by Calculated Risk on 4/05/2006 03:06:00 PM

Wednesday, April 05, 2006

NAR: Second Home Sales Hit Another Record in 2005

The National Association of Realtors reports: Second Home Sales Hit Another Record in 2005; Market Share Rises

Vacation- and investment-home sales both set records in 2005, with the combined total of second home sales accounting for four out of 10 residential transactions, according to the National Association of Realtors®.(hat tip to Peterbob)

The annual report, based on two surveys, shows that 27.7 percent of all homes purchased in 2005 were for investment and another 12.2 percent were vacation homes. All together, there were 3.34 million second-home sales in 2005, up 16.0 percent from an upwardly revised total of 2.88 million in 2004. The market share of second homes rose from 36.0 percent of transactions in 2004 to 39.9 percent in 2005.

Vacation-home sales increased 16.9 percent last year to a record 1.02 million from a downwardly revised 872,000 in 2004, while investment-home sales rose 15.7 percent to a record 2.32 million in 2005 from an upwardly revised 2.00 million in 2004.

MBA: Mortgage Volume and Rates Rises

by Calculated Risk on 4/05/2006 10:36:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Up While Refinance Share Drops (update: add Link)

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 612.8, an increase of 7.2 percent on a seasonally adjusted basis from 571.7 one week earlier. On an unadjusted basis, the Index increased 7.2 percent compared with the previous week but was down 4.6 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 8.4 percent to 438.2 from 404.1 the previous week whereas the Refinance Index increased by 5.3 percent to 1640.8 from 1558.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.49 percent from 6.36 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 5.96 percent from 5.83 percent ...

| Total | -4.6% |

| Purchase | -1.9% |

| Refi | -8.8% |

| Fixed-Rate | 5.4% |

| ARM | -22.8% |

Purchase activity is off only 1.9% from last year. This is a rebound in activity from recent weakness.

Tuesday, April 04, 2006

WaPo: Is Economy too Reliant on Real Estate?

by Calculated Risk on 4/04/2006 11:31:00 PM

Neil Irwin writes in the WaPo: Is Reliance on Real Estate a Crack in the Foundation? Some Excerpts:

The U.S. economy is more dependent on housing than it has been in a half-century ...Overall a very good summary article, however I think the following sentence is a little misleading:

... economists worry that the housing slowdown that began late last year could hurt the broader economy more than past real estate downturns, although other parts of the economy appear to be accelerating.

What makes the real estate boom of the past decade unusual is that its effects have reverberated far beyond closely related sectors such as construction, driving sales in places as varied as furniture stores and motorcycle showrooms ...

...

By almost any measure, the U.S. economy is built on housing more than in the past. In 2005, investment in housing constituted a higher proportion of the goods and services the nation produced than it has since 1950, when the nation was experiencing a massive postwar housing boom. The proportion of jobs in real-estate-related fields is the highest it has been since at least 1970.

Nationally, real-estate-related industries accounted for 74 percent of new jobs over the past five years.The economy has added 2.2 million jobs over the last 5 years and the U.S. economy has probably added 1.6 million real estate related jobs during that period (74%). However, from the low in employment (Summer 2003), the economy has added almost 5 million jobs - so real estate would only be about 30% of those jobs - still extremely high, but not the 74% number mentioned in the article.

I definitely agree with the thrust of the article: a real estate slowdown will impact many seemingly unrelated industries.

Dr. Leamer says: Expect Slow, Gradual, Painful House Price Declines

by Calculated Risk on 4/04/2006 02:38:00 PM

In this Mercury News article, UCLA's Dr. Leamer makes some interesting comments:

If history is any guide ... home prices won't peak for a while, said Edward E. Leamer, director of the UCLA Anderson Forecast. When the end of the Cold War caused consolidation of the defense industry, the number of home sales in the Los Angeles area peaked in November 1988 -- but home prices didn't top out for nearly 2 1/2 years. "Then the prices began this gradual, painful, slow deterioration" of about 5 percent a year, Leamer said.

"Don't watch the prices," he said. "Watch the volume."

In Santa Clara County, sales of new and existing houses and condos dropped 14 percent from the record mark set the previous February. It was the slowest February since 2001, according to DataQuick Information Systems.

If sales have peaked, Leamer predicts homeowners are likely to endure a test of their patience and financial mettle.

"It's really slow, not enough to drive you totally crazy," Leamer said. "It's a little bit of pain every year. If you try to sell, you can't find anybody to buy, and the price is eating into your equity little by little. That's the kind of adjustment we expect to see."

More Comments on Interagency Guidance on Nontraditional Mortgage Products

by Calculated Risk on 4/04/2006 11:54:00 AM

UPDATE: Finally, here is the MBA's response to the new guidance.

Mortgage lenders, operating within this country’s sophisticated real estate finance system, respond to a number of influences in determining their ability to originate mortgages in manner that is profitable, as well as safe and sound. The primary influence for lenders are the signals received from secondary mortgage market investors. A lender originating a large number of mortgages with an unacceptable level of risk will find itself facing significant price disadvantages in the market. These signals prompt lenders to alter product features, introduce new features and remove features that do not work. These product changes are immediate. In this manner, the private market can and does correct for excess risk more quickly than can a regulator who necessarily must move at a more deliberate pace. MBA believes that market signals have already addressed many of the concerns expressed by the Agencies in the Proposed Guidance.Emphasis added.

In simple English: Let the market provide guidance.

Original Post: The comment period ended on March 29th. Today the FDIC posted some more comments (35 total).

From the American Bankers Association:

While the banking industry agrees that these products need to be carefully managed, the industry has a number of concerns about the proposed Guidance. In brief, we believe that:Looks like fun reading. Enjoy.

1. The Guidance overstates the risks of these mortgage products.

2. The Guidance is overly prescriptive and needs to be made more flexible and clearer.

3. The Guidance combines safety and soundness guidance with consumer protection guidance, creating confusion that is best addressed by separating them.

4. The Guidance's detailed consumer protection recommendations add a layer of additional disclosure before and around the legally required Regulation Z disclosures, thereby perhaps creating significant compliance problems.

5. The Guidance's new consumer protection will only apply to regulated financial institutions and their affiliates and not to other lenders, which is inconsistent with other consumer provisions under Regulations B and Z and Section 5 of the Federal Trade Commission ACT (unfair and deceptive practices) and which leaves a significant portion of the mortgage industry unaffected.

FDIC State Profiles

by Calculated Risk on 4/04/2006 11:00:00 AM

The FDIC released their Spring state economic profiles this morning. Check out your state here.

Here are some excerpts from the California profile on employment, housing and construction jobs.

* Elevated home price growth contributed to strong employment gains in the state’s construction sector which increased 6.7 percent in fourth quarter, compared to 1.5 percent for all other sectors, and accounted for about 1 in 5 new jobs (see Chart 1). But, higher interest rates, reduced housing affordability, and rising building costs may limit new construction and slow job growth in this sector going forward.

* California home prices continued to increase at a robust pace of 21.1 percent in fourth quarter 2005, up from the third quarter and well above the national average. Similar to employment patterns, price gains in Central Valley markets typically topped the state average, but San Diego area home price growth slumped from year-ago levels to the slowest pace among California metropolitan markets.

* Innovative mortgages and investors may be buoying California housing demand. Interest-only and negative amortization loans accounted for 69 percent of non-prime mortgage originations in California in the first 11 months of 2005. During the same period, investors and second-home purchasers accounted for 15 percent of California Alt-A mortgage originations.

Monday, April 03, 2006

Construction Spending and New Home Sales

by Calculated Risk on 4/03/2006 06:16:00 PM

My new post is up on Angry Bear: Housing: Construction Spending Up, Sales Down

Check out the second graph showing the divergence between sales and single family construction spending.

Best to all.

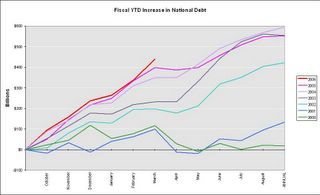

Record Increase in National Debt

by Calculated Risk on 4/03/2006 04:30:00 PM

Another month, another record increase in the National debt.

UPDATE: For a related post, see pgl's Snow Must Go.

Click on graph for larger image.

For the first six months of the 2006 fiscal year (starts Oct 1st), the National Debt has increased $438.4 Billion. The previous record was $397.8 Billion for the first six months of fiscal 2005.

"The U.S. budget deficit is falling, and it is falling fast."

Joshua Bolten, July 14, 2005, as OMB Director (soon to be Chief of Staff)

Pending Homes Sales Index Slightly Lower

by Calculated Risk on 4/03/2006 11:27:00 AM

The National Association of Realtors (NAR) released their Pending Home Sales Index today: Pending Home Sales Leveling Out, Market Balancing

The Pending Home Sales Index, based on contracts signed in February, slipped 0.8 percent to a level of 117.7 from an upwardly revised index of 118.6 in January, and is 5.2 percent below February 2005.The purpose of this index was to provide more timely data similar to New Home Sales. The index is reported when the contract is signed, as opposed to when escrow closes (as for Existing Home Sales). I haven't found the Index useful, except apparently as a marketing tool for NAR.

David Lereah, NAR’s chief economist, said most of the cooling in the housing market has already occurred. "We can expect a historically strong housing market moving forward, earmarked by generally balanced conditions across the country and fairly stable levels of home sales with some month-to-month fluctuations," he said. "This normalization is healthy because it is taking a lot of the pressure off of the decision process for both home buyers and sellers – pressure that was driving abnormal rates of price growth across much of the country over the last few years."

Friday, March 31, 2006

Housing Posts

by Calculated Risk on 3/31/2006 12:01:00 PM

Recent housing posts of interest:

Shiller on Housing: From the Berkeley Electronic Press, Dr. Robert Shiller writes Long-Term Perspectives on the Current Boom in Home Prices (require email address). Dr. Thoma provides some excerpts here and graphs. UPDATE: Professor Thoma also has excerpts of Dr. Baker's: Government Should Preemptively Burst the Housing Bubble

New Home Sales and Recessions See graph for relationship between New Home Sales and recessions.

MBA Mortgage Application Volume See graph.

Purchase activity is off 14% from last year. This provides further evidence that housing is slowing and suggests that the substantial drop in February New Home Sales was not a statistical anomaly.

February New Home Sales: 1.08 Million. See graphs.

This report is very weak, except for the median and average prices. One month does not make a trend, but New Home Sales have fallen in six of the last seven months.

Comment Period Ends: Interagency Guidance on Nontraditional Mortgage Products

Update on the new mortgage guidance and the comments from banks and lenders (mostly negative).