expensive home, expecting the extra home price appreciation to make up for the higher payments in the future.

None of these reasons make much sense to me in the current environment.

Wednesday, March 29, 2006

UCLA: Economists Predict California Slowdown

by Calculated Risk on 3/29/2006 11:43:00 AM

The LA Times reports: Economists Predict State Slowdown

A slowdown in the California economy will begin late this year and continue for the next two years as a cooling housing market leads to job losses in construction and related industries, according to the latest UCLA Anderson Forecast, to be released today.A few tidbits:

But there is no evidence that a recession is near, the widely watched quarterly forecast said.

"We see the housing crunch as a force that will slow growth, not stop it," said Christopher Thornberg, senior economist and author of UCLA's state forecast.

...

Now, the trend is becoming clear: The housing boom that has driven the state economy has peaked and is starting to soften, Thornberg said.

"The only debate now is how hard a landing there will be and what will it mean for the general economy," said Thornberg,

...

Over the last two years, construction jobs have made up nearly a fourth of all new payroll jobs in the state — "far above any normal level," Thornberg said.

...

As many as 200,000 jobs in construction and related fields will be lost in the state, including contractions in real estate sales and mortgage banking positions, the report said.

...

Although UCLA forecasters have consistently been more pessimistic about the housing boom and California's economy than many other analysts, their views are notable because they were among the first economists to predict the 2001 recession.

...

"There is no justification for the prices we're seeing now," Thornberg said.

He predicts that annual home-price appreciation will slow to 6% by the end of this year and will flatten in 2007.

He also sees a 27% decline in home sales this year and next